Bain Capital JV Plans Biomanufacturing Conversion

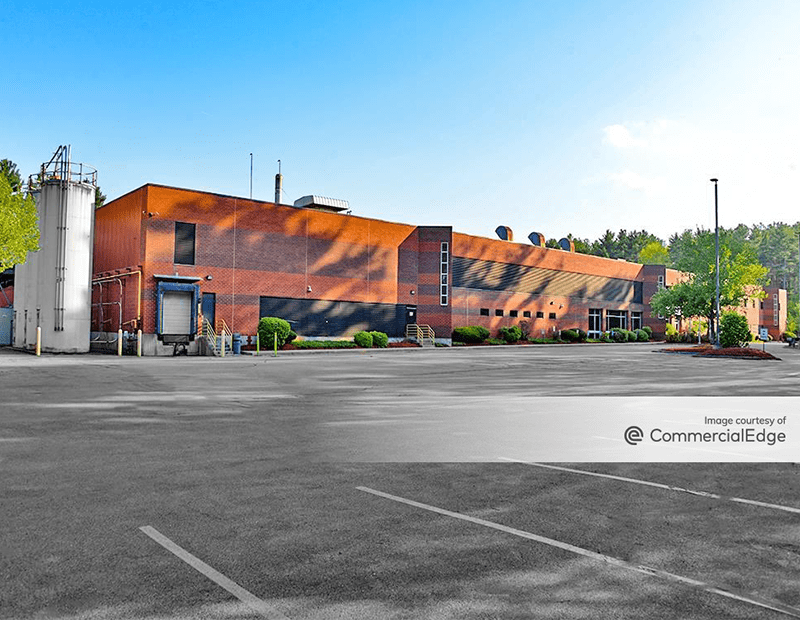

A joint venture between Bain Capital’s Real Estate team and Botanic Properties has acquired 45 Crosby Drive, an industrial asset in Bedford, Mass. Plans call for the property’s redevelopment into a Class A biomanufacturing facility. The seller was Fujifilm, according to CommercialEdge data.

GenesisM, a specialized real estate platform designed by the joint venture to develop this type of assets, is making the investment.

Developed to address the needs of biotech firms, the 154,000-square-foot building will feature 12,000 amps of electrical power, 27-foot ceiling heights, 18 loading berths and 40-foot x 40-foot column spacing. A strategic delivery could also enable multiple tenants to run highly regulated independent facilities at the site.

Fujifilm purchased the property in 2001 for $2.4 million, CommercialEdge data also shows. The building was developed in 1978.

The property is situated along the Route 3 corridor, in proximity to Greater Boston’s workforce. Kendall Square, one of the world’s leading biotech hubs in Cambridge Mass., is less than 20 miles from the facility.

READ ALSO: CPE Executive Council: What Are the Biggest Regulatory Hurdles in Developing New Properties?

The Boston office market performed well throughout 2024, according to data from CommercialEdge. At the beginning of this year, the metro had the largest development pipeline in the U.S., fueled by major life science projects. These include Fenway’s Center second phase—a $1 billion development totaling nearly 1 million square feet of office and lab space. IQHQ and Meredith Management are behind the project.

In 2024, the largest transactions in the market included BioMed Realty’s separate acquisitions of two properties in Cambridge, Mass. In one of the deals, a building at 750 Main St. previously owned by MIT Investment Management Co. commanded $361.5 million. In the another transaction, Alexandria Real Estate sold a life science building at 215 First St. for $165 million.

Bain Capital’s expansion

Since 2013, Bain Capital has invested in more than 7 million square feet of life science real estate. The company currently owns some 5 million square feet in key U.S. markets. Last summer, the firm renewed and expanded its headquarters lease at BXP’s 200 Claredon St., New England’s tallest building.

In another joint venture with Evergreen Medical Properties in Oregon, Bain Capital purchased a 60,000 square-foot medical office building in Lake Oswego, Ore. The joint venture paid $14 million to acquire the asset in October. At the time of the sale, the office building was 73 percent leased.

The post Bain Capital JV Plans Biomanufacturing Conversion appeared first on Commercial Property Executive.