Top HQ Relocation Trends

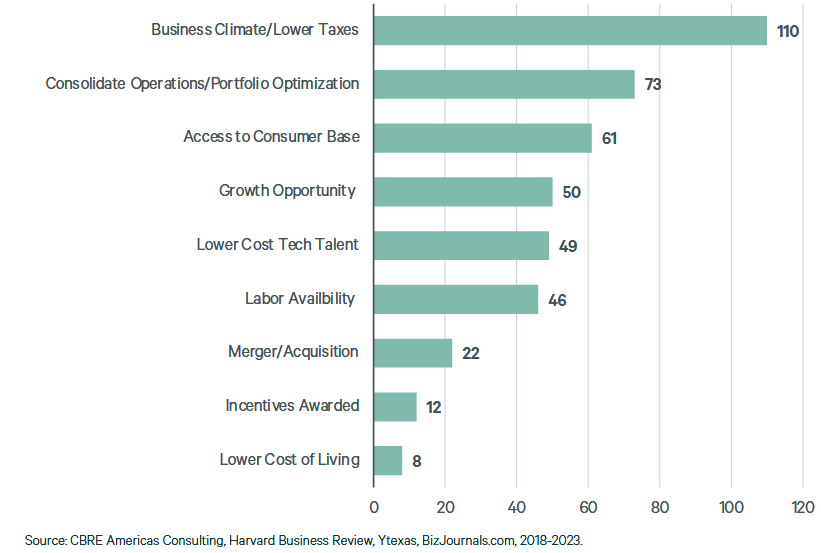

Business climate and tax rates are the top reasons for U.S. companies across many industries to relocate their headquarters as part of their corporate strategy, according to CBRE’s Americas Consulting research.

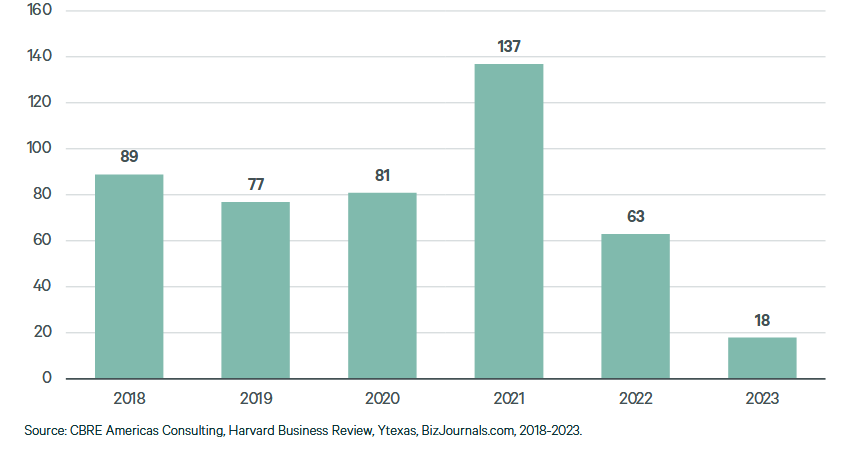

The group based its findings on approximately 500 publicly announced headquarters relocations between 2018 and 2023, ranging from start-up enterprises to Fortune 500 companies.

There have been 465 corporate headquarters relocations since 2018, with an annual peak of 137 relocations in 2021. Business climate/lower taxes led to 24 percent of the moves, with operations consolidation/portfolio optimization the next top reason at 16 percent, according to CBRE’s research.

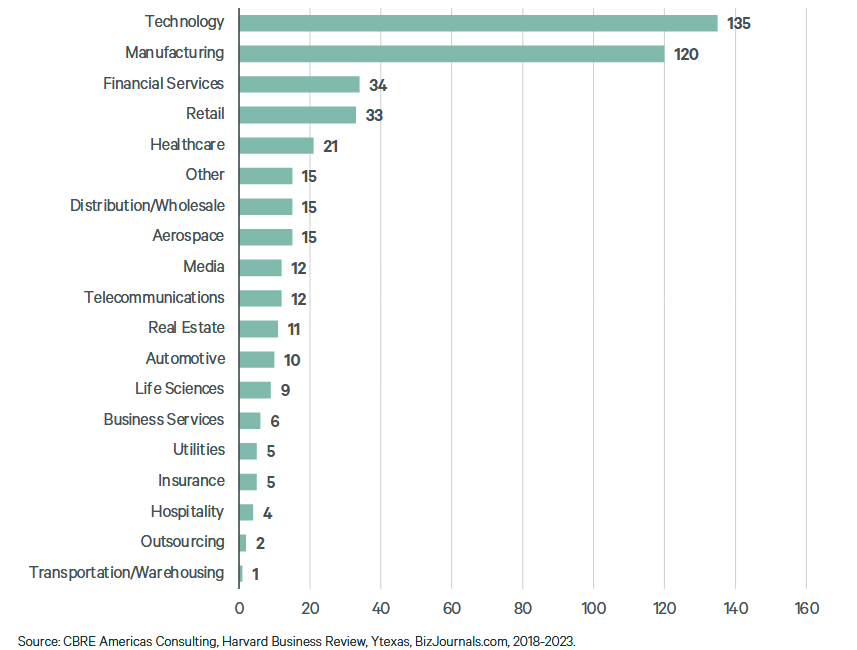

Since 2018, the top sectors for relocations have been technology (135), manufacturing (120) and finance (34).

Texas is the most popular destination, with 209 moves. Of those, 66 went to Austin, 32 to Dallas, and 25 to Houston. San Francisco/San Jose, Calif., lost 79 corporate headquarters, followed by Los Angeles/ Irvine, Calif., (50) and New York City (21).

The report found that successful relocations gained better space optimization, increased productivity and a more supportive corporate culture.

Driving innovation and growth

Seizing the opportunity to move offices to refresh workplace technology and enhance productivity has been a big driver among RealFoundations’ clients, according to Todd Fehr, its lead managing consultant.

“Clients continue to move toward enhanced Wi-Fi experiences, allowing more mobility in and around the office spaces,” Fehr told Commercial Property Executive. “Demand and continued expansion of upgraded video conferencing experiences are also a factor.”

Fortune Brands Innovations recently opted to consolidate its regional offices to a new campus headquarters in Deerfield, Ill., while maintaining its digitally focused office in San Francisco.

READ ALSO: CRE’s New Money Movers

FBIN’s new headquarters will open later this summer and will accommodate more than 1,000 workers by the end of 2027.

“Our headquarters relocation to a state-of-the-art campus is all about driving innovation and growth,” Kristin Papesh, EVP & chief human resource officer for the company, told CPE.

“Fortune Brands Innovations is increasingly developing digital solutions for our consumers and customers. By bringing our professional associates together from across our leading brands and functional areas, we are creating an environment where we can create and implement better solutions, faster.”

Papesh said the timing was right because it was part of a multi-year transformation for the company into one that is more efficient, agile and innovative.

“We chose Chicagoland after a comprehensive national search due to the world-class office space and a deep pool of talent from across industries,” she said.

Illinois also offered a significant incentive through the EDGE tax credit program.

“Our teams have felt the uplifting energy we have when we are together in the office, and our new headquarters will be a vibrant environment that enables us to network and collaborate more fully, and to capture that excitement and energy on a regular basis,” Papesh said.

“We’re also retaining our hybrid schedule where people are in the office Tuesday, Wednesday and Thursday so that we all benefit from being together while keeping remote workdays that are also productive.”

From California to Texas

Chevron recently moved its headquarters from Bishop Ranch in San Ramon, Calif., to Starbase, Texas, reflecting the unfavorable California and San Francisco Bay Area environment for oil companies, according to Ed Del Beccaro, EVP & San Francisco Bay Area Manager of TRI Commercial/CORFAC International.

Bishop Ranch/Sunset Development and the Mehran family purchased more than 1.3 million square feet within the 92-acre Chevron Park campus for $174.5 million in the first quarter of 2025. Chevron, in turn, leased 400,000 square feet elsewhere in the park.

“California has an unfriendly business environment characterized by many regulations that make it difficult to do business here, along with high taxes,” Del Beccaro told CPE.

“It takes a long time in most of the Bay Area to approve major projects vs. other parts of the country. Also, the high cost of housing has made it challenging to find an affordable workforce. The cost of energy is also the highest in the country.”

He said that other companies continue to stay in the San Francisco Bay Area because of the critical mass of intellectual capital represented by Stanford, UCSF, Cal Berkeley, the University of Davis, the military labs, including Lawrence Livermore Lab, and the Genome Center in Berkeley, Calif. Also, the San Francisco Bay Area and Silicon Valley still provide most startup venture capital.

South Florida, a hot relocation market

In Delray Beach, Fla., Pebb Capital’s project, Sundy Village, has become a magnet for corporate relocations looking to align real estate strategy with workforce trends, according to Todd Rosenberg, managing principal of Pebb Capital.

DigitalBridge—one of the world’s largest digital infrastructure investment firms—and Vertical Bridge—the largest private owner/operator of communications infrastructure in the U.S.—have signed to lease headquarters space within the 7-acre mixed-use campus.

This relocation and Pebb Capital’s decision to move its headquarters to the site account for nearly 140,000 square feet of leased space.

“The most competitive locations offer more than favorable economics—they align with how and where people want to work,” Rosenberg told CPE.

“South Florida has emerged as a standout, especially among tech and digital infrastructure firms drawn to its pro-business environment, lifestyle appeal and market resilience.”

While Miami and Fort Lauderdale, Fla., remain a focal point, nearby submarkets like Delray Beach are gaining traction for their walkability, influx of high-net-worth residents and curated tenant mixes that reflect modern workplace values, he said.

“These shifts reflect a broader trend: tertiary and suburban markets are emerging as bright spots, offering affordability, space and lifestyle advantages in today’s talent-driven landscape,” according to Rosenberg.

In March, T. Rowe Price relocated to a new office at 1307 Point St. in the Harbor Point waterfront district of Baltimore. The 550,000-square-foot building includes about 60,000 square feet of retail space on the ground floor.

The post Top HQ Relocation Trends appeared first on Commercial Property Executive.