CRE’s New Money Movers

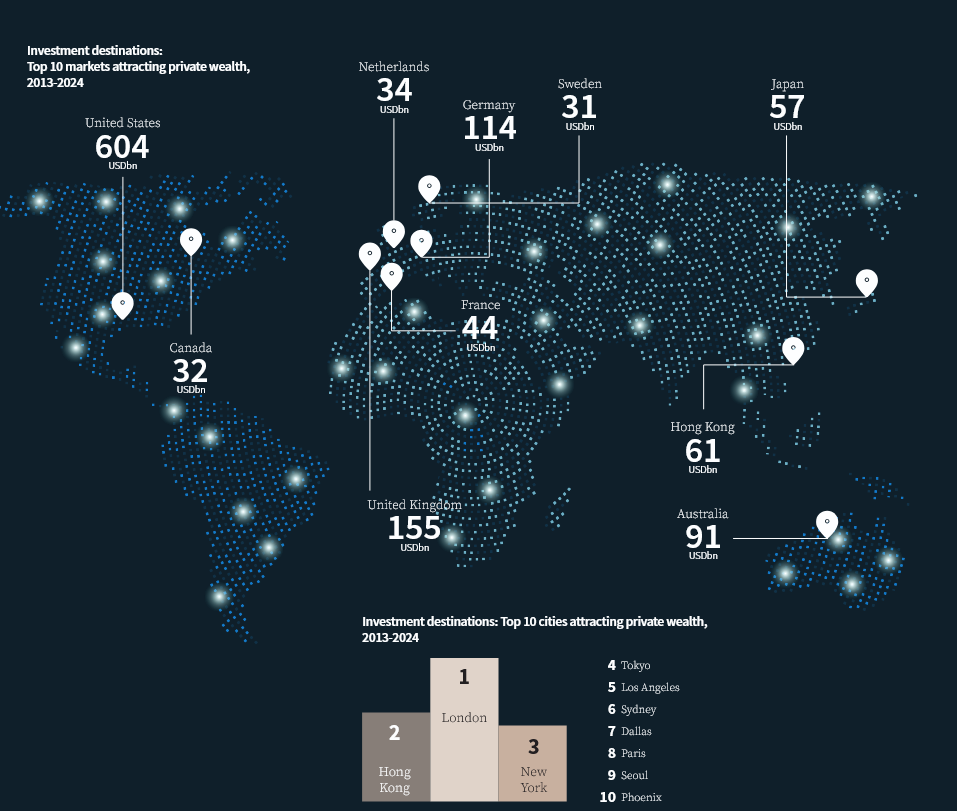

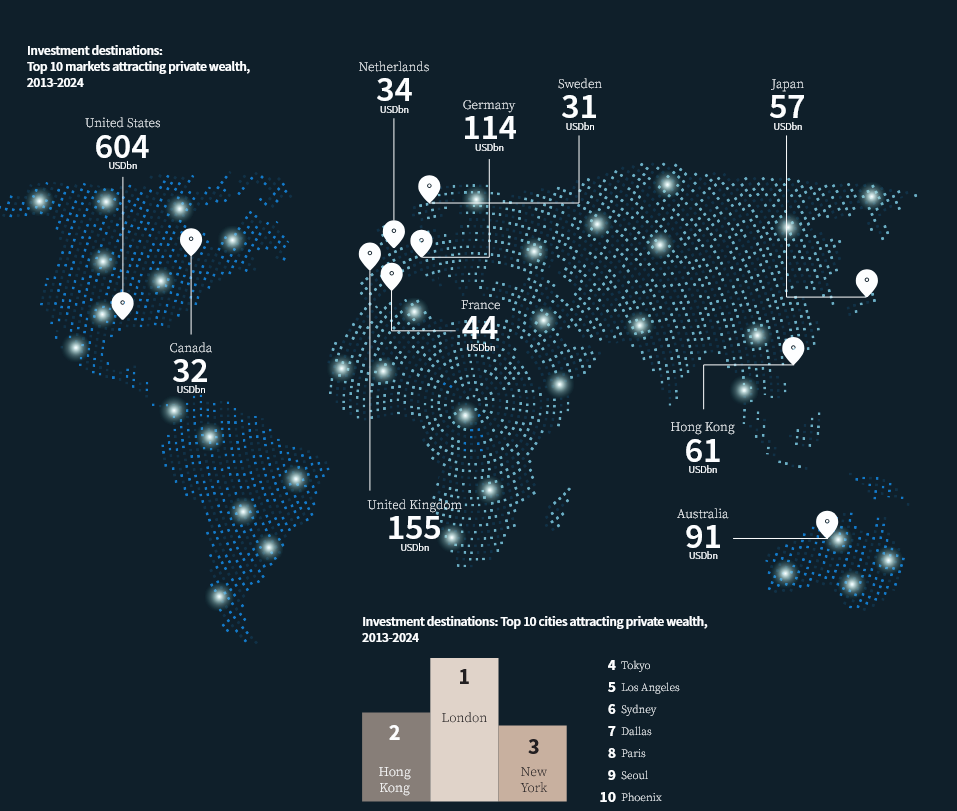

Private wealth investors have become a remarkable source in global commercial real estate, with more than $600 billion put into U.S. commercial real estate through direct deals from 2013 to 2024, making it one of the fastest-growing segments, according to a new report from JLL.

That represents 40 percent of the more than $1.5 trillion invested globally. The report also showed that office properties were the preferred asset class.

JLL reported a year ago on how private capital had begun filling the void of institutional capital flow in commercial real estate investing.

U.S. dominates global private wealth investment

Since 2013, private wealth investors have made $277 billion in cross-border investments. American investors were the most active, purchasing $22 billion in assets outside of their home market, according to the report. Roughly 10 percent of global private wealth investors’ allocations have gone to real estate.

The U.S. is home to 46 percent of the world’s billionaires. Asia Pacific and EMEA each account for 27 percent.

These investments have a 6.4 percent compounded annualized return, exceeding the returns of traditional asset classes such as bonds, gold and REITs.

US should maintain its top status

The U.S. will continue to be a favorable place to invest for private wealth clients due to several factors,” according to Katie Day, head of private wealth, Americas at JLL.

“The U.S. real estate market is the largest market globally, offering unmatched depth, diverse asset classes, and the geographic diversification that spans gateway markets and ‘momentum’ markets across the Sun Belt,” she told Commercial Property Executive.

“Not only will the wealth of family offices in the U.S. continue to grow, but the way family offices access real estate will evolve and become easier through technology and specific products created for private investors.”

Having transacted $1.5 trillion over the past 10 years, JLL has been helping families navigate the CRE space for decades, enabling them to execute their current and long-term investment strategies.

“Families can be much nimbler than institutions and move faster when they see a great investment opportunity,” she said. “Our private wealth team is dedicated to helping families continue to access institutional-quality real estate opportunities globally.”

JLL also believes that the office sector will remain one of the most attractive asset classes for U.S. private wealth investors.

READ ALSO: Most Popular Return-to-Office Policies Surprise Experts

This is expected to continue in 2025 and early to mid-2026, according to Mike McDonald, a senior managing director & co-head of JLL’s office investment sales and advisory team.

“The ‘Great Basis Reset’ that has occurred in the office sector post-COVID has created a tremendous amount of upside and opportunity for private, high-net-worth individual investors who want to take advantage of the pullback from institutional investors over the past several years and benefit from the attractive risk-adjusted returns in the office sector.”

“As we are already experiencing the influx of institutional capital into the sector, the opportunities for private wealth investors will dissipate over time as it always does during cycle reset moments,” McDonald added.

Office, a most-promising asset class

This potential upside exists even given the struggles in U.S. office performance caused in part by the pandemic, a surge in work-from-home arrangements and a general sputtering of return-to-office rates.

JLL has empirical data about trends and pricing from similar disruptions in the capital markets in the past, including the time of the RTC, Russian Ruble, Dot Com and the Great Financial Crisis.

“The early investors in the office sector after those downturns outperformed their counterparts who invested later in the recovery phase of the associated cycle,” McDonald said.

He added that the investment market is quite different—and more disciplined—this time around as it’s become a ‘stock pickers’ market based on the premise that ‘not all office is created equal.’ The savvy and astute investors understand the bifurcation in the market from a standpoint of quality, vintage and location. JLL has been weaponizing the data that we possess to strategically and adequately advise our clients about investing in the sector, McDonald said.

“There is a definite disconnect regarding risk-adjusted returns, and the market is taking advantage of this arbitrage. We firmly believe that office valuations—for the upper echelon of the market—will continue to increase as fundamentals exponentially improve at the asset level, and the capital market conditions and receptivity also improve at the macro level,” he added.

Investors who have purchased office assets in the past couple of years and are doing so in the current environment will be rewarded for the perceived risk taken, McDonald anticipates.

“Office is definitely ‘back,’ and the question is, did it really ever leave in the first place?”

Private wealth fuels debt funds

The report also underscores the pivotal role private wealth investors play in U.S. commercial real estate, according to Zachary Streit, president of Priority Capital Advisory.

“As institutional capital remains cautious, private wealth has become a primary driver of equity investments, particularly in office, industrial and retail sectors,” he told CPE.

“Additionally, private wealth channels are increasingly fueling debt funds, offering diversified financing solutions.”

The U.S. continues to be the top destination for real estate investments worldwide, despite challenges such as fluctuating regulations, tariffs and currency issues, Jeff Holzmann, COO of RREAF Holdings, pointed out.

He told CPE that the increased funds invested in office spaces suggest that the market now believes this sector has hit its lowest point in the post-pandemic era, as the momentum to return to the office exceeds the trend of working from home.

Even amid an economic pause, as investors wait to see what happens over the next several months, “smart money is still investing in U.S. commercial real estate, buying distressed office assets in downtown New York, Los Angeles and San Francisco at 30 percent of 2019 market values,” Ed Del Beccaro, EVP & San Francisco Bay Area manager of TRI Commercial/CORFAC International, told CPE.

The post CRE’s New Money Movers appeared first on Commercial Property Executive.