How Much Will CRE Investment Increase This Year?

Commercial real estate investment volume is forecast to increase by 8 percent this year in the U.S., according to the CBRE’s latest global real estate capital flows report.

Capital markets activity so far in 2025 has been challenged by relatively high long-term bond yields and CBRE expects investment activity to be relatively muted in the first half, while the 10-year Treasury yield is above 4 percent.

Inflation trends, ongoing policy uncertainty and elevated budget deficits have kept yields where they are, the report said.

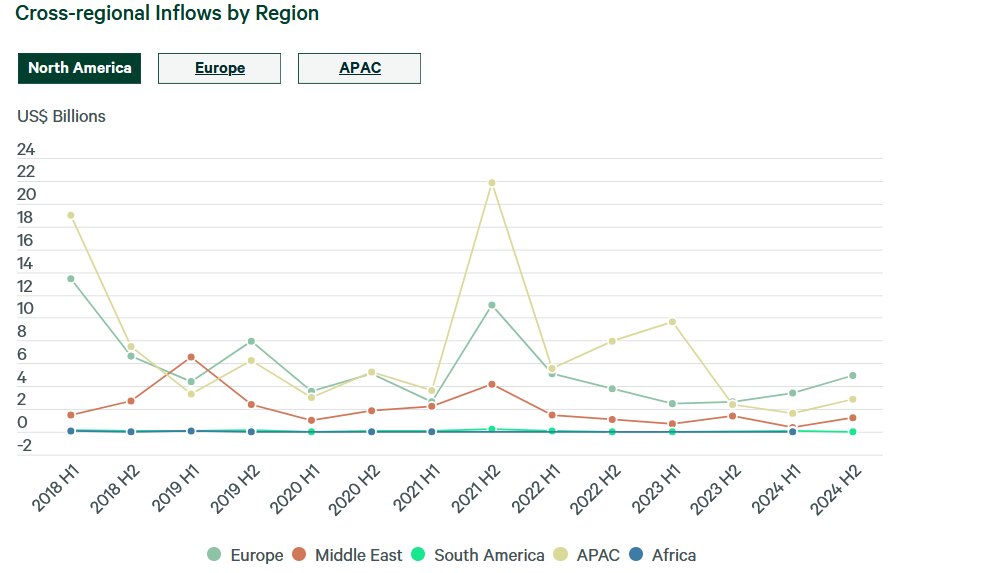

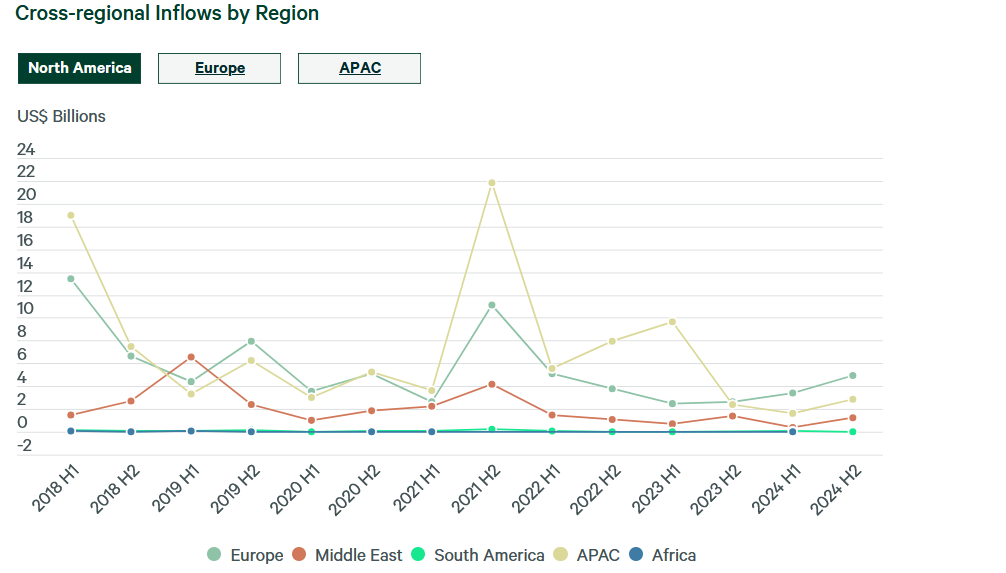

This comes after last year’s second half, which saw the largest total cross-regional capital flows to North America, Europe and Asia-Pacific since 2022. Capital flows were up 31 percent to $37 billion, but volume was much lower than its most recent peak of $88.5 billion in the second half of 2021. U.S. total inflows increased by 40 percent year-over-year in the second half of 2024 to $9 billion.

Industrial’s strength

For the fourth consecutive half-year period, the industrial and logistics sector attracted the most cross-regional investment. At 47 percent, its share was the highest on record, and the volume was substantial across all regions.

The cross-regional office investment volume volume markedly recovered in the second half of 2024, revealing a 50 percent year-over-year increase to $7 billion.

Retail and multifamily cross-regional investment volume remained stable.

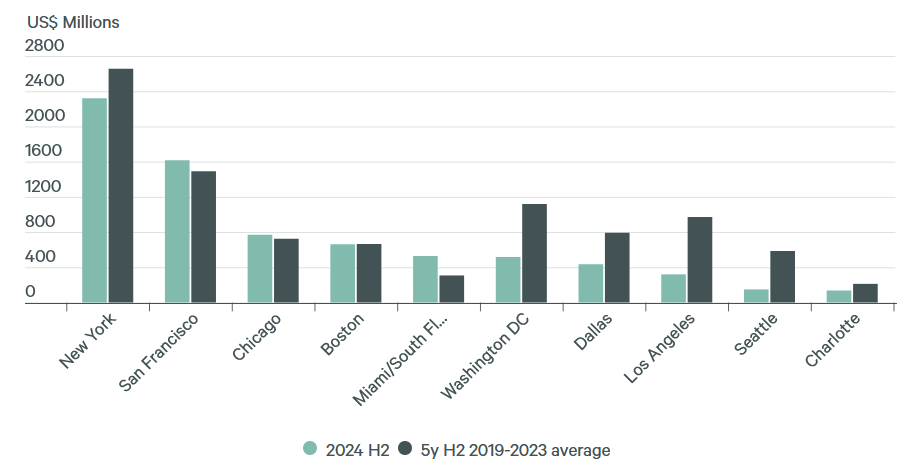

Investors found New York Boston and San Francisco the most attractive places for prime industrial, logistics and office assets, according to CBRE’s report.

Partnerships are investors’ priority

Large global investors are prioritizing strategic partnerships over individual transactions, Bill Shanahan, chairman of capital solutions & restructuring at CBRE Capital Markets, told Commercial Property Executive.

“Multifamily and logistics remain the preferred sectors, while data centers are highly sought-after, though high-entry barriers often push investors toward indirect participation,” Shanahan said.

The sweet spot lies in core-plus and value-add opportunities that provide steady income today rather than relying on future growth, Shanahan added. “Larger players favor scalable, partnership-driven strategies to enable consistent capital deployment over the long term.”

READ ALSO: What CRE Investors Want to Buy in 2025

The increased capital flows are being reflected in the U.S. debt capital markets, according to Zachary Streit, president of Priority Capital Advisory.

“During the past six months, we have seen increased interest and tightening spreads from all lenders, including banks, debt funds and CMBS lenders,” he said.

“We have also seen outsized interest in industrial, retail and office transactions. We believe this trend will continue, and we are excited about the prospect of our clients capitalizing on a market with increased liquidity.”

CBRE’s latest data indicates that capital is slowly returning to the U.S. real estate market with greater scrutiny and selectivity, according to Heather Crowell, EVP of investor relations at Gregory FCA.

“The uptick in foreign investment in selective office opportunities suggests a turning point in sentiment,” she told CPE.

“Data also suggests affirmation of retail sector stability amid strong fundamentals. Rather than a broad-based rebound, this feels like a recalibrated vote of confidence in U.S. commercial real estate and a potential opportunity for companies to leverage capital markets again to secure efficient capital sources.”

The post How Much Will CRE Investment Increase This Year? appeared first on Commercial Property Executive.