What Is a Good Mortgage Rate to Buy a House?

What is a good mortgage rate? See what home shoppers consider a good mortgage rate in today's market and get expert tips before buying a home.

Buying a home is exciting, but securing a good mortgage rate can be challenging, especially when the housing market feels unsettled or unpredictable. But when you’re shopping for a home, what is a good mortgage rate?

In this guide, we’ll explain what influences mortgage rates and what might qualify as a “good” rate based on historical trends and your goals as a homebuyer. We’ll also outline some steps you can take to help you secure the best deal possible.

What factors influence mortgage rates?

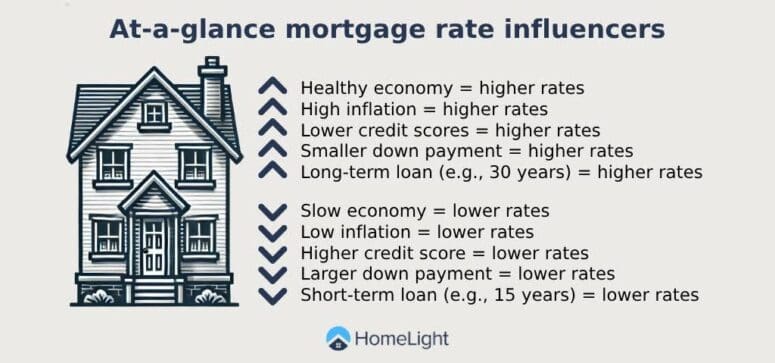

Let’s take a quick look at the mix of economic and personal factors that influence mortgage rates on a home loan:

- Federal Reserve policies: The Federal Reserve doesn’t directly set mortgage rates, but its actions to control inflation through short-term interest rate adjustments significantly impact mortgage rate trends.

- Economic conditions: When the economy is thriving, mortgage rates tend to rise as borrowing demand increases. In contrast, rates often drop when the economy slows. In recent years, the market has generated confusing economic indicators that have been tricky for economists to interpret.

- Inflation: Mortgage lenders set rates to keep pace with inflation. High inflation usually drives rates up, while lower inflation typically keeps them down.

- Loan amount and down payment: Borrowers with larger down payments and smaller loan amounts may receive more favorable rates because lenders view these loans as less risky.

- Credit score: Borrowers with higher credit scores typically qualify for lower rates, as lenders consider them more likely to repay on time.

Here are a few additional factors that can play a role in mortgage interest rates:

- Employment and wage trends: Strong job growth and rising wages can lead to higher mortgage rates, as these indicate a healthy economy with greater borrower demand.

- Global events: Events like international conflicts, supply chain disruptions, and global economic slowdowns can impact U.S. mortgage rates, as they often influence investor behavior.

- Lender competition: Rates may vary slightly depending on the competitiveness of your local mortgage market. Lenders offer better rates to attract more borrowers in highly competitive areas.

- Loan term: A shorter loan term (e.g., 15 years) typically comes with lower interest rates than a standard 30-year mortgage due to faster repayment schedules.

- Loan type: Conventional, FHA, VA, and USDA loans may all offer different rates due to varying eligibility criteria, fees, and government guarantees.