LA Was Among Hotspots for Office Investment in 2024

Los Angeles ended last year as one of top markets for office sales, while construction activity remained slow, the latest CommercialEdge data shows. Investor appetite in the City of Angels increased throughout 2024, with the last quarter being the busiest period.

Office prices fluctuated from $1,406 per square foot in January to the $274.98 per square foot of December. Still, the metro ended last year as one of the most expensive markets in the U.S. With high vacancies hitting most key markets, Los Angeles’ rate remained below the national average.

L.A. among top-performing markets

At the end of last year, a total of 7.7 million square feet across 53 properties changed hands in the metro, generating a combined value of $2.1 billion. This marked a 7.3 percent drop when compared to 2023 and placed Los Angeles on the third spot among top-performing markets. Manhattan had the largest investment volume at $4.1 billion in deals, while Washington, D.C. followed with $3 billion.

Investment activity in Los Angeles increased throughout 2024: the first quarter ended with $130.5 million in deals, while the third quarter recorded $789.5 million in sales, marking a 136.9 percent year-over-year growth. The last quarter of 2024 was the busiest period, with investment volume reaching $1 billion.

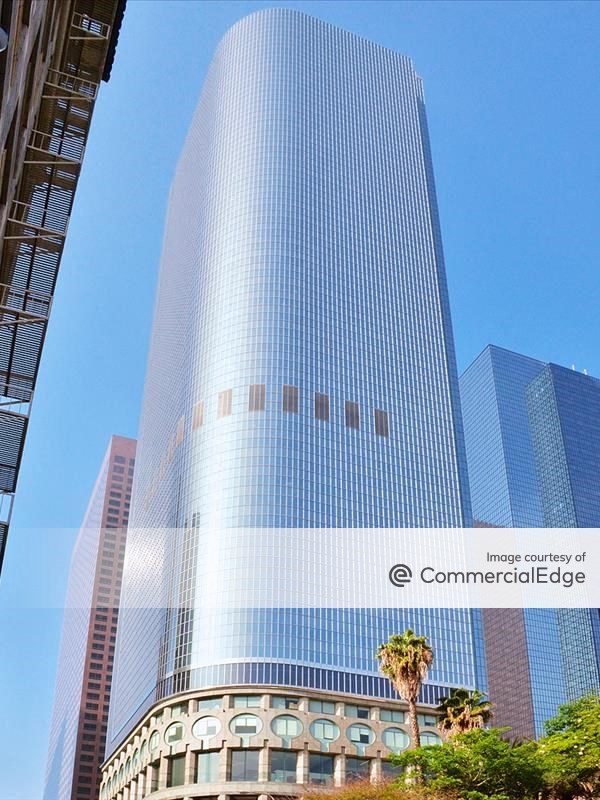

One of the biggest transactions of 2024 was the $200 million acquisition of The Gas Company Tower, a 1.3 million-square-foot office property in downtown Los Angeles. The high-rise traded after Brookfield Properties defaulted on a $350 million and Wilmington Trust sold it via a foreclosure to Los Angeles County.

Another notable deal was Drawbridge Realty’s $185 million purchase of 2220 Colorado Ave., a Class A low-rise property in Santa Monica, Calif. The 201,006-square-foot building is occupied by Universal Music Group and was sold by Clarion Partners.

Pricy deals continue in 2025

The average sale price per square foot in Los Angeles stood at $274.98 in 2024—way above the national figure of $171.61 per square foot and higher than in 2023, when properties traded at $262 per square foot. The metro ranked fourth among most expensive gateway markets, with Miami emerging as the leader, where office assets changed hands at $395.24 per square foot.

Sales prices in L.A. fluctuated throughout last year—from the $1,406 per square foot recorded in January to the $163 per square foot at the end of March, the lowest value during last year.

So far in 2025, CommercialEdge data shows that five properties totaling 740,115 square feet already traded in the metro, generating $174.2 million. The average sale price per square foot stands at $235.31.

The biggest office deal since the start of the year was Pelisades Group’s $69.4 million acquisition in Calabasas, Calif. The company worked in partnership with Cross Ocean Partners for the buy of the 232,888-square-foot building at 4500 Park Granada, also known as The Park Calabasas.

Construction activity came to a halt

At the end of 2024, the metro had 1.9 million square feet of office space underway, representing 0.7 percent of existing stock—slightly below the national average of 0.8 percent. Boston led the nation with 3.4 percent, followed by San Francisco (2.3 percent) and Dallas (1 percent). When adding developments in planning stages, the figure reached 3 percent—above the national average of 2.9 percent and on par with Manhattan.

In terms of square footage, Los Angeles’ pipeline outperformed that of Miami (1.8 million square feet), Seattle (1.8 million square feet) and Washington, D.C. (1.1 million square feet) and placed eight in the nation. Boston led with 8.7 million square feet under construction.

The list of the largest project underway remained unchanged in the City of Angels: JMB Realty’s Century City Center is the biggest development in terms of square footage. Totaling 731,250 square feet and rising 37 stories at 1950 Avenue of The Stars, completion is slated for early 2026.

Construction starts for the past year totaled 709,340 square feet across eight properties, accounting for 0.2 percent of existing stock. Meanwhile, Los Angeles developers completed 955,610 square feet of space across 14 properties, representing 0.3 percent of the existing stock and marking a 45.6 percent drop in year-over-year completions.

Among notable deliveries is the 331,000-square-foot building at 444 Universal Hollywood Drive in Studio City, Calif. The Class A+ property was developed by NBC Universal and came online in September.

L.A. expands coworking footprint

The coworking sector in Los Angeles included 6.5 million square feet of space across 409 locations—a notable expansion from the 4.6 million square feet registered at the end of December 2023. The metro had the third-largest flex office footprint among gateway markets, after Manhattan (11.6 million square feet) and Chicago (7.1 million square feet).

The metro’s share of flex space as percentage of total leasable office space reached 2.2 percent—above the national figure of 2 percent and on par with Chicago’s and San Francisco’s rate, while Miami led with 3.8 percent.

Regus, with operations totaling 709,839 square feet, was the flex office provider with the largest footprint in Los Angeles. Other companies with a significant presence were WeWork, with 709,408 square feet, Spaces, with 594,194 square feet, Premier Workspaces, with 517,623 square feet and Industrious, with 427,407 square feet.

Office rents among highest in L.A.

As of December, Los Angeles’ office vacancy rate clocked in at 16 percent—below the national average of 19.8 percent and lower than in similar markets, such as Boston (17 percent), Washington, D.C. (18.5 percent) and Chicago (18.8 percent). Across gateway markets, San Francisco recorded the highest rate in December, at 28.8 percent, while Miami’s 15.2 percent was on the other end of the spectrum.

Los Angeles listing rates hit $42.41 per square foot in 2024—above the national average of $33.11. San Francisco led with $70.56 per square foot and was followed by Manhattan ($68.42 per square foot), Miami ($54.37 per square foot) and Boston ($54.35 per square foot). The most affordable gateway market was Chicago, where office rents averaged $27.30 per square foot.

Significant office leases last year include a 467,000-square-foot extension signed by Snap Inc. The company inked a 10-year commitment at Santa Monica Business Park, a 1.2 million-square-foot office campus owned by BXP.

Another notable deal was CIM Group’s 198,553-square-foot long-term lease with Southern California Gas Co., for its new headquarters at City National 2CAL, a 1.4 million-square-foot tower in downtown Los Angeles. The commitment was the largest new office lease signed in 2024.

A large inventory for residential makeovers

Office-to-residential conversions pose a feasible opportunity to readapt underutilized office buildings and as a response, CommercialEdge launched the Conversion Feasibility Index. This tool evaluates which office markets are strong candidates for makeovers using a set of property-level scores. At the start of 2025, Los Angeles had 267 properties totaling 24.9 million square feet in the Tier I category.

There are multiple federal and local governments policies that support conversion projects, such as California’s $400 million in incentives for redeveloping downtown commercial buildings into housing. Meanwhile, the Los Angeles Adaptive Reuse Ordinance received its latest amendments in December, allowing more underutilized properties to be converted into residential use.

One example of such a repurposing is the makeover of 3325 Wilshire Blvd., a 1955-built, 233,000-square-foot office building. In November, Jamison Properties and Arc Capital Partners broke ground on the project that will feature 236 residential units across 13 stories and 15,000 square feet of retail space.

The post LA Was Among Hotspots for Office Investment in 2024 appeared first on Commercial Property Executive.