Commercial and Multifamily Mortgage Debt Outstanding Increased Modestly in Q2

The level of commercial/multifamily mortgage debt outstanding increased by $31.4 billion (0.7 percent) in the second quarter of 2024, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report, released last month.

Total commercial/multifamily mortgage debt outstanding rose to $4.69 trillion at the end of the second quarter. Multifamily mortgage debt alone increased $19.4 billion (0.9 percent) to $2.09 trillion from the first quarter of 2024. Commercial mortgage debt outstanding grew at a modest pace in the second quarter.

Every major capital source increased its holdings of mortgages backed by income-producing properties, but the growth was mixed, with life insurance companies increasing their holdings by 1.8 percent and banks increasing their holdings by 0.2 percent.

CRE and multifamily mortgage balances

With fewer loans paying off, CRE mortgage balances have continued to grow in recent quarters despite a marked fall-off in the volume of loans being made. We anticipate that long-term interest rates, which are significantly lower than a year ago, will help increase origination activity in coming quarters, boosting both new loans coming onto the books and the payoff of existing ones.

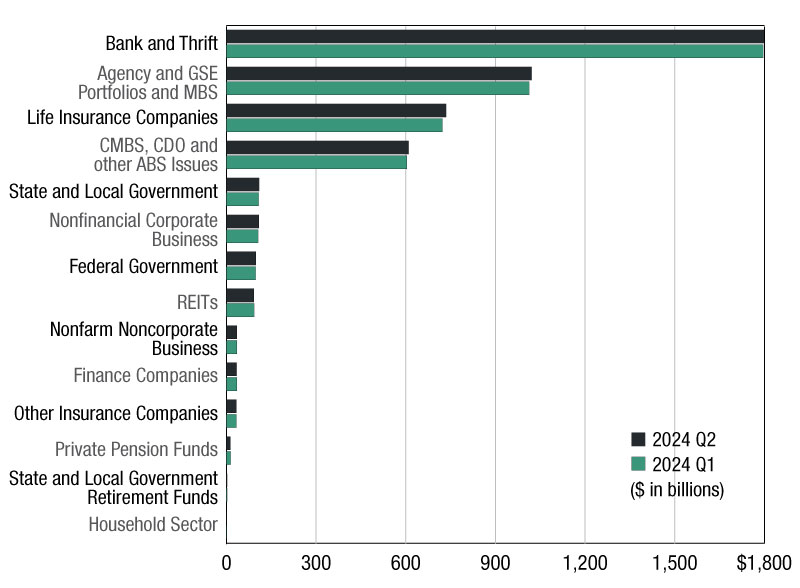

Commercial banks continue to hold the largest share (38 percent) of commercial/multifamily mortgages at $1.8 trillion. Agency and GSE portfolios and MBS are the second-largest holders of commercial/multifamily mortgages (22 percent) at $1.02 trillion. Life insurance companies hold $735 billion (16 percent), and CMBS, CDO and another other ABS issues hold $609 billion (13 percent). Many life insurance companies, banks and the GSEs purchase and hold CMBS, CDO and other ABS issues. These loans appear in the report in the “CMBS, CDO and other ABS” category.

Looking solely at multifamily mortgages in the second quarter of 2024, agency and GSE portfolios and MBS hold the largest share of total multifamily debt outstanding at $1.02 billion (49 percent), followed by banks and thrifts with $625 billion (30 percent), life insurance companies with $234 billion (11 percent), state and local government with $91 billion (4 percent), and CMBS, CDO and other ABS issues holding $67 billion (3 percent).

Changes in commercial/multifamily debt outstanding

In the second quarter, life insurance companies saw the largest gains in dollar terms in their holdings of commercial/multifamily mortgage debt—an increase of $12.8 billion (1.8 percent). Agency and GSE portfolios and MBS increased their holdings by $8.1 billion (0.8 percent), CMBS, CDO and other ABS issues increased their holdings by $5.4 billion (0.9 percent), and bank and thrifts increased their holdings by $2.9 billion (0.2 percent).

In percentage terms, nonfinancial corporate business saw the largest increase—2.0 percent—in their holdings of commercial/multifamily mortgages. Conversely, state and local government retirement funds saw their holdings decrease 12.8 percent.

—Posted on October 29, 2024

The post Commercial and Multifamily Mortgage Debt Outstanding Increased Modestly in Q2 appeared first on Commercial Property Executive.