A new growth cycle?

Commercial real estate transactions began to increase about midway through 2024, inching up ever so slightly—at just 0.2 percent year-over-year for the first three quarters to $316.2 billion.

But this is a marked improvement from earlier in the year, when volume dropped nearly 11 percent in the first quarter year-over-year and about 2 percent below the prior year in the second quarter. PwC expects that positive momentum to continue through the end of 2024 and into 2025.

The result—a renewed, though still cautious, optimism for a new commercial real estate growth cycle.

The professional services firm states in its U.S. deals 2025 outlook that the optimism is due in part to expectations for further cuts in borrowing costs, an improved regulatory environment as the new federal administration takes office and increased price transparency as more deals close.

Responses to the annual PwC and the Urban Land Institute survey published in the recent Emerging Trends in Real Estate 2025 forecast for the U.S. and Canada also picked up on improved industry vibes. The survey found 65 percent of participants believe profitability will be good to excellent in 2025 compared to 41 percent in 2024.

“There is optimism across the board,” Tim Bodner, U.S. and global real assets deals leader, told Commercial Property Executive. “That certainly came through in our Emerging Trends in Real Estate for 2025 [report] here in the U.S. But it also came through in the edition we did in Europe and Asia.”

READ ALSO: These CRE Transactions Typify an Interesting 2024

Bodner said the volume of deals that are being underwritten now is up significantly from where it had been and there are more deals in the pipeline than in the past two years.

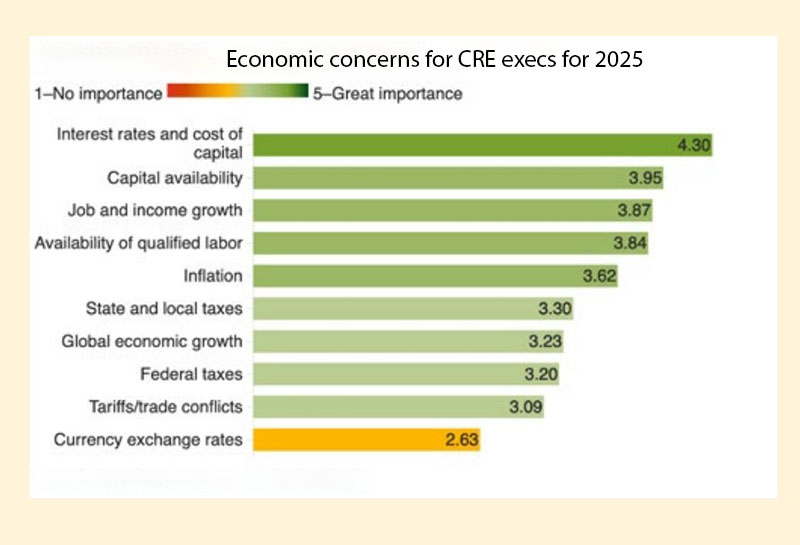

Despite the increasing optimism, PwC notes market participants still face challenges, including an elevated interest rate environment. While the Federal Reserve has begun reducing its benchmark rate this fall, future cuts are likely to be more gradual. The Fed is slated to meet next week for its final session of the year. Economists are anticipating a 25-basis-point cut as was the case in November, following a 50-basis-point reduction in September.

Bodner said it seems like the Fed is likely to make an adjustment next week, but future reductions may be slower, and the rates may stay higher for longer than people would prefer. In its outlook, PwC also noted the 10-year Treasury bond yield rose after the Fed’s last rate cut, leaving borrowing costs higher than many had hoped to spur deal activity. Those data points along with concerns the economy may be slowing means dealmakers are likely to remain increasingly selective and cautious and focus on markets with sustainable growth and returns, according to PwC.

Emerging opportunities

While challenges remain, Bodner noted there are “also incredible opportunities” coming through retail-focused capital raising, new asset classes and transformative operating models.

Over the course of 2024, Bodner said they saw a lot of volume in alternative classes and niches like data centers, cold storage and the wellness sector.

“When you look at the wellness industry overall, it’s a multitrillion-dollar industry. The fastest-growing component of that is wellness real estate,” Bodner said. “As that industry continues to expand it’s going to need capital and there are a number of investors looking at building businesses around that trend to deploy capital.”

The deals outlook noted the importance of data centers as a trend to watch because of the impact for both investors and developers.

“Far outpacing all other subsectors, data centers remain a high conviction theme in many playbooks,” the report states.

The demand is fueled by numerous drivers including artificial intelligence, cloud storage, mobile data traffic and overall internet traffic as well as new and growing uses like autonomous vehicles. But the demand far exceeds the pace at which the new supply can be delivered. Obtaining power for new data centers is a significant issue, Bodner said.

“Our caution, though, is broader and has to do with the available land to build new data centers and the impact of local regulations to allow data centers to be built in the first place,” he said.

The report further notes the supply and demand imbalance has resulted in a lack of available data center space in major markets causing rapidly rising rents. That scenario is likely to continue for the foreseeable future, according to PwC.

Focus on tariffs, deregulation

While there is some uncertainty about how President-Elect Donald Trump will enact the stiff tariffs he is proposing and whether they could exacerbate inflation and increase interest rates, Bodner said they could also spur investments and increase industrial and manufacturing opportunities. He said they have already seen a number of sovereign wealth funds, particularly from the Middle East, make statements about increasing investments in U.S. real estate.

“We think that it will be in some respects a tailwind for activity,” Bodner said.

Trump and his administration are also expected to cut regulations across the board, which Bodner said has led to enthusiasm from investors on a level he has never seen because they think it will be easier to do business.

Regulatory relief combined with lower interest rates, greater clarity about the operating environment and price discovery can continue to help narrow the bid-ask spread and further reinvigorate transaction activity, PwC noted. However, the firm urges investors to be more discriminating about the valuations they’re paying because interest rates are higher than have been over the past 15 years and the operating environment is increasingly complex.

The post A new growth cycle? appeared first on Commercial Property Executive.