Birtcher, Belay Sell DFW Light Industrial Portfolio

Birtcher Anderson & Davis and Belay Investment Group have sold a 439,916-square-foot, eight-property light industrial portfolio in the Dallas-Fort Worth metro. The buyer was Basis Industrial, which financed the purchase with a $138 million loan from Beach Point Capital Management, according to CommercialEdge information.

Birthcher and Belay had acquired the properties in 2020 for $47.5 million. The seller at the time was the locally based Fort Capital.

Bob Anderson, Birtcher Anderson & Davis co-chairman, said in a statement that there is strong investor appetite for light industrial properties in North-Central Texas. The sellers tapped Newmark to take the assets to market.

READ ALSO: Industrial Demand Slips, But Avoids a Slump

The portfolio includes:

- Manana Business Park at 2526 Manana Drive in Dallas

- Garden Brook Industrial at 3109, 3113 and 3300 Garden Brook in Farmers Branch

- 4101 Lindberg in Addison

- Luke Business Park at 1100-1220 Luke St. in Irving

- Hickory Business Park at 1665 Hickory Drive in Haltom City

- 1115 and 1101 NE 23rd St. in Fort Worth

- Suffolk Industrial Park at 2901, 2905, 2921 and 2951 Suffolk Drive in Fort Worth.

The assets were 87.7 percent leased at the time of sale to more than 85 tenants.

Also this month, Birtcher and Belay sold the 78,000-square-foot, six building Pomona East Commerce Center in Pomona, Calif., to Arete Venture Partners. The industrial portfolio was 92 percent occupied at the time of closing.

Light industrial assets in demand

Small bay industrial continues to attract strong demand from private capital and 1031 exchange investors, Mark Shaffer, CBRE senior vice president, said at the time of the Pomona East Commerce Center sale, which his company facilitated.

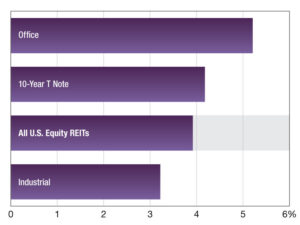

In terms of returns, the light industrial subsector (assets of less than 200,000 square feet) demonstrates particular resilience, especially when compared with other property types, including larger industrial assets, according to new research study by BKM Capital Partners.

Supply hasn’t kept up with demand. The development of new light industrial assets, particularly small-bay properties, has been held back by significant barriers to entry, Brian Malliet, BKM CEO & CIO, told Commercial Property Executive.

The post Birtcher, Belay Sell DFW Light Industrial Portfolio appeared first on Commercial Property Executive.