South Florida Condominium Crises: New Laws, HOA Fees, and Solutions

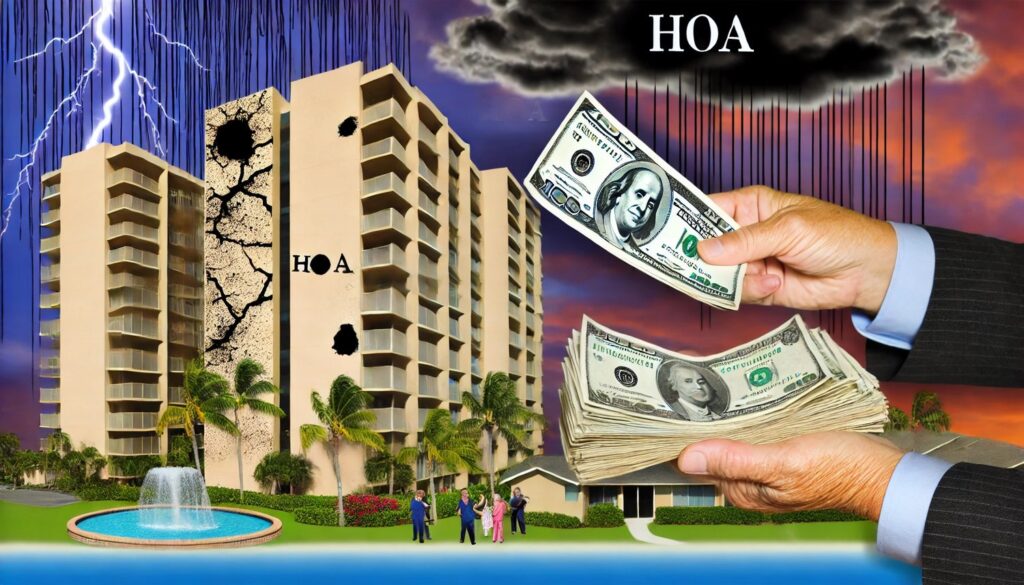

A visual representation of the South Florida Condominium Crises, featuring a large condo building with visible structural damage. The image highlights the challenges faced by residents, including rising HOA fees and assessments, with a coastal background symbolizing the region’s unique environment

South Florida is renowned for its luxury condos and vibrant lifestyle. However, recent years have seen condo owners facing rising fees, assessments, and stringent new laws. The situation has left many residents asking, “What’s happening to our dream lifestyle?” In this comprehensive article, we’ll break down the South Florida Condominium Crises, delve into HOA fees, assessments, and the impact of recent condo laws, and explore possible solutions.

Understanding the South Florida Condominium Crises

South Florida’s condominium market has been under immense pressure recently. While condos were once considered a haven for those seeking the ultimate Florida lifestyle, they now face a series of crises involving escalating costs, structural concerns, and stricter regulations. This shift has put condo owners on edge, fearing that their investment might turn into a financial burden.

Causes of the Crisis

There are several contributing factors to the condominium crises in South Florida, including:

Aging infrastructure: Many condominium buildings are decades old and require substantial repairs.

Natural elements: Exposure to salt water, humidity, and hurricanes accelerates structural wear and tear.

Financial mismanagement: Some HOAs have poorly managed funds, leading to deficits when major repairs are needed.

The Role of HOA Fees and Assessments

HOA fees cover routine maintenance, insurance, amenities, and reserves. However, when major repairs or improvements are required, owners are often hit with unexpected assessments. With rising costs and more frequent assessments, many condo owners are finding themselves in a financial pinch.

The Impact of Aging Infrastructure

Many South Florida condos were built during the boom years of the 1970s and 1980s. As these buildings age, they need extensive repairs to remain safe and functional. Common issues include concrete spalling, corroded rebar, outdated electrical systems, and leaking plumbing.

These repairs come with hefty price tags, which are often passed on to condo owners through increased HOA fees or special assessments.

The Surfside Tragedy and Its Aftermath

The tragic collapse of the Champlain Towers South in Surfside in June 2021 served as a wake-up call. It brought to light the consequences of deferred maintenance and inadequate reserves. This catastrophe prompted Florida lawmakers to reassess condo regulations, emphasizing safety, inspections, and reserve funding.

The New Florida Condo Laws

In response to the Surfside tragedy, Florida passed new laws requiring:

Mandatory inspections: Condos over 30 years old (or 25 years if within three miles of the coast) must undergo structural inspections every 10 years.

Reserve studies: Associations must conduct reserve studies every 10 years to ensure sufficient funds for future repairs.

Increased transparency: HOAs are now required to share financial reports with residents regularly.

These laws aim to improve safety but also contribute to increased costs for condo owners.

Financial Implications for Condo Owners

The impact of these new laws is significant. Condo owners can expect to see:

Higher HOA fees: As associations collect more funds to meet reserve requirements.

Increased assessments: For necessary repairs identified during inspections.

Tighter budgets: Many owners will need to adjust their finances to accommodate these changes.

Possible Solutions and Preventive Measures

The key to addressing these challenges lies in proactive measures:

Regular maintenance: Regular upkeep can prevent costly repairs in the long run.

Proper funding: HOAs should prioritize reserve funding to cover future repairs.

Effective communication: Transparent communication between HOAs and residents fosters understanding and trust.

The Role of Reserve Studies and Funding

A reserve study is a detailed analysis of a condo’s common elements and the funds needed for future repairs. It’s like a savings plan for the building. By conducting regular reserve studies, HOAs can accurately forecast future expenses, minimizing the risk of surprise assessments.

How to Handle Special Assessments

Special assessments are additional fees levied on condo owners when there’s a shortfall in reserve funds. Here’s how to handle them:

Understand the reason: Ask your HOA to explain why the assessment is necessary.

Negotiate payment plans: Many HOAs offer installment options for large assessments.

Seek legal advice: If you believe an assessment is unjustified, consult an attorney.

What Condo Owners Can Do

As a condo owner, you can take proactive steps to protect your investment:

Attend HOA meetings: Stay informed about decisions affecting your property.

Review financial reports: Understand how your fees are being utilized.

Get involved: Consider running for the board or joining a committee.

Government Involvement and Support

The government can play a significant role in alleviating the crisis by:

Offering grants or low-interest loans: To help associations fund critical repairs.

Implementing tax incentives: For buildings that undergo safety upgrades.

Providing educational resources: To guide HOAs in financial planning and maintenance.

Future Outlook for South Florida Condos

While the current situation is challenging, these changes may lead to a more sustainable and safer condominium market. New laws and proactive measures can prevent future tragedies, ensuring that condo living remains a viable and attractive option in South Florida.

Conclusion

The South Florida Condominium Crisis is a complex issue that combines aging infrastructure, financial mismanagement, and evolving regulations. While the new laws bring additional costs, they also promise a safer and more transparent environment for condo owners. By understanding the challenges and taking proactive steps, residents and HOAs can navigate this crisis effectively.

FAQs

HOA fees are rising due to the need for extensive repairs, maintenance, and compliance with new state laws requiring reserve funding and inspections.

Special assessments are additional fees levied on condo owners when there’s a shortfall in the reserve fund. They’re necessary to cover unexpected repairs or improvements.text goes here

The new laws require mandatory inspections, reserve studies, and increased transparency, leading to higher costs for maintenance and repairs.

Condo owners should stay informed, participate in HOA meetings, review financial reports, and advocate for effective financial planning.

While there’s limited direct assistance, the government may provide grants, loans, or tax incentives for critical repairs and safety upgrades.