Sentiment Takes Deep Hit Amid Policy Turbulence: CREFC

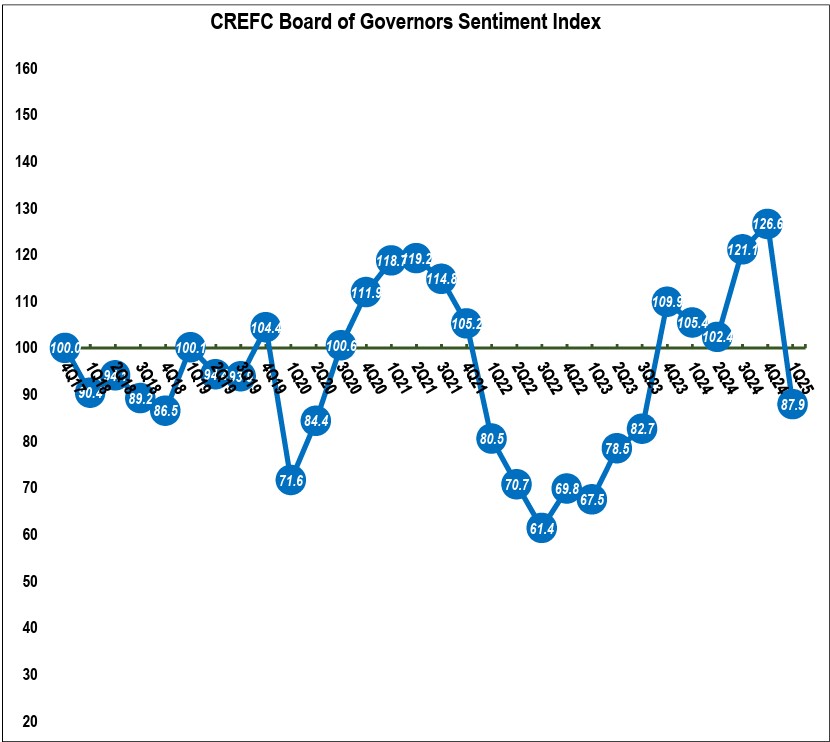

What a difference a quarter makes. Following a record high of 126.6 at the end of the fourth quarter, the CRE Finance Council’s Board of Governors Sentiment Index has plummeted to 87.9—a fall of 30.5 percent.

This was the second-largest drop in the index’s history, and was surpassed only by the pandemic’s onset in the first quarter of 2020. Specifically, the decline brings the index below its baseline of 100 for the first time since the pandemic era.

The survey on which the index is based, CREFC said, “captured a dramatic shift in market sentiment that coincided with President Trump’s ‘Liberation Day’ tariff announcements on April 2.” The survey was conducted from March 31 to April 7.

The group’s statement added, “The precipitous decline reflects growing concerns over economic uncertainty triggered in large part by recent trade policies that have led to heightened market volatility.”

In a prepared statement, CREFC President & CEO Lisa Pendergast commented, “The dramatic drop in our Sentiment Index clearly signals concern, but beneath the headline numbers we see pockets of cautious optimism, particularly regarding how lower interest rates might finally break the transaction logjam that has persisted through much of 2024.”

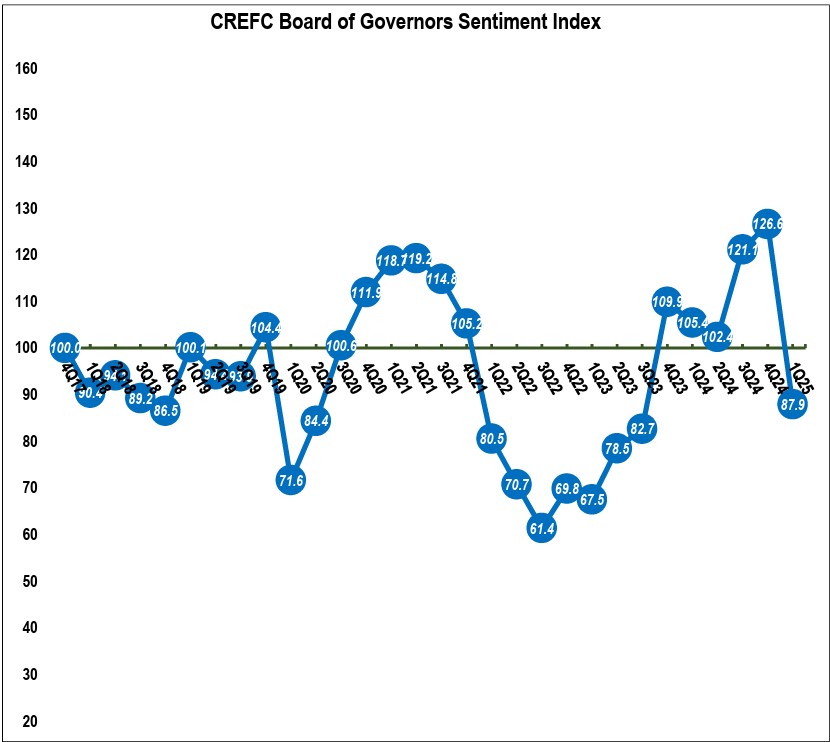

Beyond the single metric of the Sentiment Index, CREFC noted that 80 percent of survey respondents expect worse economic conditions over the next 12 months, versus only 12 percent last quarter. And just 7 percent expect improvement, compared with 42 percent in the previous survey.

Other highlights from the survey include:

- “notably split sentiment” over the effect of declining interest rates, with 30 percent shares each seeing positive and negative impacts, regarding whether lower rates might offset other negative factors

- sharply lower expectations on CRE fundamentals

- more modest expectations as to transaction activity, with just 35 percent expecting increased demand

- lower expectations—though still positive overall—with respect to financing demand

- more pessimism regarding market liquidity, as just 15 percent expect better conditions and 26 percent expect worse conditions

Finally, 60 percent of the respondents were either very or extremely concerned about the effects of tariffs on construction costs and CRE development.

Suggestions of optimism

The new report bristled with pungent observations about the new economic environment.

On market volatility, one respondent said, “There is a lot of volatility right now which makes the market very unpredictable. This hurts issuers’ ability to bring deals to market in a timely and orderly manner. Everything is a cluster.”

Another called the situation “The most astonishing set of unknown unknowns as we have experienced in my professional life. … I don’t have a clue.”

READ ALSO: 5 Trends Defining CRE Development in 2025

Regarding interest rates, one individual wrote, “I always believed that 2025 would be a year of increased velocity of trades due to various reasons but the primary one being investment fatigue. With the drop in interest rates, the velocity of investment should increase quicker.”

Another commented, “It’s going to take time to understand the effect of tariffs. I expect interest rates to stay a touch lower than where they were mid-Q1 which should bring more borrowers to the table.”

Despite the turmoil and the plunge in the Index, some of the comments on CRE market activity were optimistic.

One respondent said, “The DOGE layoff and non-lease renewal impact on government leasing in the long run will be offset by government return to office mandates, which is the more important long term trend.”

And another one said, “Recessionary impact on real estate cash flow and therefore real estate valuations will be offset by lower rates and cap rates—I think a net positive for real estate values.”

The post Sentiment Takes Deep Hit Amid Policy Turbulence: CREFC appeared first on Commercial Property Executive.