CRE Outlook Remains Stable Despite Headwinds

The state of commercial real estate today does not resemble the years of the Global Financial Crisis for several reasons. According to CBRE, fundamentals for most real estate sectors remain near historical norms amid unexpectedly sturdy economic growth.

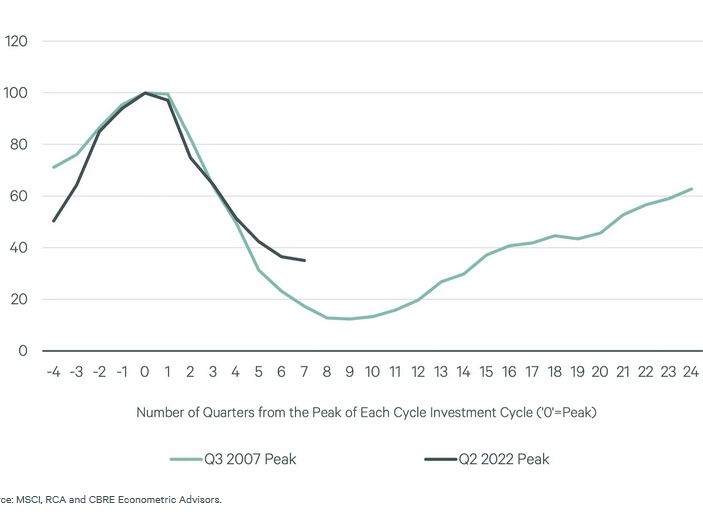

Fraction of Quarterly CRE Investment Volume as a Share of the Cyclical Peak. Chart courtesy of MSCI, RCA and CBRE Econometric Advisors

Nonetheless, the dearth of liquidity and price discovery has conjured comparisons with the 2008-09 cycle and current office debt delinquencies are beginning to reflect that time as well.

“In 2008-2009 a painful economic contraction encouraged companies and banks to hold onto cash,” CBRE reported.

“Today’s suppressed deal volume owes to high interest rates and uncertainty about their future path—quite different from central banks’ post-GFC zero-interest-rate policy—resulting in wide bid-ask spreads and less accommodative credit markets.”

READ ALSO: Why the Outlook Is Positive for Those in CRE

Deal volume was down 60 percent in the first quarter of 2024 compared with the 2022 peak, however the decline is less severe than during the GFC.

Blackstone’s flip of the Equity Office Properties’ portfolio in 2007 exaggerated the subsequent percentage decline in trading volume, CBRE pointed out.

“We expect deal volume will stabilize further now that the worst of inflation is behind us, and the Fed appears to be done hiking rates,” CBRE’s report indicated.

It calls for deal activity to pick-up, perhaps in early 2025, “but we do not anticipate an investment volume boom because borrowing costs and cap rates are likely to decline more slowly than in past cycles.”

The post CRE Outlook Remains Stable Despite Headwinds appeared first on Commercial Property Executive.