Denver’s Office Sales Slow as Deliveries Slightly Increase

Denver’s office market has continued to see a slowdown in development activity, while its office vacancy rate continued to climb since the start of the year, according to CommercialEdge data. Developers completed seven properties totaling 1.3 million square feet, marking an uptick in deliveries year-over-year.

Office deals in Denver posted a 31.3 percent year-over-year drop, but the metro’s total office investment placed it among the top-performing U.S. markets, outpacing San Francisco. Meanwhile, even if the metro’s vacancy rate became one of the highest ones in the nation, Denver still closed some significant leasing agreements since the start of the year.

As of November, there were 680,961 square feet of office space under construction across seven properties, accounting for 0.4 percent of total stock—below the national rate of 0.8 percent. The figure was on par with that of Detroit’s and Phoenix’s, while it outpaced that of Portland’s (0.1 percent). When adding projects in prospective and planning stages, Denver’s rate reached 2.8 percent of existing stock—still below the national rate of 3.0 percent.

Notable office projects came online

In terms of office supply, Denver’s pipeline outpaced that of Phoenix’s (529,050 square feet), Charlotte (524,657 square feet), while Atlanta led across similar markets, with 1.7 million square feet. One of the largest office developments currently underway in the metro is Beacon Capital Partners’ Steel House, a 309,308-square-foot project in Denver’s Five Points submarkets. Construction on the 12-story project started in February 2023, with $100.2 million in construction financing by Bank OZK. The project is designed to received LEED Gold and WELL certifications.

Another notable development nearing completion is the 134,393-square-foot CV Innovation Campus, a life science project in Louisville, Colo. Developed by Koelbel & Co., the project is an adaptive reuse development of a former 1996-built Lowe’s store into life science and R&D space aimed for biotech and pharmaceutical companies.

Year-to-date through November, developers had broken ground in 690,666 square feet across six properties, while deliveries totaled nearly 1.3 million square feet across seven properties—accounting for 0.7 percent of existing stock and marking a 19.8 percent year-over-year growth.

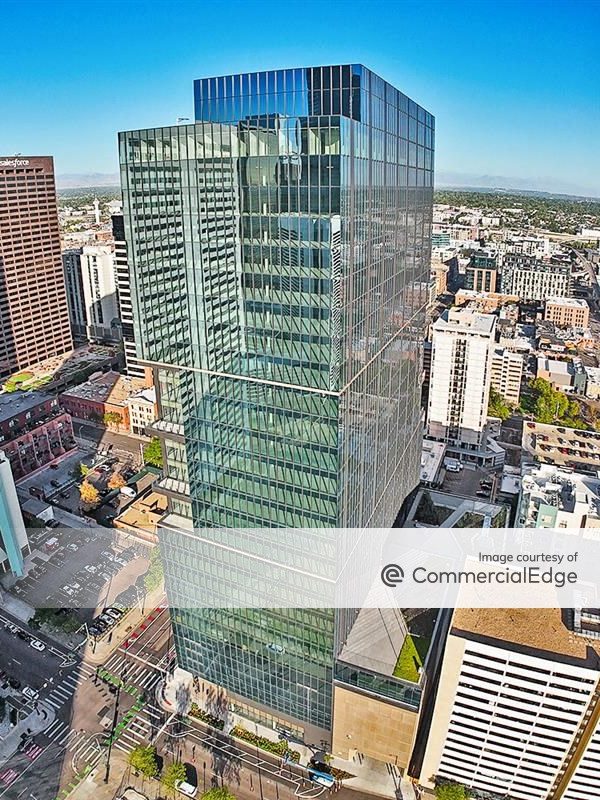

A recently delivered project is the 726,450-square-foot 1900 Lawrence, a Class A+ high-rise in Denver’s central business district. Completed in August, the 30-story office tower was developed by Riverside Investment & Development and financed by a $242 million loan by Bank OZK. Currently marketed for lease by JLL, the property is considered the largest skyscraper delivered in Denver in four decades.

Denver’s potential for office-to-residential makeovers

As vacancies continue to increase in most markets, office-to-residential conversion emerged as a trend for office owners across the U.S. CommercialEdge launched The Conversion Feasibility Index, a new tool that evaluates which markets show strong office-to-residential repurposing fundamentals, based on a set of property-level scores.

Denver had 18 properties totaling 1.7 million square feet in the Tier I category, with CFI scores between 90 and 100 points. Meanwhile, 212 properties accounting for 22.1million square feet of space made up the Tier II category, with CFI scores between 75 and 89 points.

One example of an office-to-residential project currently underway is the 124,000-square-foot building at 4340 S. Monaco St., that was purchased by Shea Properties. The company started the adaptive reuse project, with plans to add 143 affordable residential units. Originally completed in 2001, the Class A four-story property has been vacant for the past five years.

A drop in office sales

Year-to-date through November, Denver investors traded $768 million in office assets, with 60 properties totaling 8.2 million square feet of space that changed hands at an average sale price of $119 per square foot—below the national average of $179 per square foot. Among similar markets, deals were pricier in Phoenix ($164 per square foot), Portland ($164 per square foot), Atlanta ($148 per square foot), while Denver prices per square foot outpaced the ones from Houston ($107 per square foot) and Dallas ($115 per square foot).

The total sales volume in the metro was 31.3 percent lower on a year-over-year basis and placed Denver 13th among the top 25 U.S. office markets, outpacing San Francisco ($747 million), Seattle ($687 million) and San Diego ($651 million). Among notable deals in Denver is the $45.5 million sale of TeleTech Headquarters, a 271,678-square-foot property in Englewood, Colo. CommonSpirit Health, a Catholic hospital chain, acquired the property at 9197 S. Peoria St. from TeleTech Services, with plans to turn it into a medical campus.

Another significant deal is the $31.2 million sale of Sisters Grove Pavilion, a 116,367-square-foot medical office building in Colorado Springs, Colo. Harrison Street and MedCraft Investment Partners bought the property from CommonSpirit Health in October.

Office vacancy continues to rise

As of November, Denver’s office sector had a 24.6 percent average vacancy rate, one of the highest rates in the nation, and marking a 320-basis-point increase over the same period of last year. While the national rate was set at 19.4 percent, Atlanta and Phoenix were the similar markets with lower vacancy rates, with 17.8 percent and 18.4 percent, respectively.

Significant deals in the metro include Bet365’s 120,000-square-foot lease at One Platte, a 250,000-square-foot building owned by Nichols Partnership and Shorenstein. The U.K.-based sports betting firm opened its new U.S. corporate headquarters at the property in October, with the move expected to bring nearly 1,000 jobs in the area.

In May, Brookfield Properties signed a 121,000-square-foot renewal agreement at 717 17th St., a 693,565-square-foot property in downtown Denver. The tenant is Johns Manville, a Berkshire Hathaway subsidiary that will continue to use the space as its global headquarters through at least 2035.

A high share of flex office space

As of November, Denver’s coworking sector reached 3.7 million square feet of space, representing 2.2 percent of total leasable office space—above the national figure of 1.9 percent.

The largest flex office provider in Denver remained Regus, with operations totaling 694,250 square feet of space. The company was followed by WeWork (307,846 square feet), Expansive (229,867 square feet), Spaces (180,252 square feet) and Office Evolution (155,916 square feet).

The post Denver’s Office Sales Slow as Deliveries Slightly Increase appeared first on Commercial Property Executive.