Houston a Bright Spot Among Slowing Medical Office Sector

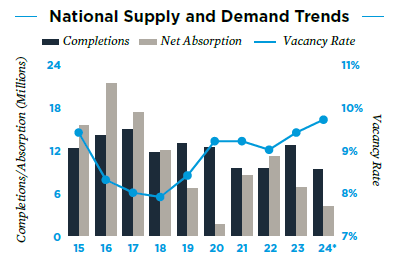

Medical office construction has slowed – especially outside of Texas – and healthcare retailers are shuttering, according to Marcus & Millichap’s National H1 Medical Office Report.

Most medical office construction projects are less than 50,000 square feet. However, Houston has several large projects slated for 2024, and will host nearly 22% of medical office space delivered nationally this year.

This will help Houston cater to its aging population, which is expected to see the nation’s third-largest increase in cohorts aged 65 and older by 2034.

Given inflation for material and labor costs, Marcus & Millichap expect more future projects to involve traditional office conversions.

Failing retail sites are another commercial real estate asset option for the medical office sector.

“The decision from some pharmacy retailers to offer limited, on-site medical care has emerged as a potential competitor for medical office operators in recent years,” according to the report.

Marcus & Millichap said that “in practice, this strategy has produced mixed success,” with similar attempts by Walmart and Walgreens proving less than profitable.

Transaction Velocity Down Nearly 40% YoY

Deal flow in the sector fell in the first quarter, and leading private buyers are finding alternative financing, particularly for assets with smaller price tags.

Year-over-year as of March, transaction velocity was down by nearly 40 percent. The bulk of trades that took place were in the $1 to $10 million price tranche, according to the report.

Trades in a lower price tranche have impacted the average sale price. During the trailing yearlong span that ended in March, the mean price per square foot for medical office space was $292, with a corresponding average cap rate of 7.2 percent. Regional differences emerge compared to pre-2020.

READ ALSO: Office Sector Adapts Amid Market Shifts

“While deal flow has declined from the highs recorded in 2021 and 2022, trades were more closely aligned with pre-pandemic trends,” Marcus & Millichap said.

Over the same period, half of the eight regions recorded transaction velocity above their pre-pandemic five-year average.

Cyber Attacks Common, Costly

Ransomware attacks are presenting headwinds, as cyber security concerns loom over the health system. A cyberattack in February aimed at UnitedHealthcare cost the company $870 million. According to the American Hospital Association, 94 percent of hospitals reported being financially impacted by the February cyberattack.

The report said the added expense of cyber security could also prompt cost-cutting in other areas, including real estate holdings.

In the case of UnitedHealthcare, it shrunk its traditional office real estate footprint after the attack. Other large companies may face similar attacks, which could impact their buy/sell/lease decisions of commercial real estate, including medical office, according to the report.

The post Houston a Bright Spot Among Slowing Medical Office Sector appeared first on Commercial Property Executive.