Fed Cuts Interest Rates in Final Meeting of 2024

At final meeting of the year, the Federal Reserve Open Markets Committee slashed interest rates by another 25 basis points, a move identical to its meeting last month. Heading into 2025, the current federal funds rate target range is 4.25 to 4.5 percent, level with the range of December 2022. The current rage is a bull percentage point down from the peak of 5.25 to 5.5 percent.

The anticipated move follows a second straight month of rising inflation, which throws a wrench in the Fed’s plans. The annual rate increased from 2.6 percent in October to 2.7 percent in November, while core inflation has increased from 3.17 percent in July to 3.32 percent last month.

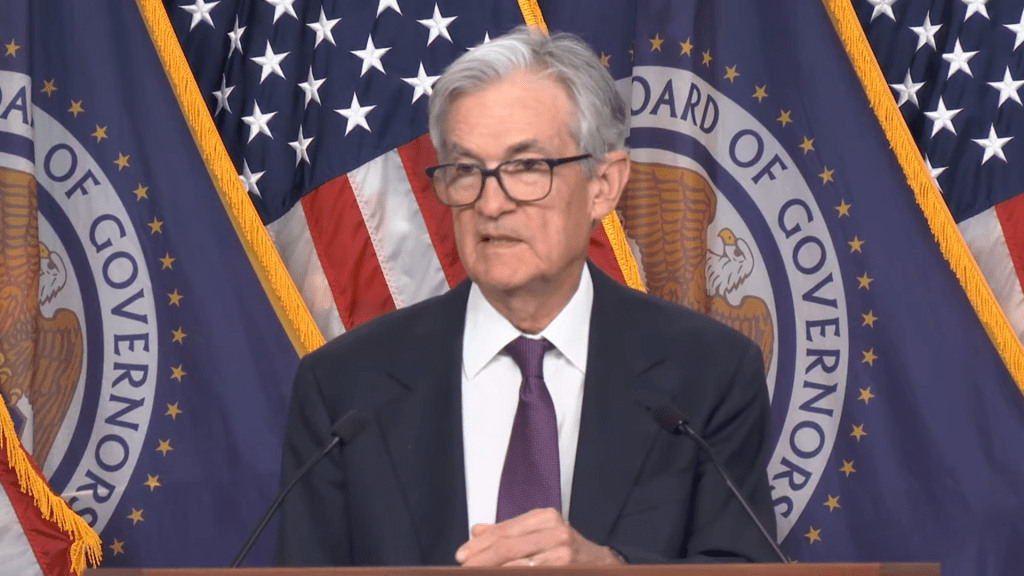

Mindful of these trends, Chair Powell underscored the Fed’s neutral approach to its dual mandate of slowing inflation while protecting the labor market, despite the recent indicators. “Today was a closer call, but we decided that it was the best decision towards achieving both of our goals,” Powell said at a Dec. 18 press conference.

What the Fed decides to do in 2025 is dependent on a number of factors, but the Fed will likely cut rates fewer times than anticipated at September’s meeting, in part due to persistent inflation, which the committee projects to fall to 2.5 percent in 2025. The median FOMC participant anticipates that the committee will cut twice in 2025, with rates falling to 3.9 percent at the end of 2025, and to 3.4 percent at the end of 2026. At the press conference, Powell said that “we are at or near a point where it will be appropriate to slow the pace of future adjustments. But we still see ourselves on track to continue to cut.”

Stability, at last?

With most of the economy’s key indicators proving resilient, some industry experts are optimistic about the state of commercial real estate investments in 2025. “Anticipated interest rate cuts by the Federal Reserve are expected to reduce borrowing costs, enhancing the appeal of real estate investments,” said Carey Heyman, a managing principal of the real estate industry at CLA.

READ ALSO: Is This the Start of CRE’s New Growth Cycle?

Others are a bit more cautious in their outlook. In the mind of Tamas Mark, global head of real assets at IQ-EQ, an asset management and administration firm, how investors will fare next year will likely be due more to political events than monetary policy. The chief driver could be policy changes by the incoming Trump administration. “Changes in tax policies, the impact of potential tariffs and a tax decrease might result in higher inflation and interest rate hikes, potentially also slowing down the forecasted rate cuts by the Fed,” Mark told Commercial Property Executive.

At the same time, Mark is optimistic about investors’ prospects going into the second half of the decade. “For now, the U.S.’s strong income growth with tailwinds from decreasing supply creates momentum,” Mark said.

The post Fed Cuts Interest Rates in Final Meeting of 2024 appeared first on Commercial Property Executive.