Catalyst IOS Sells, Recaps $164M Portfolio

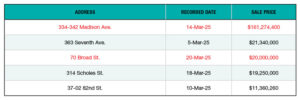

In separate transactions, Catalyst Investment Partners has sold and recapitalized two IOS portfolios totaling 18 properties with a state pension fund. The assets, located in seven supply-constrained markets across the East Coast, were valued at $163.5 million.

The portfolios come by way of Catalyst’s first and second IOS funds and were acquired during the past four years. Catalyst IOS Fund II closed in March 2024, oversubscribed with $187 million in discretionary capital commitments.

The properties’ tenants are in the equipment rental, e-commerce, logistics, home services, building materials and infrastructure industries.

Catalyst’s IOS portfolio comprises more than 75 sites worth over $500 million throughout the East Coast. In December, the firm closed on two credit facilities with a maximum combined capacity of $260 million that were seeded with 27 properties acquired by Catalyst IOS Fund II.

Aggregating data helps IOS transactions

Nick Vinson, a vice president with Foundry Commercial’s Development & Investments platform who specializes in IOS, told Commercial Property Executive investor demand for such properties is driven by their early-stage growth, fragmented ownership and limited institutional capital.

“Unlike traditional industrial, where data is abundant and deals are priced to perfection, IOS offers a competitive edge to those who can aggregate data,” Vinson said.

He added IOS is highly attractive due to strong supply-demand fundamentals, high barriers for new construction, tightening vacancy and constant rent growth, all of this combined with low CapEx, smaller investment sizes and higher diversification potential.

READ ALSO: Why Industrial Outdoor Storage Will Always Be In

Vinson also mentioned IOS buyers are shifting toward properties with multi-bay service facilities with a small office component and sub-15 percent building coverage, with less emphasis on pure drop lots.

“While truck parking took a hit in the recent trucking recession, demand from equipment rental, maintenance and construction material firms remains strong, prompting investors to prioritize flexibility by acquiring sites with buildings,” he said.

According to Vinson, smaller properties—ranging from 2 to 4 acres—are more in demand. However, location remains critical. He pointed to Atlanta and South Florida as leading markets in the Southeastern U.S.

“Atlanta has a highly central location and is the largest industrial market in the Southeast, for which IOS demand has followed suit,” Vinson said. “South Florida has one of the densest populations and strongest industrial markets in the country, has high barriers to entry, and provides port access—all of which have driven IOS demand.”

The post Catalyst IOS Sells, Recaps $164M Portfolio appeared first on Commercial Property Executive.