What CRE Investors Eye in 2025

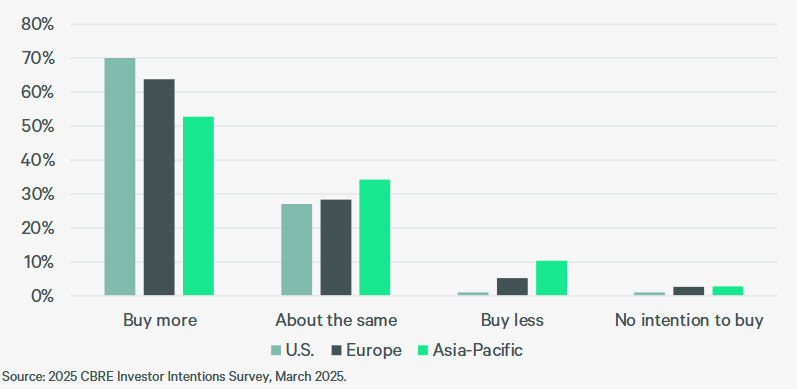

Seven in 10 U.S. investors said they intend to buy more commercial real estate this year than they did in 2024, according to a new survey from CBRE.

Nearly three in 10 said they would buy roughly the same amount, citing favorable pricing as trumping the rising cost of debt.

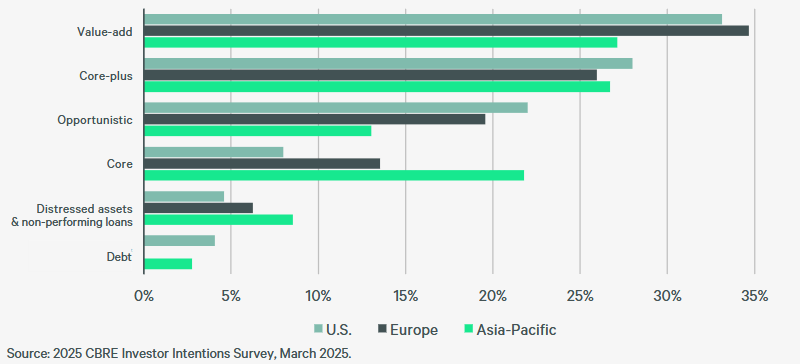

Such sentiment has cooled slightly since the survey, conducted over November and December, but capital continues to target real estate. CBRE data show a steady increase in monthly bidder activity, particularly in value-add assets.

The idea that a majority of investors plan to buy at least as much real estate in 2025 as they did in 2024 is interesting because the main reason deals didn’t work last year was pricing and deal-level economics, according to Dillon Freeman, CFA, senior commercial loan officer at Fidelity Bancorp Funding.

“Lending spreads have come in, but I am not sure they will be enough to result in meaningful increases in volume, all else equal,” he told Commercial Property Executive.

Freeman said this would suggest that investors expect sellers to capitulate, or there will be more of the same for 2025. Interestingly, the five-year U.S. Treasury stands today exactly where it did a year ago. “Despite rising cap rates, many people would agree that we have not yet seen a new mark-to-market for commercial real estate assets across the board due to the depressed transaction volume we have seen since 2023.”

Regarding value-add strategies, the trajectory for capital deployment will continue as investors receive distributions and the cycle continues, according to Russ Romero, managing director & head of Institutional Solutions at PEG. “We see a real opportunity for residential and hospitality specialists who will not only execute at favorable valuations but also add value through deep operational expertise,” he said.

Multifamily, industrial lead the way

Multifamily and industrial were found to be the most attractive property types, according to the participants.

“Multifamily is a top preference nationally and locally in the San Francisco Bay Area due to unmet housing demand and lack of inventory,” Ed Del Beccaro, EVP and San Francisco Bay Area manager for TRI Commercial Real Estate Services/CORFAC International told CPE. “The challenge is rising construction costs caused by prospective tariffs and the significant reallocation of resources to rebuild the LA fire-damaged areas.”

He said additional complications in the SF Bay Area include high interest rates and several cities with rent control.

READ ALSO: 5 Trends Defining CRE Development in 2025

“Therefore, a preferred property type to develop is for-sale townhome projects,” according to Del Beccaro. “Apartments in fast-growing areas are attracting attention, such as Solano County in the Bay area, not subject to rent control. Industrial light manufacturing and logistics are also preferred investment types, reflecting the growth in online retailing and the onshoring of various manufacturing concepts.”

The U.S. multifamily sector continues to show strong resilience, with a substantial pipeline of new units completed in 2024.

“While financing costs remain elevated compared to the pre-pandemic landscape, the high cost of condominiums and single-family homes—coupled with sustained rental demand—means that multifamily investments still pencil out as the more stable and attractive opportunities in 2025,” Andrew Schwartz, senior vice president of Residential Asset Management at Taconic Partners, told CPE.

BTR demand is rising

Build-to-rent could gain multifamily transaction share in 2025.

“We are increasingly confident that the capital pressures affecting the industry are starting to ease, with clear indications of renewed momentum and recovery,” Greg Fedorinchik, managing director of equity capital markets for NexMetro Communities, told CPE.

“It’s no longer a question of if—but rather of when and how quickly the systemic tailwinds in housing shift us into a new era of growth. We are seeing strong signs of the market tailwinds of strong demand, economic growth, favorable demographics, consumer preferences, the high cost of homeownership and lack of inventory.”

READ ALSO: How Generative AI Is Reshaping Bay Area CRE

Commercial real estate investors remain “extremely cautious” given current interest rates, rising construction costs, and the potential impact of both U.S. tariffs and retaliatory tariffs by other countries, according to Todd Monahan, executive vice president & managing director at WCRE/CORFAC International in Philadelphia.

“Multifamily also remains a hot asset class, especially in markets where new project starts are extremely low, allowing existing projects to raise rents,” he told CPE. “This, in turn, drives down multifamily cap rates for desirable assets.”

As for office, Monahan added that investors remain skittish unless the asset is distressed and can be acquired at a steep discount for a potential conversion to residential or another use.

“Industrial and warehouse assets remain a preferred sector, although there are concerns about an oversupply of big boxes,” Monahan said. “Historically, however, there has been a low vacancy rate below 5 percent.

Office market outlook varies by market

Office interest did not register well. No U.S. investors placed it among their top three preferred property sectors. Bill Harter, principal ESG solutions advisor at Visual Lease, said the “return to work” trend has been restoring some demand for office space in the U.S.

Notably, the recent lease terminations by the federal government are increasing supply, not just in Washington, D.C., but throughout the country.

“These federal lease terminations certainly create more uncertainty for office assets than other property types,” Harter told CPE.

READ ALSO: Potential Federal Building Sale Adds Uncertainty to Office Sector

Higher uncertainty in the office sector will make it harder to identify those opportunities today, but they will become more apparent as the recent political disruptions work out, Harter anticipates. “A changing office market will create more value-add opportunities, which investors will recognize as stability eventually returns to the market.”

Del Beccaro added that most suburban office markets in the Bay Area are characterized by high vacancies.

“The office buildings that are selling are going for huge discounts below replacement value and historical debt levels,” he said. “So, this sector is attracting more local and regional buyers as opposed to foreign investors.”

The post What CRE Investors Eye in 2025 appeared first on Commercial Property Executive.