Best Capital Stack Strategies for 2025

In early 2025, borrowers tasked with putting capital stacks together are starting to find themselves on stronger footing than they’ve been for a few years.

They may not quite have the pick of lenders they did before rate hikes started in 2022. But the long-awaited easing of interest rates, improved fundamentals in many asset sectors and an increasing number of attractive deals are prompting some lenders to rethink their pullback from the market. That’s offering more options for the borrowers seeking to package debt and equity, especially for those in a position to bring strong projects and deals to the table.

That bodes well for debt across the spectrum. “Both senior and mezzanine financing remain a market need, so I’d anticipate continued expansion from lenders across the capital stack,” said Aaron Jodka, director of capital markets research at Colliers.

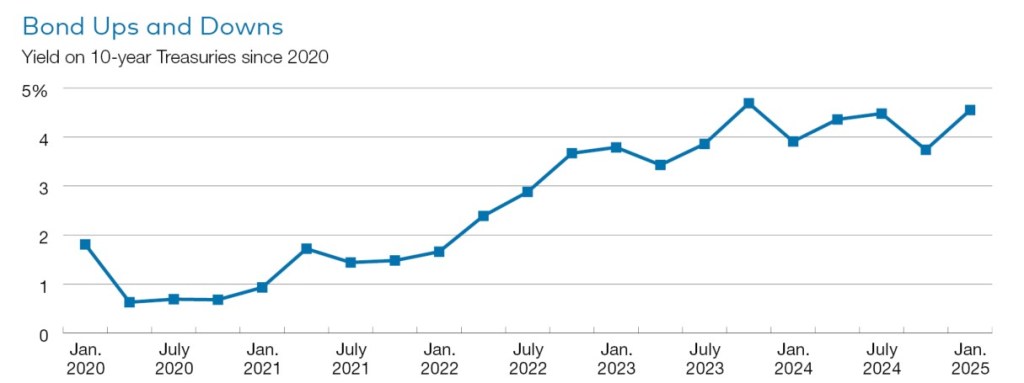

That said, it isn’t clear how much terms will change, considering that 10-year Treasury yields—which have a more direct impact on CRE lending—have yet to change much.

Market rebound

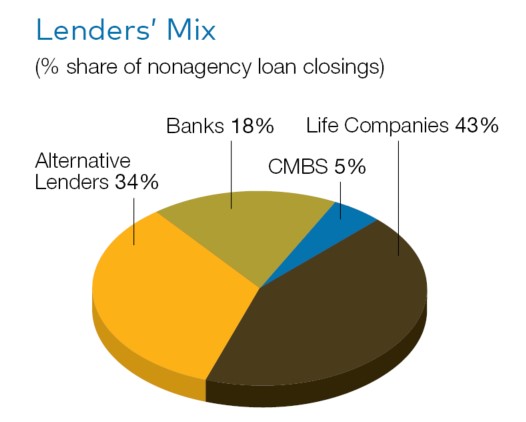

As always, CRE borrowers will benefit from established relationships with lenders and deals involving high-quality projects and properties. Yet in a welcome development, some lenders may be more open to new clients this year. Life companies, CMBS conduits and commercial banks, which favored their best clients in recent years, will “start to come out of the woodwork again in search of additional customers and additional lending opportunities,” predicted Charles Krawitz, chief capital markets officer & head of commercial lending at Alliant Credit Union.

Also figuring into wider capital-stack options are projected improvements in the market. CBRE forecasts investment activity will increase as much as 10 percent this year. Lower rates will boost investors’ confidence in their underwriting, moving some of the cash on the sidelines back into the market.

“Greater confidence in the economy and improved rates of return on property investments will drive this activity, despite the continued high cost of debt capital,” observed Darin Mellott, CBRE’s head of U.S. capital markets research. “Cap rates are likely to decline slightly in 2025, but we expect them to decline more slowly and stabilize at higher percentages compared to past cycles.”

The prospect of improving market conditions is further expanding confidence among providers of debt and equity. Private lenders have been stalwart participants when other sources have pulled back, and some report that they are further expanding their offerings. “We see significant opportunities,” commented John Brady, Oaktree Capital Management’s global head of real estate. “The need to recapitalize assets is immense, given the unprecedented and drastic repricing.”

In November 2024, Oaktree launched Formida Capital, which will specialize in loans from $5 million to upward of $75 million. A focus will be higher-leverage senior financing, mezzanine loans, preferred equity and participating debt.

Preferred equity will become more necessary in 2025 to help plug the gap to a cash-neutral refinance. Sponsors would rather give up some interim cash flow in exchange for not needing to do a capital call, said Greystone senior managing director Eric Rosenstock.

In 2024, many sponsors were hesitant to refinance using preferred equity and instead were extending their current debt instrument, with the belief that the Federal Reserve would cut rates enough to make their deals cash-neutral or even a cash-out, Rosenstock added.

“However, the temperature of what’s to come for the next 12 months has most definitely changed and sponsors are becoming more comfortable with “gap” capital that will eventually be repaid using supplemental financing from the GSEs.”

Borrowers with solid deals always have leverage in negotiating terms, and the current environment makes that even more true. A lender that’s skillful at structuring earnouts, for instance, will have more to bring to the table, to the benefit of borrowers. As Krawitz put it, “We’ll give you X dollars and additional proceeds if you provide us between month 18 and month 24 (documentation) that shows your debt service coverage has improved from Y to Z.”

The cost of capital

The market is beginning to respond to the lower interest rate environment, according to Boulder Group President Randy Blankstein, but the reduction in the federal funds rate doesn’t represent an automatic lowering of the cost of capital.

“The expectation is that the lower Secured Overnight Financing Rate will assist in spurring transactions in 2025, as lower borrowing costs will encourage money to come off the sidelines to reenter the market, increasing buyer demand,” he said.

However, he cautioned, the impact on transaction velocity will remain muted until the 10-year Treasury yield follows the federal funds rate and heads lower. The 10-year Treasury yield ended 2024 at a little over 4.5 percent. A year earlier, the yield stood at just over 3.9 percent.

“With the Fed’s latest action and commentary, the market responded with a pullback in the stock market and the yield on 10-year Treasuries rising to levels seen in (early 2024),” said Jodka. “Clarity on interest rates and the Fed’s path is important for investors, but so, too, are benchmark levels.”

Overall, capital will be easier to come by in 2025, as lenders increase their interest in CRE, said Krawitz. “When you’ve sunk so low, it isn’t hard to come bouncing off the floor.

“There will still definitely be challenges at play. We aren’t going to suddenly find everyone being hyper-aggressive, but it’s going to be encouraging overall to the marketplace.”

Read the February 2025 issue of CPE.

The post Best Capital Stack Strategies for 2025 appeared first on Commercial Property Executive.