What Global Trade Shifts Mean for US Industrial

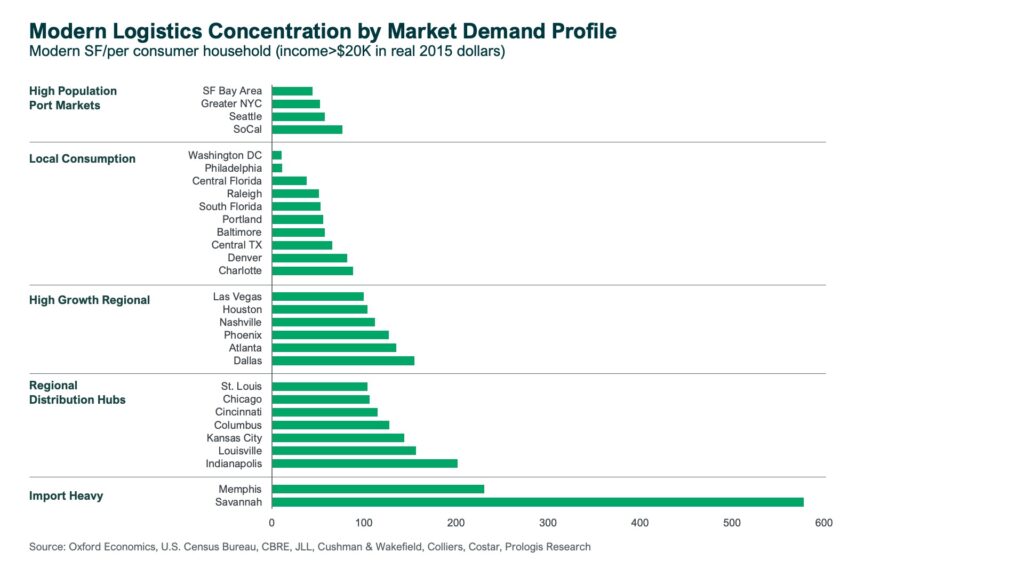

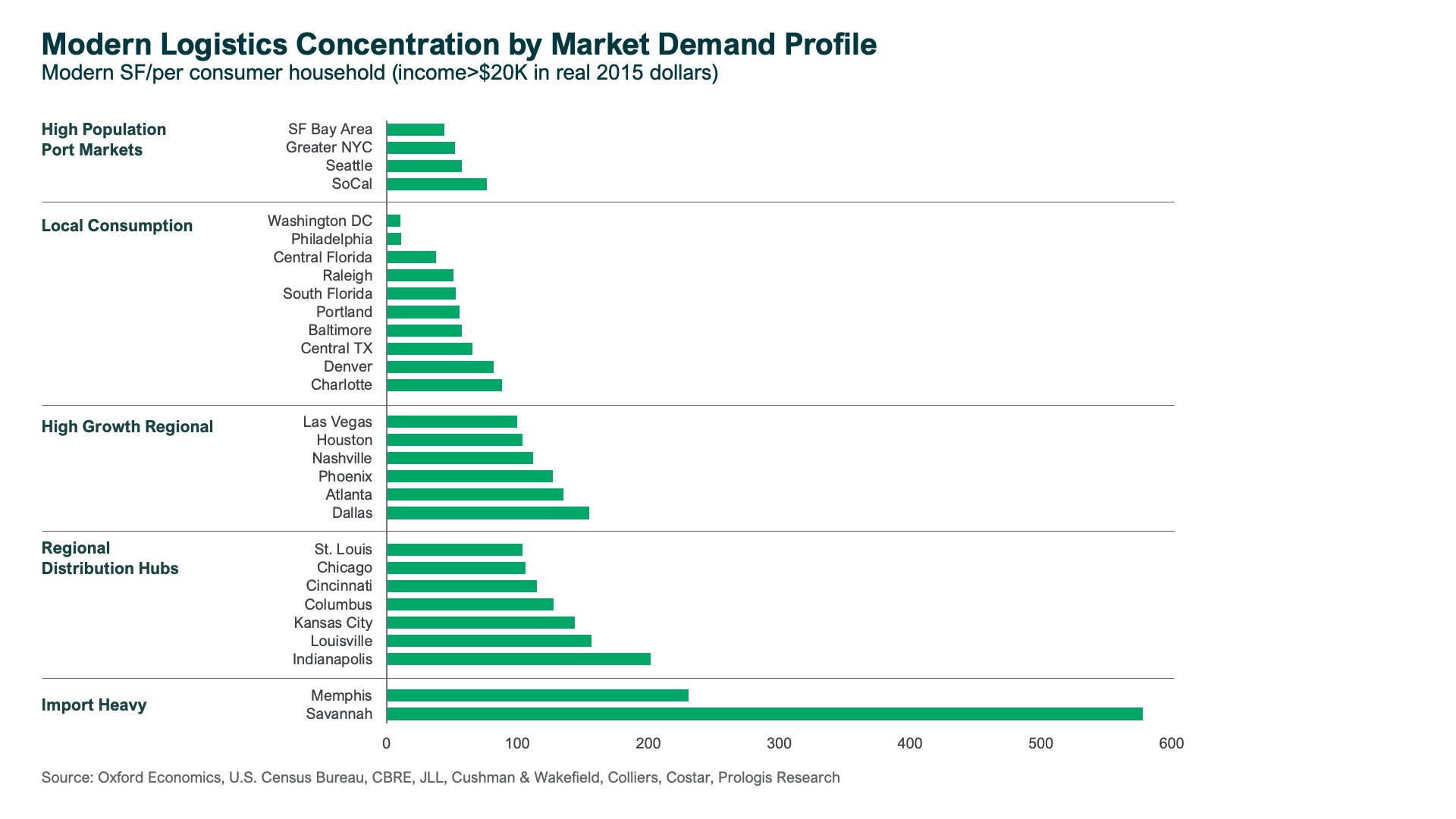

Despite uncertainty stemming from federal tariffs imposed on China and other nations, a new Prologis report argues that most logistics demand in the U.S. has been insulated from ensuing shocks. That’s because about three-quarters of mentioned demand is tied to regional and local distribution meant to handle domestic consumption, and is less impacted by changes in trade flows.

The report, the first in a series of white papers planned by Prologis Research, found that because of the pivot made more than a decade ago to focus on domestic consumption and regional distribution rather than global trade, import exposure is lower than it appears in the U.S.

READ ALSO: Industrial’s New Groove: Gradual Growth and Tariff Talks

With approximately 75 percent of the logistics demand tied to the consumption end of the supply chain, 15 percent is trade specific and the remaining 10 percent is from manufacturing, services, research and development and other uses.

Even high-profile, trade-oriented hubs such as ports and intermodal facilities are focused around domestic consumption including e-commerce fulfillment, retail restocking and food and beverage distribution. The growing demand for last-mile delivery and rise of just-in-case inventory strategies have added to this trend.

“Industries weighted by logistics real estate footprints skew toward essentials and domestic sourcing, with limited reliance on China and high-price inelasticity,” the report stated.

Some industrial markets feeling the pinch of trade tariffs

However, Prologis notes there are several U.S. trade-oriented markets, including Savannah, Ga.; Memphis, Tenn.; and Charleston, S.C., that are highly exposed to global trade. Calling them import-heavy markets, Melinda McLaughlin, vice president & global head of research at Prologis, noted that they face outsized risks to shifts in trade policy due to their smaller populations.

About 75 percent of the customer operations in markets like these are related to international flows rather than also providing local and regional distribution. By comparison, ports in high-population markets such as Southern California, the San Francisco Bay Area and New York-New Jersey, are considered economic powerhouses and multi-purpose locations serving both consumption and trade flows.

“Because of the way their economies have developed, they also have this massive local consumption and they’re also well-positioned to distribute to other markets,” McLaughlin told Commercial Property Executive.

Uncertainty creates pauses, challenges

The report outlines several short-term impacts. These mainly stem from uncertainty from the policies rather than the tariffs themselves, as customers delay decisions on long-term investments. Prologis is seeing slowing leasing activity and more interest in shorter, more flexible terms.

During the April 16 first-quarter 2025 earnings call with analysts, Prologis CFO Tim Arndt said the company experienced a roughly 20 percent drop in leasing in the two weeks following the president’s April 2 tariff announcement. But he noted the deals—representing about 80 leases and more than 6 million square feet—also “reflect a market that’s still active.”

READ ALSO: What CRE Investors Want to Buy in 2025

The situation is also driving demand for flexible solutions with companies pursuing overflow space, third-party logistics assistance and Foreign Trade Zones as stopgap tools to navigate the volatility, according to the white paper.

McLaughlin said the uncertainty also presents a “challenge” to decision making. She added some long-term decisions are likely on pause because, “You don’t have all the facts to look into the future and make long-term investments.” For example, those considering moving manufacturing back to the U.S. would face a two- to five-year process, she estimated.

“I think we’ll definitely see some more thoughtful and deliberate decision making,” McLaughlin said.

The post What Global Trade Shifts Mean for US Industrial appeared first on Commercial Property Executive.