Fed Cuts Interest Rates at Last; CRE Experts Weigh In

At the conclusion of its September meeting on Wednesday, the Federal Reserve’s Open Markets Committee has elected to slash interest rates by 50 basis points, its first such cut following more than two years’ worth of increases and subsequent status-quo policy. The move lowers the Federal Funds rate to 4-3/4 to 5 percent from 5.25 to 5.5 percent, a range last seen in March of 2023.

The deeper-than-expected cut follows a period of steadily declining inflation and shows the Fed’s confidence in its goals of reducing inflation, which reached a nearly 40-year high in July 2022. The current inflation rate sits at 2.5 percent, the lowest since January of 2020, and is still 50 basis points above the Fed’s target.

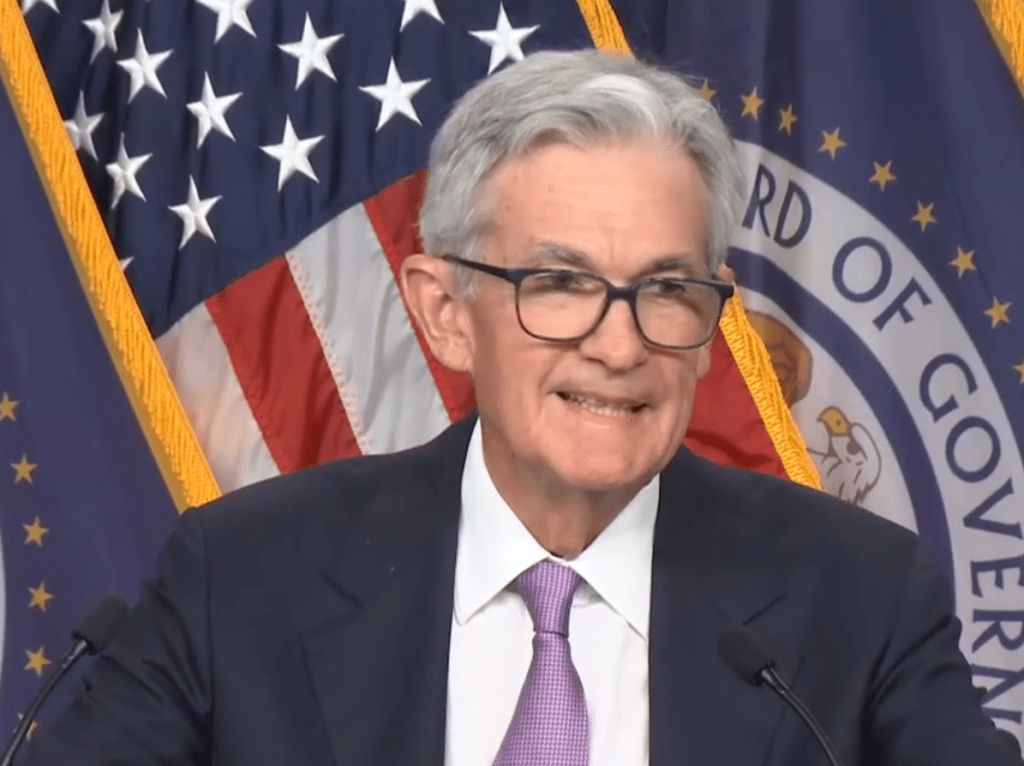

At a press conference following the announcement, Federal Reserve Chair Jerome Powell further explained the more aggressive than expected decrease, saying that “reducing policy restraint too quickly could hinder progress on inflation, and reducing it too slowly could unduly weaken economic activity and employment.”

What the Fed does before the end of the year remains to be seen, but the central bank’s focus has shifted from taming inflation to protecting the labor market. Powell did not rule out additional rate cuts before the end of the year, even with the nation 47 days out from an election. Individual FOMC participants believe that, if the economy evolves as expected, the median federal funds rate will be 4.4 percent at the end of this year. “This recalibration of our policy stance will help retain the strength of the economy and the labor market, and will continue to enable further progress on inflation as we begin the process of moving toward a more neutral stance,” Powell said.

Today’s 50 basis-point slash likely points to a more accommodating monetary policy. “This initial rate cut is expected to be the first of several future rate cuts that should help turn what had been a significant headwind into a tailwind that helps support a recovery in the commercial real estate markets,” said Rob Durand, executive vice president of finance at KBS Realty Advisors.

Tempered reactions and expectations

Though the announcement was welcomed by commercial real estate experts, the consensus is that the cut, in the immediate term, does more for sentiment than it does to lower capital costs or cap rates. “We’re not expecting to see a monumental shift in in the immediate aftermath of a rate cut,” said Brain Good, managing partner at iBorrow, a provider of bridge loans. “People want to buy, and they’re starting to trickle back in, but there is still a fair amount of hesitancy, even with a rate cut. We expect to see more momentum building after the election and into the new year.”

READ ALSO: NYC Executives Stay Sober-Minded on Eve of Expected Rate Cut

For dealmaking, rate cuts could do more to tip the leverage scale back in a positive direction, even if cap rates lag interest rates by 6 to 12 months, according to Erin Lavelle, head of real estate strategy at Armanino, a New York City-based accounting firm. “Some investors have been taking on negative leverage the last few months with the expectation interest rates would come down, so I think this month’s cuts may just be getting some investments back to ‘baseline’,” Lavelle commented.

More attractive deals for borrowers and capital providers may also be in the cards. “Borrowing costs and cap rates should both trend downward over time, and we are already seeing tentative signs of this in the data,” noted Ryan Severino, chief economist at BGO. Stressing the importance of what the Fed’s move signals, he added, “The key really is enough confidence in the outlook for interest rates, and that’s where forward guidance will matter.”

The post Fed Cuts Interest Rates at Last; CRE Experts Weigh In appeared first on Commercial Property Executive.