Black Friday Retail Traffic Tops the Charts

Black Friday excitement is what it is this year, as data shows many consumers wanted to experience bargain hunting in person, according to Placer.ai’s November mall traffic report.

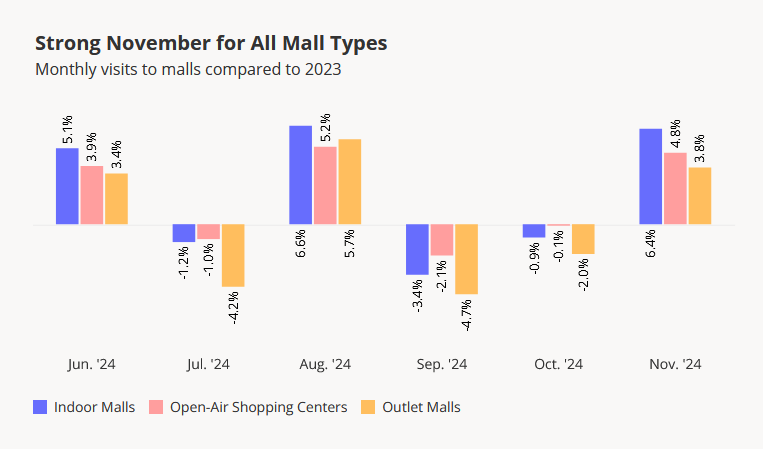

Indoor malls experienced the biggest year-over-year increase, up 6.4 percent in November. Open-air shopping center visits grew by 4.8 percent and outlet mall visits spiked by 3.8 percent.

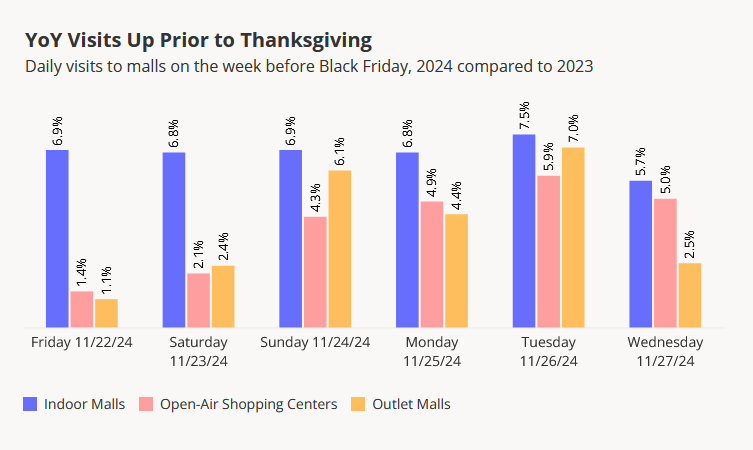

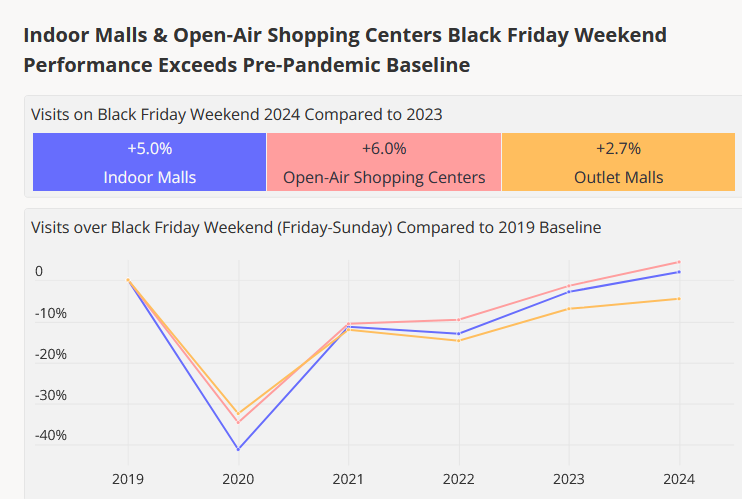

During Black Friday weekend alone (Friday, Saturday and Sunday), indoor mall visits jumped 5 percent year-over-year, OASC visits were up 6 percent and outlet mall visits rose by 2.7 percent.

The indoor mall and OASC data exceeded their prepandemic 2019 volumes. Placer.ai reported that this came a month after weaker foot traffic performances in September and October.

“Black Friday weekend sent a strong message and reinforced our positive outlook for the holiday season,” Stephen Lebovitz, CEO of CBL Properties, told Commercial Property Executive.

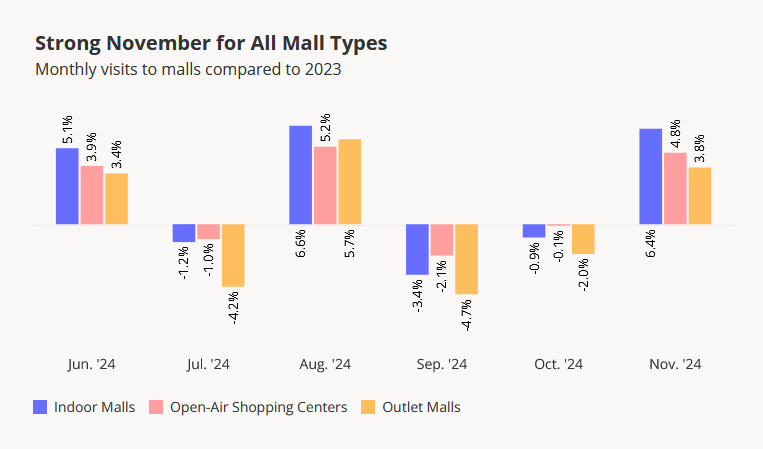

“Traffic trends across our portfolio are consistent with Placer.ai’s report. Not only did we see traffic increases on Black Friday, but we also saw mid-single-digit increases during the entire week, including increases on the Wednesday before Thanksgiving.

“Our retailers indicated that sales were strong over Black Friday, with several retailers meeting or exceeding plans and the prior year by late afternoon on Friday,” Lebovitz added. “With a shortened shopping season, we also saw significant traffic on the Monday after Thanksgiving, typically when we see a lull.”

Lebovitz said several retailers reported that buying online and picking up in-store orders drove traffic throughout Black Friday weekend and Cyber Monday.

READ ALSO: Retail’s Post-Pandemic Recovery

Estimates of retail holiday sales over the Thanksgiving week period were modestly stronger than anticipated, reinforcing the 2024 theme that consumers have continued to spend resiliently in spite of high consumer prices, economic uncertainty and a cooling job market, according to James Bohnaker, senior economist, Cushman & Wakefield.

“There are a range of estimates from industry and private sources (final December retail sales numbers from the government will not come out for a couple of months) that show that holiday retail sales over the early shopping period rose 3 percent to 5 percent versus last year and that e-commerce shopping rose 10 percent to 15 percent,” Bohnaker said.

“These numbers are usually a good predictor for how the full season will end up, and the short calendar between Thanksgiving and Christmas this year means plenty of spending has yet to occur.”

Jewelry, electronics, and apparel have been particularly strong this year, with apparel and footwear benefiting from cooler temperatures after an unseasonably warm start to the fall season, he said.

Beyond the shopping experience

At Simon Malls, Black Friday has continued throughout the holiday season, according to Lee Sterling, the company’s chief marketing officer.

“Retail sales are thriving, and so many people are heading to the mall for that in-person experience,” Sterling said. “We had people lined up ready bright and early on Black Friday across the country, with many popular stores reporting double-digit sales increases compared to last year.”

It’s about more than purchasing gifts—whether visiting Santa year after year or discovering a new dining experience, there’s something special about visiting the mall this time of year, Sterling added. “With a blend of shopping, dining and entertainment, our centers have become key spots for creating memories that last well beyond the holidays.”

In Burbank, Calif., Black Friday 2024 was a success for its downtown area, with a reported 88,000 shoppers visiting its mixed-used district’s retailers and dining establishments. This foot traffic figure is 92 percent as compared to the same day before the pandemic in 2019, according to Placer.ai.

READ ALSO: How Dining Trends Are Reshaping Shopping Centers

Downtown Burbank has seen a 15 percent increase in foot traffic, with steady growth over the past three years since 2021, as post-pandemic recovery continues to report increasing numbers for brick-and-mortar holiday shopping.

Additionally, the average visitor dwell time in downtown Burbank this year exceeded 2 hours and 15 minutes.

“These impressive Black Friday visitor numbers are a great kick-off to the holiday shopping season in downtown Burbank,” Eric Maenner, general manager of the Burbank Town Center, told CPE.

“The foot traffic and visitation has continued in a growth trajectory over the past couple weeks as the downtown Burbank Property Based Business Improvement District, the Burbank Town Center and the City have programmed many events that are aimed at drawing even more people to its festive atmosphere, shopping and dining experiences.”

The post Black Friday Retail Traffic Tops the Charts appeared first on Commercial Property Executive.