Why Big Data Centers Are Going Nuclear

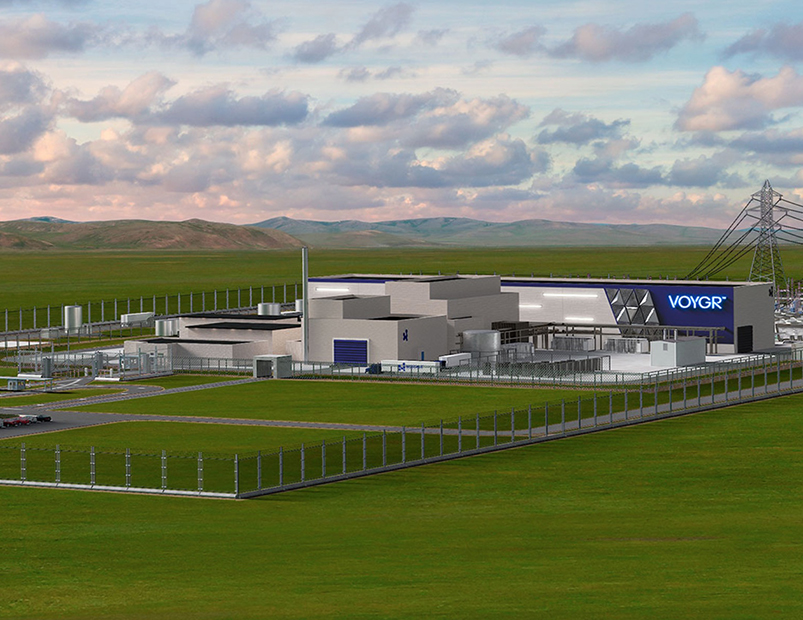

small modular reactor facility. Courtesy of NuScale

small modular reactor facility. Courtesy of NuScaleIn 2023, data centers across the globe consumed 7.4 gigawatts of power, a 55 percent increase over 2022 usage, Cushman & Wakefield. And by 2026, AI electricity consumption could be 10 times higher, exceeding 1,000 terawatts globally—equivalent to Japan, predicted the International Energy Agency.

This level of growth is causing alarm among power companies and grid operators, as data centers already put a tremendous strain on existing electrical grid infrastructure, potentially leading to localized power shortages, high costs to upgrade the grid and challenges in managing peak demand fluctuations, particularly if concentrated in specific regions, noted a report from global law firm White & Case. One solution gaining ground with utilities and large-scale data center operators is nuclear energy both for its high capacity and its energy efficiency.

READ ALSO: Interest Rates Are Still High. So Now What?

“It is the only green, at-scale solution for gigawatt-scale power,” said Todd Smith, co-leader of Transwestern’s Technology Properties Group. “AI is driving trillions of capital deployment and forcing a grid that has had low growth for 20 years to suddenly expand. This will drive atomic investment.”

Nuclear in action

Nuclear power is already playing a major role in powering data centers. Various utilities serving major data center markets receive 20 percent to 35 percent of power from nuclear generation, Lynch pointed out, noting for example, that nuclear makes up nearly 34 percent of Dominion Power’s fuel mix in Northern Virginia, the biggest data center hub in the nation.

“Nuclear provides great baseload generation power, which differentiates itself from variable generation power,” said Pat Lynch, executive managing director CBRE Data Center Solutions, explaining that baseload power is important for data centers because of the uptime-reliability requirement of 99.9999 percent. Nuclear can provide a sustainable alternative to fossil-fuel energy generation, replacing coal, natural gas and oil-fired plants, he added.

Data center operators are also continuing to ramp up nuclear energy capacity. Microsoft, for instance, recently signed a 20-year power purchase agreement with Constellation Energy to provide electricity to Microsoft data centers in the mid-Atlantic region from the Unit 1 reactor at the Three Mile Island nuclear power plant in Pennsylvania, which was unaffected by the 1979 partial meltdown of the Unit 2 reactor.

. Rendering courtesy of NuScale

. Rendering courtesy of NuScale“For data centers, nuclear is better all-around than renewable energy,” commented Sean Farney vice president of America Data Center Strategy at JLL, noting that it’s not only more reliable than renewable energy resources but cleaner, because renewable energy sources require a carbon-powered grid to work. Nuclear energy also provides predictable kilowatt rates, and reactors have a life cycle of 40 years or more.

“Every data center operator out there wants nuclear because it answers ESG goals better than any other form of energy out there,” Farney remarked. “And the Magnificent Seven or hyperscale companies—the Microsoft, Googles, Metas and Amazons—have very strict goals and regulations internally around how sustainable they are.”

Efficient growth

A mid-year JLL data center report noted data center power loads are increasing, with new projects typically requiring 100 megawatts, and some new developments eclipsing one gigawatt. And the data center sector is not alone in its increasing power appetite. Manufacturing reshoring and electric vehicle adoption also challenge the grid. JLL mapped out general U.S. energy demand and supply projected over the next 10 years and found that supply can accommodate growth projected today. “The problem is,” said Farney, “data centers are growing much, much faster than everything else.”

Therefore, energy efficiency is critical. The White & Case report, which looked at innovative ways make data centers more energy efficient and sustainable, noted that cooling data centers account for a vast portion of total energy consumption. It noted, for example, that some operators are employing natural resources for cooling: Japan is using snow, Finland is using seawater and geothermal techniques are being deployed in Iceland and Norway.

“The cost, source and availability of electricity are top priorities for data center operators,” said Lynch, noting many data center operators are employing tactics, such as energy-saving software technologies and design features that maximize energy efficiency. They also are eliminating unnecessary equipment in server rooms and replacing old, inefficient equipment and cooling systems with more energy- and temperature-efficient technology.

But the bottom line for data centers is reliability, and currently available renewable energy sources cannot provide that consistency 24 hours a day. That presents a challenge both for growth and for sustainability, to which the tech industry is committed. That’s why low-carbon nuclear energy has risen to the top of the conversation.

“We have clients who are scouring the entire world for a lot of available power that’s reliable, and nuclear rises to the top of their list,” Farney said.

Barriers to entry

Nuclear power adjacent to the actual user can solve for grid constraints, but there are challenges. “Time to deploy is a major obstacle that must be overcome with regulatory clarity,” Smith remarked. Therefore, data centers will require an interim solution before migrating to nuclear, most likely on-site generation with natural gas.

The primary investors in colocation energy facilities are legacy utilities and the infrastructure funds that back them, according to Smith. Hyperscalers, including Amazon, Oracle, Google and Meta, are all putting a toe in the water to help kickstart newer tech such as Molten Salt nuclear reactors, but it is not enough.

“There must be a concerted effort by Wall Street and the U.S. government to drive this innovation forward,” Smith stressed, noting that traditionally 80 percent of U.S. nuclear facilities have been funded by Department of Energy loans.

READ ALSO: Are Data Centers Immune to CRE Market Forces?

The NIMBYISM around nuclear facilities is also an issue, since much of the U.S. population, especially people who remember the Three-Mile Island and Chernobyl reactor meltdowns, still feels negatively about nuclear energy. “If that industry were to talk about its safety, because of the extreme amount of regulations and safety operation protocols, I think the public-perception tide would turn,” Farney said.

There are plans to build energy grids dedicated to distributing power to data centers, but these are mostly in rural locations. “It is going to be hard to do it in cities due to emission concerns for natural gas turbines, and certainly NIMBYISM for reactors in such locations,” Smith noted.

New technologies gain momentum

One of the most promising, innovative technologies soon to come online is small modular reactors, a small-scale nuclear technology embraced by big tech giants Oracle, Google and Amazon Web Services.

“They are all the talk,” Farney said. “Because of the scale, they can be done comparatively quickly compared to large nuclear plants.” Regulatory approvals and construction for a nuclear power plant, on the other hand, can take up to a decade.

While no SMRs are currently in operation today, the first SMR design, NuScale Power Corp.’s VOYGR has won Nuclear Regulatory Commission approval. NuScale, which is the technology provider, has partnered with ENTRA1 Energy, an independent global energy investment, development and production company, to finance and build its SMR facilities. ENTRA1 is underway on VOYGR

has won Nuclear Regulatory Commission approval. NuScale, which is the technology provider, has partnered with ENTRA1 Energy, an independent global energy investment, development and production company, to finance and build its SMR facilities. ENTRA1 is underway on VOYGR factories worldwide.

factories worldwide.

The NuScale Power Module, which is designed based on proven pressurized water-cooled reactor technology, is 100 percent factory built, and two U.S. projects are already underway. The NuScale-ENTRA1 joint venture has partnered with Standard Power, a provider of infrastructure services to advanced data processing companies to develop and operate two VOYGR -powered facilities in Ohio and Pennsylvania. Together, these facilities will produce nearly 2 gigawatts of clean, nuclear energy to support nearby data centers. The joint venture also is underway on VOYGR

-powered facilities in Ohio and Pennsylvania. Together, these facilities will produce nearly 2 gigawatts of clean, nuclear energy to support nearby data centers. The joint venture also is underway on VOYGR factories in Bulgaria, Romania, the Czech Republic, Poland and the Ukraine.

factories in Bulgaria, Romania, the Czech Republic, Poland and the Ukraine.

Tech giants Oracle, Google and Amazon Web Services all have data center-SMR colocation projects in the works. Google, for example, has partnered with SMR startup Kairos Power to build seven small nuclear reactors to power its AI drive. Under the agreement, Kairos Power will develop, construct and operate a series of advanced reactor plants, which will be co-located with Google data centers and provide a total of 500 megawatts of power by 2035. The first SMR facility will come online in 2030.

Amazon, which has pledged to be carbon-neutral by 2040, has signed an agreement with Energy Northwest, a consortium of state public utilities that will enable the development of four advanced SMRs. The reactors, which will be constructed, owned and operated by Energy Northwest, are expected to generate roughly 320 megawatts of capacity for the first phase of the project, with the option to increase to 960 megawatts. These projects are scheduled to come online beginning in the early 2030s.

OKLO, another SMR startup, has signed agreements this year to provide up to 1250 megawatts of power to three data center operators, including 500 megawatts to Equinix, one of the nation’s largest data center operators. The firm’s business plan differs from most other SMR developers in that OKLO does not sell its technology but rather acts as the energy plant developer and operator, selling electricity to its clients.

OKLO currently is working with Equinix to evaluate specific locations for SMR deployment, according to Brian Gitt, head of business development at OKLO. He noted that Equinix has publicly announced a $15 billion joint-venture fund with GIC and the Canada Pension Plan Investment Board to launch XScale, the firm’s hyperscale product, nationwide.

“They’re looking to build data center campuses of 100-megawatts or more, targeting 1.5 gigawatts total,” Gitt said, noting that the contract with OKLO will contribute to those projects. At full buildout, this new fund will nearly triple the investment capital in the Equinix XScale program.

Recycling nuclear waste

OKLO has developed an innovative, next-generation nuclear technology called “powerhouses,” which essentially recycle nuclear waste. The company’s Aurora powerhouse design is based on proven liquid-metal, cooled-sodium, fast-reactor, fission technology. The fast neutron reactor transports heat from the reactor core to a power conversion system that runs on material from spent nuclear fuel known as HALEU, or “high-assay, low-enriched uranium.” The company’s reactors are designed to scale to 15 megawatts and 50 megawatts. This provides the flexibility expand a site’s power production by adding reactor units as data center capacity increases to meet growing demand, noted Gitt.

OKLO’s SMR technology is also mostly modular, which will reduce project regulatory complexity, costs and the construction timeline to about three years once the initial design is approved, which can take four to five years, according to Gitt. “There are significant differences from a technology perspective, and the impacts on cost and site and civil works are very substantial in that regard,” he noted. “But our approach is that we are building as much of the plant in a high-quality, factory environment.”

The post Why Big Data Centers Are Going Nuclear appeared first on Commercial Property Executive.