How Much Can You Make Flipping Houses? The Answer May Surprise You

Get all the stats on the average ROI on house flipping and how to account for unforeseen costs that drive down your margins.

Flipping can be a great way to earn quick cash,” advises Dustin Parker, a top-selling real estate agent in Millsboro, Delaware, who’s also a house flipper himself.

“However, you run the risk of purchasing a property at a high price point right before the market takes a downturn. If home values fall while you’re doing the renovations, then you’re stuck with a lot of money invested in a house that you can’t sell at a profit.”

So, how much can you make flipping houses? Here we’ll cover:

- How much you can make on a single flip

- The average earnings for a house flipper

- House flipper success rates

- All the costs you need to budget for on each flip

- How to get financing for your investment property

Then, we’ve got 5 tips from experienced investors on how to avoid losing money on your first few house flips.

How much can I make on a single flip?

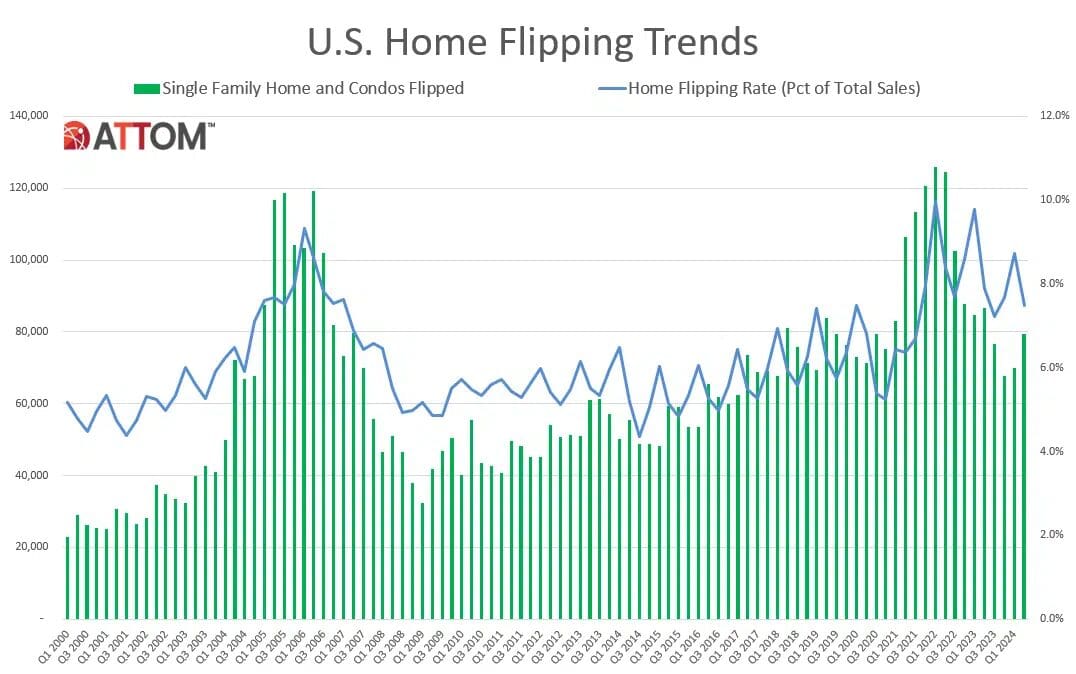

In the second quarter of 2024, flippers averaged a 30.4% ROI or a gross profit of $73,492 per flip, according to leading property data firm ATTOM Data Solutions. In this case, ROI is calculated by dividing the gross flipping profit ($73,492) by the purchase price (a median of $241,508). To be considered a flip by ATTOM’s standards, a property has to be bought and sold within a 12-month span.

It’s important to note that the gross profit figure is the difference between what a property originally cost and what it sold for. In ATTOM’s methodology you’ll see that this number does not include the cost of rehab and renovations, which flipping veterans estimate will run between 20%-33% of the home’s value after repairs.

So let’s see how much you’d make with a hypothetical flip house based on these gross average returns while also accounting for your expenses.

- You buy a house for the median price of $241,508 with the intention of flipping it.

- Based on the current averages, your gross profit would amount to $73,492 (or 30.4% ROI) for a resale price of $315,000.

- Your average cost of renovations as 20%-33% of the after repair value (in this case $315,000) amount to: $63,000-$103,950.

At best your calculations work out like so:

Sale price: $315,000

–

Purchase price: $241,508

–

Rehab costs and other expenses incurred (low end): $63,000

=

You take home: $10,492 flip (4.34% profit)

At worst, you lose money:

Sale price: $315,000

–

Purchase price: $241,508

–

Rehab costs and other expenses incurred (high end): $103,950

=

You lose: $30,458 on this flip (-9.67% profit)

- Source: ATTOM Data Solutions

“It’s always our goal to make about 20% profit margins for the investors that we work with on flips, which is pretty standard for our area,” says Parker. “While we target 20%, sometimes you fall a little short. I would say the average margin for a flip is 15%. However, it’s possible you’ll hit a home run and get 50% or 60% on one flip alone.”

But there’s no guarantee that you’ll make that much — especially if you have inexperience working against you.