Economist’s View: Distress Opportunity Awaits—Or Does It?

In today’s environment of dislocated capital markets and an inverted yield curve, signs of financial distress are widespread. But whether that translates into a wave of investment opportunities is questionable. In fact, it seems unlikely. Instead, a lot of loans will be “kicked down the road.”

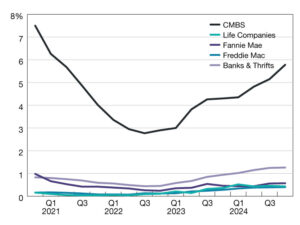

In 2023, 441 securitized loans, totaling $13.6 billion, were modified, up from about 380 loans modified in 2021 and 241 in 2022. From 2024-2025, about $270 billion of CMBS collateral, across the major property sectors, will mature.

Image by ferrantraite/iStockphoto.com

Sam Zell frequently said that investors say they wish they were around for the distress that existed from 1973-1976, 1980-1983, 1990-1995, after 9/11, and 2009-2013. He always laughed and said that in fact when such distress appears, most investors are too frightened to act. This has largely been the case over the past 18 months, as indicated by plunging transaction volumes. The reason is always: “Deals don’t pencil.” But in each of those episodes, a patient and well-capitalized investor was handsomely rewarded on deals that were hard to pencil at the time.

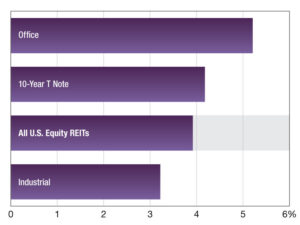

Deal volume is running about 20 percent of normal. This is despite the availability of nearly $300 billion in dry powder at private equity shops, with more at sovereign funds, pension funds, and about $3 trillion in excess bank reserves. The lack of deals is largely because buyers are seeking 20 percent or more value reductions from mid-2022 values, even for industrial and apartment properties, for which NOIs are generally up by 5-10 percent. Buyers are effectively using an unchanged rent and occupancy proforma versus 18 months ago, plugging in today’s loan terms and leverage, and “back-solving” for the value that yields their target IRR. This results in roughly 20 percent lower bids. But there is simply no reason for owners with locked-in low-rate seven- to 10-year debt and increasing NOIs to sell at such pricing.

Is the story different for floating-rate debt owners who have seen 400-500 basis point interest rate increases? Even with increased NOIs, floating-rate borrowers with 60 to 70 percent LTVs have been pushed into negative cash flow situations, giving bidders hope. But simple math indicates this hope is largely a fantasy.

Consider a stabilized apartment property that was worth $100 million at a 3.7 percent cap rate in early 2022. It has a $70 million interest-only loan with an original floating interest rate of 2.5 percent. Given the market changes since early 2022, we estimate that this owner is facing net cash flow of -$1.4 million per year.

With the expectation of falling short-term rates, it is highly implausible that such owners would take the 20 percent value reduction. Not only does history show that capital markets adjust when fear swings to greed, but such a sale would wipe out two-thirds of the owner’s equity and any fees generated by the asset. Owners realize that the property will once again cash flow when the short-term interest rate falls by 200 bps, even if NOI fails to grow. The owner may be compelled to sell at 4 to 5 percent less, but not 20 percent. Instead, they will beg, borrow or come out-of-pocket to fill the shortfall and keep asset value optionality alive. Thus, while capital sources are looking to put out $40 million in new equity to buy such assets at $80 million with a 50 percent LTV, they are only finding opportunities to place perhaps $2 million to $3 million in mezzanine debt to cover the owner’s shortfalls.

Dr. Peter Linneman is a principal & founder of Linneman Associates (www.linnemanassociates.com), Professor Emeritus at the Wharton School of Business, University of Pennsylvania, author of “Real Estate Finance and Investments: Risks and Opportunities,” and co-author of “The Great Age Reboot: Cracking the Longevity Code for a Longer Tomorrow.” Follow Dr. Linneman on X: @P_Linneman

Read the May 2024 issue of CPE.

The post Economist’s View: Distress Opportunity Awaits—Or Does It? appeared first on Commercial Property Executive.