Retail Owners Gain Leverage in JLL Report

Retail landlords can find some good news in JLL’s United States Retail Outlook for the second quarter.

Retail net absorption increased 75.4 percent quarter-over-quarter to 7.7 million square, particularly in community centers, lifestyle centers and Class C malls. Tenants are quick to lease available space. Rents are increasing and Gen Z consumers are becoming mall rats.

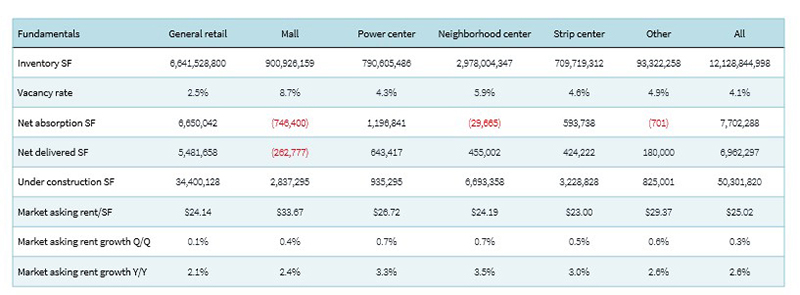

The report notes that, with increasing competition for space, landlords have the advantage, especially when it comes to rents. Overall market asking rents were up slightly from the first quarter of 2024 to the second, just 0.3 percent. But year-over-year, market asking rents increased 2.6 percent, according to the report.

READ ALSO: Single-Tenant Deals Get a Boost

Neighborhood center asking rents were up the most on an annual basis, 3.5 percent, followed by power centers with a 3.3 percent year-over-year hike. Strip center rents rose by 3 percent, Even mall rents were up 2.4 percent, JLL stated. Markets in the South and Southwest continue to see some of the strongest rent gains. Factors include population growth and consumer-driven demand.

“There has been no significant increase in new construction, which means that as long as leasing demand stays steady, rents will continue to rise,” James Cook, JLL’s director of retail research, told Commercial Property Executive. “These increases will be the highest in places with more competition, including Class A malls, some prime urban corridors and in open-air centers in many desirable neighborhoods.”

With construction starts at record lows and availability below historical averages, landlords are “wielding much greater pricing power, often holding firm in rent negotiations,” the report states.

Limits on supply

Building starts are expected to remain at historic lows as higher construction and financing costs are holding developers back from building new projects. During the second quarter, there was a total of 50.3 million square feet of all retail under construction, according to JLL. Most of that–34.4 million square feet –falls under general retail. There is less than 1 million square feet of power center space under construction. Neighborhood centers fare the best with about 6.7 million square feet of space under construction.

The overall vacancy rate was 4.1 percent in Q2. Malls saw the highest vacancy rate in the second quarter at 8.7 percent followed by neighborhood centers, which saw a vacancy rate of about 5.9 percent and strip centers which had a vacancy rate of 4.6 percent.

JLL found Class C malls had a boost in absorption compared to overall mall net absorption, which fell slightly in the second quarter, down 0.8 percent. The report notes this could be because of low availably at Class A and B malls. Competition is increasing, particularly at Class A malls, which have an average availability rate of 3.7 percent, leading to tenants inking leases in record time – a new low of 8.5 months.

At power centers the average size of new leases signed rose quarter-over-quarter and year-over-year.

Small spaces dominated new leases inked during Q2 with many of them leaning toward food and beverage outlets like Wingstop, Jersey Mike’s and Starbucks. Other tenants taking small spaces included Xponential Fitness, AT&T and Verizon.

Other fitness tenants, including Crunch Fitness and Planet Fitness, are boosting their leasing, too. According to JLL, experiential concepts in general accounted for 15 percent of all leasing activity over the past two years. The King of Prussia Mall in Pennsylvania recently signed a deal for more than 100,000 square feet of space with Netflix House, an entertainment venue that will bring popular Netflix titles to life through restaurants, stores and other immersive experiences.

JLL reports indoor mall foot traffic increased in the second quarter, up 8.6 percent year-over-year. Some of that growth is apparently coming from Gen Z. An ICSC study found 97 percent of Gen Zers want to shop in brick-and-mortar stores and 60 percent just want to hang out with friends.

Investments expected to rise

Despite some positive trends, national retail transactions still faced challenges in the first half of 2024 because of the combination of high debt costs and uncertainty surrounding monetary policy, JLL stated. Transaction volumes are expected to be down 36 percent from 2023 to about $16 billion. However, there is growing optimism for the second half of this year and into 2025 with the Federal Reserve expected to begin cutting interest rates possibly as soon as September.

“If the Federal Reserve does drop interest rates in September, as many expect they will, we believe it will result in an increase in investment activity. However, real estate transactions can take time, so it may not be until 2025 that we see a marked increase in transaction volume,” Cook said.

The post Retail Owners Gain Leverage in JLL Report appeared first on Commercial Property Executive.