When Does It Make Sense to Own vs. Rent Your House?

Instead of telling you what to do, we’ve combed the data and consulted the experts to give you the facts on when it’s better to rent, or buy your own home.

When it comes to paying for a place to live and choosing between renting vs owning your home, which is better?

While there’s a strong argument for both positions, the truth is — there’s no right answer to this question.

However, there is a right answer for you.

Renting vs Owning a Home: The 7 factors that matter

With a swarm of opinions attempting to sway you into a decision, it can be difficult to determine if renting or owning a home is in your best interest.

Instead of telling you what to do, we’ve combed the data and consulted the experts to give you the facts on renting a home vs owning a home, so you’ll be well-equipped to figure out which living arrangement is right for your lifestyle and finances.

1. Analyze monthly housing costs

The first and most important factor to consider is pretty much a no-brainer — pick whichever option is cheaper for you month-by-month.

“When people are trying to decide whether to rent or buy, they should look at the rental rates in the neighborhood where they’re considering buying and compare it to how much the mortgage would cost on a similar property in the same area,” says Myra Beams, a top-selling agent in Hobe Sound, Florida.

“If you’re in an area with a high cost of living, sometimes it really is less expensive to buy a property as opposed to renting. So, if you’ve got some job stability, then you should start looking for a place to buy.”

Of course, figuring out your monthly housing expenses isn’t as simple as just looking at your potential monthly rent or mortgage payment amounts.

For example, if you’re paying $1,600 a month to rent a two-bedroom apartment — but you qualify to buy a two-bedroom home with a monthly mortgage payment of $1,500 — buying might sound like the smarter financial decision.

But not so fast.

That home may be in a neighborhood with a homeowners association (HOA) that requires an additional $350 a month in association fees.

Then, you’ll need to pay anywhere from $700 to $10,000 in annual property taxes depending on your state’s property tax rate. That averages out to an extra $60 to $850 a month.

Plus, your rent may cover other housing expenses, like utilities and maintenance costs, that you must pay for on your own when you’re the homeowner.

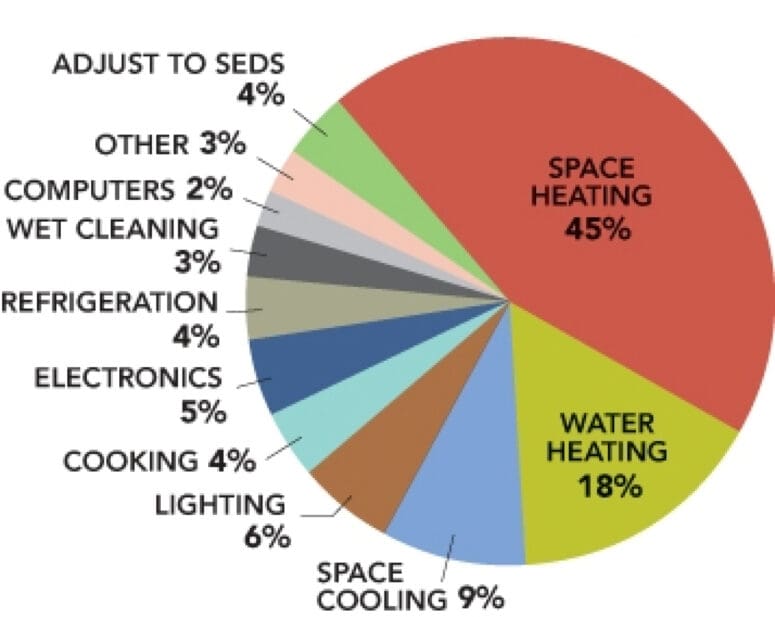

Location plays a big role in how expensive your utilities will be. However, the average household spends just over $2,000 on energy alone. That averages out to $167 a month just for electricity. You’ll still need to cover water, sewage, garbage, and gas.

- Source: Energy.gov

Add all those expenses onto that lower $1,500 mortgage payment and suddenly, you’re paying anywhere around $2,000 to $3,000 a month in housing costs.

Renting is sounding better and better, right?

Maybe not.

Homeownership comes with some big benefits that offset the money you might save by renting.

For starters, buying guarantees you a stable monthly payment. Even if a mortgage is more expensive than rent to start, your landlord will probably raise your rent annually — so you’ll have to either pay more and more every year, or move.

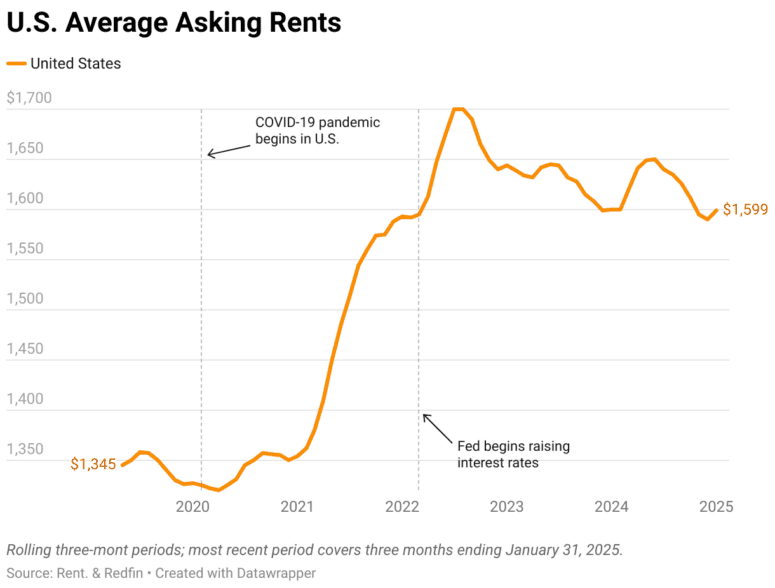

In fact, a recent report by Rent.com found that since the Fed raised interest rates in March 2022, rents have been elevated. Prices are currently holding steady, with a month-on-month growth of 0.5%, which could further increase once renters feel the effects of lower levels of new apartment construction.

When you buy, your monthly mortgage payment is guaranteed to stay at that same amount, unless you refinance five years down the road — which would likely save you money — because you’ll now owe less on a home that’s worth more.

That’s thanks to the next big benefit that comes with homeownership: building home equity.

When you rent, a big chunk of your monthly income is going straight into your landlord’s wallet with no other benefit beyond a place to live…temporarily.

When you buy a house, you’re not only getting a permanent place to live; you’re making an investment in an asset that will likely increase in value over time.

“If you look at the historical numbers overall, homes tend to appreciate at a rate of around 5% per year,” explains Beams.

“So if you own a home for five years and then sell, you’re going to have a good bit of equity built up in your home. Whereas the person who’s just continued to rent for those five years has nothing except some canceled checks.”

As an example, let’s say you buy a home for $290,000. If it appreciates 5% (or $14,500) each year, it could be worth $362,500 in five years.

Add that $72,500 to the equity you’ve built up by paying down your mortgage debt and you’ll get significantly more in net proceeds than you paid out of your savings for a down payment.

The verdict:

Rent: When rent is cheaper than a mortgage payment

Buy: When a mortgage payment (and other housing expenses) are cheaper than renting in the long run