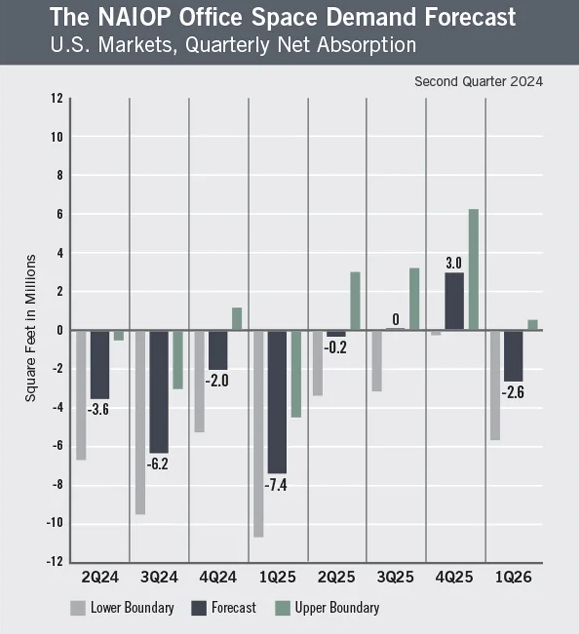

Office Absorption to Stay Negative Through 2025

Office space absorption is expected to remain negative through 2025, with that rate gradually slowing by the end of next year, according to a new report from NAIOP.

The office market performed worse in the first quarter of 2024 than previously forecast, with national office net absorption totaling a negative 13.4 million square feet, the NAIOP Research Foundation’s Office Space Demand Forecast reported.

Some companies might have paused expansion plans due to a reversal of optimism they held late in 2023 about 2024’s prospects.

Elevated interest rates are not helping. They are expected to remain high, at least in the near term.

The combination of net absorption rates (a large supply of unrented office space) and a great number of loans that need refinancing will create devastating effects for regional banks, Alan Hammer, executive committee member at Brach Eichler, told Commercial Property Executive.

“We are on the verge of a crisis in the industry, with very little lending ongoing at the regional level because the banks need the money themselves to offset their exposures,” he said. “However, the problem right now is not just higher-for-longer interest rates. As the interest rates continue to rise, borrowers will not be able to replace their existing debt amounts for reasons including their inability to meet their debt service coverage ratios.”

He said anyone who aggressively refinanced their loans in the past five years will have a hard time refinancing and meeting their coverage ratios, forcing banks to extend existing loans and work out terms on an individual basis.

READ ALSO: Office Distress Risks Are Rising

Many have pointed to the structural shift in the use of space due to remote work (i.e., less office space leased per employee) as a culprit, but NAIOP said much of this change is already reflected in current market conditions.

“Occupiers have had several quarters to adapt to new work patterns, and macroeconomic and general business conditions will likely play a larger role in shaping their leasing decisions in the coming quarters,” the report stated.

The timing of lease signings

Tere Blanca, founder, chairman & CEO of Blanca Commercial Real Estate, told CPE that current market conditions largely reflect the structural shift in space usage stemming from the pandemic, resulting in a “math problem” of sorts, regarding the state of leases.

Although different from market to market, she said the average length of an office lease in the U.S. is five years.

“With the structural shift in office space usage starting in the latter half of 2020 and into 2021, most tenants that signed leases before the pandemic have had the chance to adjust their office footprint, which is already reflected in absorption and vacancy numbers,“ Blanca said.

“While some larger tenants, who typically sign longer leases, have not yet signed a new lease, those who have determined they have excess space have likely already listed that space for sublease or attempted to negotiate terminations or contractions with landlords,” she added.

Blanca said that most companies have a grasp on their office usage and have been able to adjust their footprint to reflect that. However, space usage is not static, and some tenants may decide to reduce footprint further, or expand closer to their original footprints.

Returning unused office space now common

Four years after the global lockdown, companies are now better equipped to make long-term decisions regarding their space requirements, according to Adam Starr, vice president of leasing & senior director at PEBB Enterprises.

He told CPE these companies, now in a stronger position to plan for the future, have increasingly decided to give back large blocks of space.

“This trend of returning unused space has become common over the past 18 months,” Starr said.

“Despite current market conditions which has some consideration by the early prevalence of remote working, the percentage of tenant giveback space has increased overall as companies have adjusted to their office space needs in a new work environment.”

Analyzing occupancy and optimizing space utilization, along with leveraging labor-cost arbitrage and government incentives, are key strategies for reducing real estate costs, said Doug Ressler, Yardi Matrix.

“Buildings with consistently low space utilization rates are candidates for downsizing or repurposing, with some being converted into coworking spaces,” Ressler said.

“This indicates a transformation in the way companies approach their workspace needs, with a growing inclination toward coworking spaces that offer flexibility, cost savings and opportunities for collaboration. The coworking space market is responding by expanding and diversifying to meet these evolving demands.”

Adding inventory is a minus

Millions of square feet of office space signed up pre-COVID will be coming up for renewal in the next two years, Pierre Debbas, managing partner at Romer Debbas, told CPE.

“Adding more inventory to the market, which has had a very low absorption rate, will lead to this saga continuing as it’s almost a guarantee that most companies will downsize their space from what they may currently have,” Debbas said.

He said Class A office space differs from the rest of the market.

“While no segment of the market is immune from the working from home phenomenon, major corporations have still invested in office space with a focus on Class A and using the space to create more amenities to entice their employees to come into the office,” Debbas said.

“Small to mid-sized businesses for the most part cannot afford this luxury and have used the new reality we live in to shed costs, which is creating more difficulties in the Class B and Class C office market.”

Bill Harter, principal & ESG Solutions Advisor at Visual Lease, told CPE that ESG trends impact how companies enter into new leases.

The Visual Lease Data Institute found that 88 percent of surveyed senior finance executives say that sustainability factors are a high priority when evaluating new lease agreements, such as increasing the number of LEED-certified buildings in their lease portfolios or increasing the number of energy-efficient vehicles in their fleets.

READ ALSO: Where Office Work Is Heading Now

“These changes in behavior will likely result in longer negotiation periods,” Harter said. “And while many companies may wind up with a smaller real estate footprint, it’s important to note that more lease terms actually translate to more lease data to keep track of when it comes time for reporting.”

Checking occupancy-per-employee

Jeff Holzmann, COO at RREAF Holdings, said in data lies the ultimate truth. In NAIOP’s report, the occupancy of office space per employee has remained stagnant and fell short of the forecast.

“When it comes to office occupancy, the Location and Quality metric (often measured in terms of A, B, or C Class building) is a key factor,” he said. “The total, net or average figures may not always reflect the local reality, and this is where the art of data interpretation comes into play.

“For historical context, consider that the COVID-19 pandemic created a situation never seen in U.S. history. Office work was effectively shut down from 100 percent to zero in a matter of days. While the pandemic restrictions have been lifted, the return-to-work trend was slower to catch up.”

Some companies adopted hybrid work schedules, some moved on to remote work, and some downsized altogether and never snapped back.

“It’s fair to say that the market has stabilized in the traditional sense with more openness to hybrid. The pandemic did not kill the office culture, at least not in this round.”

Interestingly, companies that did decide to go back to traditional models upgraded, Holzmann said.

“As more space became available, office buildings were foreclosed on and sold in a fire sale, and owners gave concessions to get tenants to stay, many businesses were able to move from class C to class B or even from B to A,” he said. “This opened opportunities for smaller businesses to fill in the gaps, and the market eventually found equilibrium.”

The post Office Absorption to Stay Negative Through 2025 appeared first on Commercial Property Executive.