A Homebuyer’s Ultimate Guide to Rent-to-Own Homes: Everything You Need to Know

Trying to buy a house while renting can seem impossible. Our ultimate guide to rent-to-own homes answers your questions about this homebuyer option.

Trying to buy a house while still paying rent can feel like you’re endlessly pushing a boulder uphill, only to find mud pits waiting every time you think you’re making progress. Balancing the cost of monthly rent with the challenge of saving for a down payment and closing costs — typically based on a percentage of the home’s purchase price — can be exhausting and overwhelming.

Even with the housing market cooling slightly in 2024, home prices are still on the rise. By the time you finally save enough, it often feels like the goalposts have shifted, making the climb even steeper. Meanwhile, the ongoing burden of rent drains a significant portion of your income, making it even harder to get ahead.

It’s no surprise that many prospective homebuyers are intrigued by rent-to-own agreements. In these agreements, renters lease a home with the intention of buying it later, and a portion of their rent payments goes toward a future down payment. However, rent-to-own deals come with significant risks, including the potential for scams. Buyers should thoroughly review contracts to ensure they have the option to exit the agreement if problems arise.

Despite these risks, rent-to-own arrangements have helped many buyers secure and eventually purchase their dream homes. When carefully negotiated and structured, these agreements can provide a viable path to homeownership, especially for those needing more time to save or improve their financial situation.

We’ve put together the ultimate guide to rent-to-own homes. From understanding the risks and rewards to tips on finding rent-to-own properties, navigating contract terms, and more, this guide has you covered. Here’s a key takeaway: partnering with a top real estate agent can be invaluable in helping you avoid potential pitfalls and protect your future investment.

Ready to dive in? Let’s get started!

Why rent to own?

A rent-to-own real estate agreement can be a great option for some buyers, but it’s not the best fit for everyone. Compared to traditional home financing through a mortgage, rent-to-own deals carry additional risks, which is why most homebuyers still opt for securing a mortgage.

That being said, rent-to-own arrangements can make sense under the right circumstances. Here are seven key reasons why renting to own might be worth considering.

1. Build or improve your credit

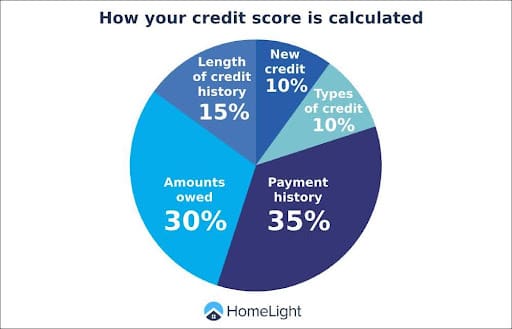

One of the main reasons some buyers consider a rent-to-own arrangement is to gain extra time to improve their credit scores before applying for a mortgage. While you can qualify for an FHA loan with a credit score as low as 580, having a higher score can secure you better interest rates. For conventional loans, the minimum credit score requirement typically is 620.

Opting for a rent-to-own home lets you move into the house you want today while working on your credit. This way, when you’re ready to purchase, your improved credit score can help you qualify for a mortgage that fits your budget and financial goals.

2. Build your work history

If you just moved to the country, or you just entered the workforce, then you might not have a deep enough work history to qualify for a mortgage loan. Typically, lenders will want to see at least two years in the same career, and preferably at the same company, so if you’re embarking on a brand-new career path, it might be more difficult to qualify for a loan temporarily.

Maybe you don’t want to wait until you’ve got two years of work history under your belt to start shopping for a house to buy, in which case, a rent-to-own home might work nicely for your situation.

3. Save money

Buying a house is costly. You’ll need a down payment — usually at least 3% for a conventional loan or 3.5% for an FHA loan — and closing costs, which can range from 2% to 5% of the loan amount. If a 20% down payment isn’t realistic, consider a loan with mortgage insurance (PMI), which adds a monthly premium. However, if you save 20%, you can avoid PMI, and some local programs might let you put down less.