High Office Vacancy Persists Across U.S.

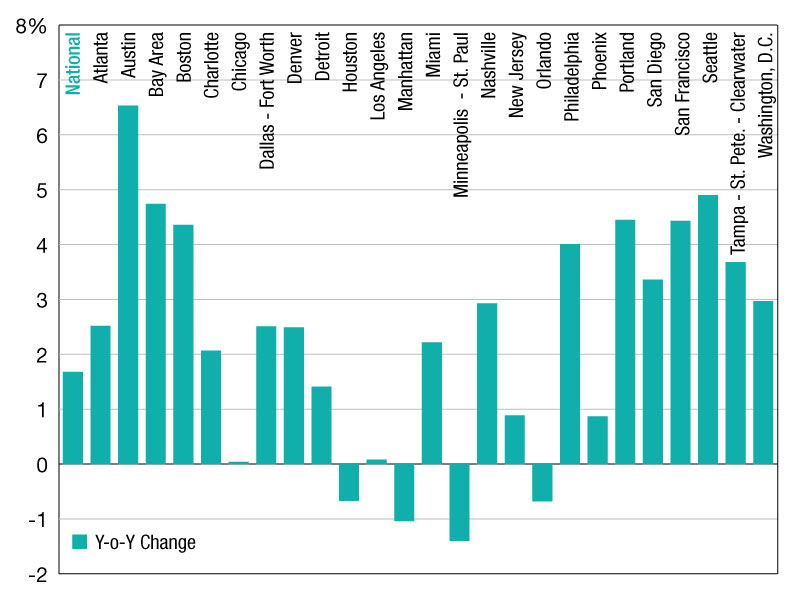

As of March, the national office vacancy rate posted a year-over-year increase of 1.7 percent, reflecting a persistent imbalance between supply and demand across U.S. markets, according to CommercialEdge data.

Although not as steep as previous periods, the upward trend remained widespread, with a majority of tracked metros seeing vacancy expansions.

Austin led the country with one of the largest year-over-year vacancy increases at 6.5 percent—continuing a pattern of oversupply that has weighed on Sun Belt cities. Seattle (4.9 percent), the Bay Area (4.7 percent) and Boston (4.3 percent) followed closely, underscoring ongoing hurdles in tech-heavy and coastal urban markets.

West Coast struggles, East Coast improves

Portland, Ore. (4.4 percent), San Francisco (4.4 percent) and San Diego (3.4 percent) also reported significant jumps, highlighting a slower recovery trajectory for West Coast cities, CommercialEdge shows.

Meanwhile, Los Angeles and Chicago stood out for their near-zero year-over-year changes in vacancy. In Los Angeles, the vacancy rate ticked up just 10 basis points, from 16.4 percent in March 2024 to 16.5 percent in March 2025. Chicago saw a similarly negligible rise.

On the other end of the spectrum, a handful of markets recorded year-over-year improvements. At -1.4 percent, Minneapolis–St. Paul saw one of the sharpest declines. Manhattan (-1.0 percent) and Orlando, Fla. (-0.7 percent) also posted vacancy contractions, reflecting limited new construction or recovering tenant demand.

The data also revealed divergence among Florida markets: Tampa–St. Petersburg–Clearwater recorded a notable increase (3.7 percent), while Miami remained relatively stable (2.2 percent).

—Posted on April 29, 2025

The post High Office Vacancy Persists Across U.S. appeared first on Commercial Property Executive.