Life Science Trends to Watch in 2025

The life science lab occupier market is expected to continue experiencing a stratified leasing market, according to JLL’s new report.

“The landscape is transforming significantly,” according to Maddie Holmes, JLL’s senior research analyst, life science industry insight and advisory, and one of the report’s authors.

There’s a shift toward prime locations and quality assets, with AI driving scientific discovery and strategic space management, Holmes told Commercial Property Executive.

“Prime life science real estate locations are concentrated in established Tier 1 clusters like Boston/Cambridge, the San Francisco Bay Area and San Diego, with emerging markets such as Houston gaining traction,” said David Choukroun, vice president of investments at SPHERE Investments.

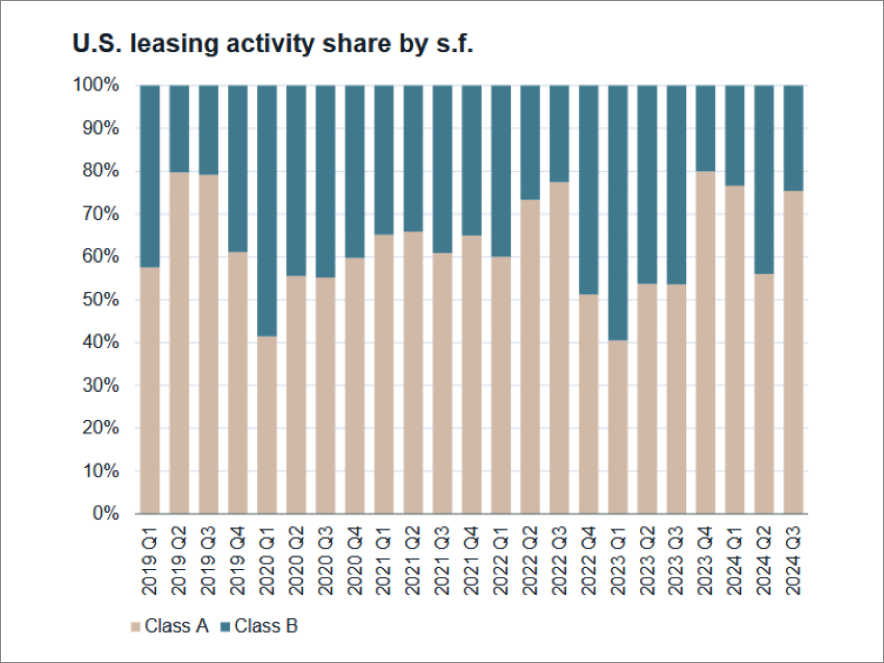

The most sought-after assets are Class A purpose-built lab and R&D facilities, high-quality spaces in desirable locations with amenities, energy-positive buildings and specialized biomanufacturing and GMP facilities, Choukroun explained.

“These prime assets are characterized by their proximity to major hospitals, leading universities and research institutions, access to skilled workforces and capital funding, strong property-level fundamentals with stable cash flows and the ability to support advanced infrastructure and technological requirements.”

Investors and companies are prioritizing these top-tier assets in prime locations, expecting them to absorb demand before secondary or underperforming spaces in the market, according to Choukroun.

Heavier venture capital funding will lead to more mid-size lab leases (20,000 to 50,000 square feet), allowing landlords to consider a multi-tenant lease-up strategy, according to Tucker White, U.S. life science lead, market intelligence, Avison Young.

“Lab tenants will begin to compete with office tenants in select life science markets as unleased life science projects start to gain interest from office occupiers looking to move to newer, better-located buildings,” he said.

P3s reshaping the market

Ecosystem resilience through incubators and public-private partnerships is reshaping the life science market, while global collaboration and cost optimization are becoming key priorities.

“CRE professionals in the life science sector must balance these evolving trends, adapting their strategies to support innovation while optimizing operational efficiency,” Holmes said.

The Philadelphia life science market ecosystem is emerging as a key player in driving innovation and growth in the sector. It is supported by a robust network of academic institutions, namely the University of Pennsylvania and Children’s Hospital of Philadelphia, pharmaceutical giants and biotech startups.

“The region’s resilience, underscored by its ability to attract talent and investment, positions it as a critical hub for research and development,” Todd Monahan, executive vice president & managing director, WCRE/CORFAC International, told CPE.

READ ALSO: The Most Active Life Science Markets in the US

“This dynamic growth is reshaping lab real estate, with incubators and public-private partnerships playing pivotal roles.”

Incubators like Blabs and Pennovation Works foster early-stage startups by providing cost-effective lab space, mentorship and resources to accelerate breakthroughs.

Meanwhile, P3s facilitate large-scale, state-of-the-art lab developments by merging public funding with private sector expertise, ensuring market stability amid economic fluctuations.

“Together, these forces create a sustainable ecosystem supporting innovation while meeting the increasing demand for flexible, high-quality lab space,” Monahan said.

Lab space must attract top talent

Companies now prioritize high-quality spaces in desirable locations with amenities to attract and retain top talent while enhancing productivity.

“Companies are placing greater importance on securing strategic real estate in key regions, as these locations are crucial in attracting top-tier talent and fostering innovation,” Daniel Maldonado, Unispace’s managing director of life sciences, Americas, told CPE.

“As organizations strive to remain competitive, the need for spaces that support collaboration, creativity and research excellence is becoming more pronounced.”

Companies now demand environments that meet all the criteria for research and innovation while creating quality-of-life benefits for employees that aid in recruitment and retention, according to Boston-based Mark Barer, director of development at Lendlease.

FORUM is a nine-story, 350,000-square-foot life science development in Boston’s Allston-Brighton neighborhood. It includes amenities designed to enhance the employee experience.

“Employees prefer live-work-play environments,” Barer said. “The development’s location in the Boston Landing area of Allston-Brighton provides employees access to a walkable urban district with a lively mix of retail, dining and entertainment options.

“Attracting talent from across the metro is made easier by the area’s nearby transit options, including the Boston Landing MBTA Commuter Rail station, Massachusetts Turnpike, MBTA bus routes and a Bluebikes station.”

AI to affect real estate management

In 2025, integrating AI and advanced technologies will significantly impact scientific processes and real estate management.

Organizations will leverage AI to accelerate scientific discovery and implement AI-driven workplace strategies that reflect the industry’s recognition of real estate as a critical strategic function.

“AI is revolutionizing scientific discovery and strategic space management by transforming research methodologies, accelerating experimental processes and reshaping laboratory infrastructures,” Choukroun said.

Through advanced machine learning models, AI enables faster hypothesis generation, predictive capabilities and cross-disciplinary insights, allowing researchers to process vast amounts of data and uncover complex patterns previously undetectable, observed Choukroun.

He explained that in strategic space management, AI is driving the evolution of laboratory design toward more flexible, technologically integrated environments that support both computational and experimental work, optimizing infrastructure through digital simulations and enabling more distributed, collaborative research models.

“This technological integration is fundamentally changing how scientific spaces are conceptualized, designed and utilized, creating more adaptive, efficient and innovative research ecosystems that can rapidly respond to emerging scientific challenges and opportunities.”

More laboratory facilities featuring significant data storage requirements due to the adoption of AI in R&D are expected, according to Adam Enright, vice president at PMA.

“Space needs for dry labs and computing labs will likely be greater than traditional needs. While we haven’t seen marked increases yet, we do anticipate that companies are still learning how to leverage AI—and it is only a matter of time,” Enright said.

There will be more focus on operational costs, and there is a drive to ensure they are providing a more critical focus on their real estate strategies, according to Jason D’Orlando, executive managing director of industrial and life sciences & project and development services lead at Mission Critical.

“We are seeing more requests and analysis to either find or build out spaces that shift toward more efficient building designs and energy optimization to meet cost-cutting pressures without sacrificing innovation.”

The post Life Science Trends to Watch in 2025 appeared first on Commercial Property Executive.