CRE Lending Climbs Despite Market Jitters

Despite an economy that often seems to be going in every direction except forward, commercial real estate lending swelled in the first quarter, buoyed by larger financing volumes and strong activity from banks, according to the latest Lending Momentum Index report from CBRE.

Despite this possibly surprising rush of lending, the report cautions that federal policy and economic uncertainty around Treasury yields remain significant factors.

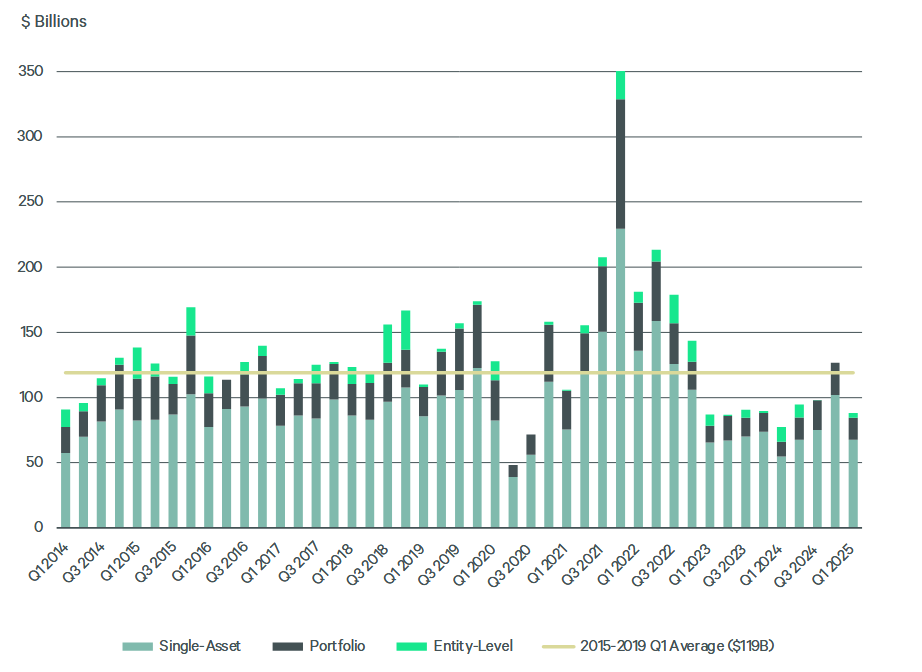

The Index tracks CBRE-originated U.S. commercial loan closings, which rose by 13 percent from the fourth quarter of 2024 and by 90 percent year-over-year.

READ ALSO: Regional Banks’ Quiet Comeback

In that set of mortgage closings, loan spreads tightened substantially in the first quarter, averaging 183 basis points, which was down by 29 basis points year-over-year.

Office financing experienced a notable rebound, as several major office SASB deals reached successful closures, according to a company statement. Meanwhile, data center construction loans remain a focal point, supporting a wide array of tenants beyond conventional models.

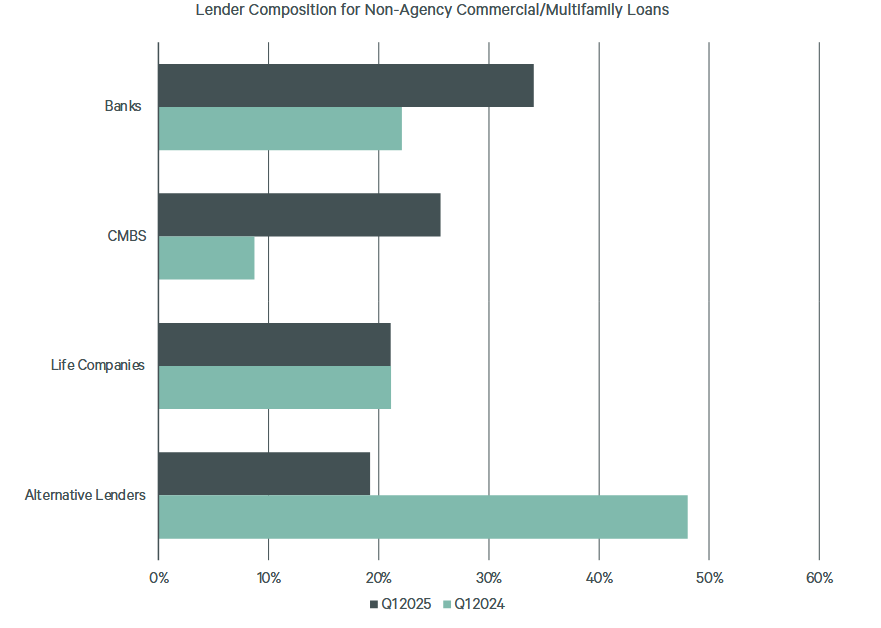

Banks predominated in the non-agency loan closings tracked by CBRE, with a 34 percent share, versus just 22 percent in the previous quarter.

The second-most active lenders were CMBS conduits, at a 26 percent share, compared with just 9 percent a year prior. As of the end of the first quarter, private-label CMBS issuance was 132 percent higher than the previous year.

Life insurance companies, meanwhile, maintained their steady 21 percent share of non-agency loan closings.

Alternative lenders such as debt funds and mortgage REITs made up the remaining 19 percent of non-agency loan closings, a major drop from their 48 percent a year prior. The CBRE report commented that “While remaining active, debt funds are exercising caution in the current market and facing increased competition….”

The average underwritten cap rate rose by 24 basis points quarter-over-quarter to 6.1 percent, but debt yields jumped by 90 basis points to 10.3 percent in the first quarter.

Investment, international-style

On the investment front, CBRE reported that CRE investment volume rose to $88 billion in the first quarter, a 14 percent year-over-year increase.

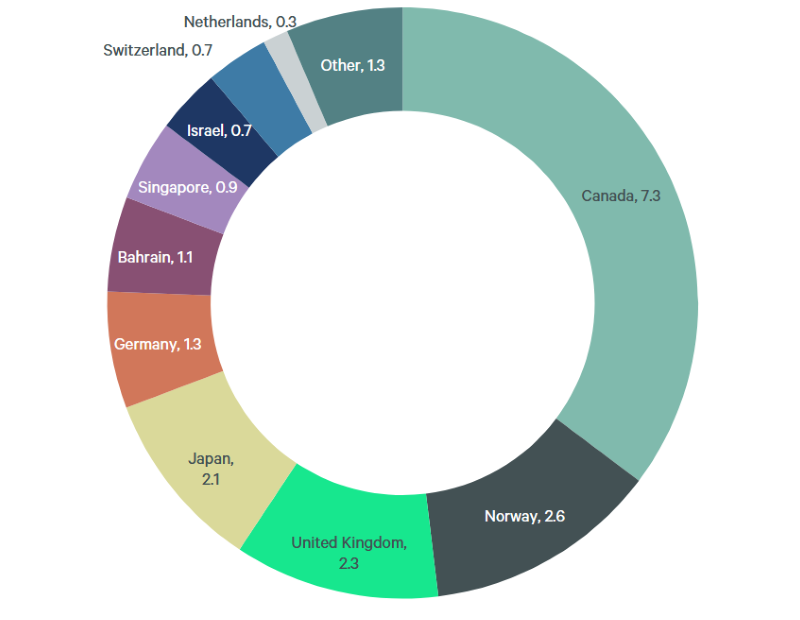

Led by the industrial sector, inbound cross-border investment increased by 7 percent in the first quarter, to $4 billion. The outsized deal that drove this was the Norwegian sovereign wealth fund’s acquisition of a $1.1 billion stake in the Canadian pension plan’s U.S. logistics portfolio.

Across CRE product types, Canada remained the leading inbound cross-border investor, at 35 percent of the total, or $7.3 billion across four quarters.

The post CRE Lending Climbs Despite Market Jitters appeared first on Commercial Property Executive.