Commercial Mortgage Delinquency Rates Increased in Q3

Delinquency rates for mortgages backed by commercial properties increased slightly during the third quarter of 2024. This is according to the Mortgage Bankers Association’s latest commercial real estate finance Loan Performance Survey, released in October.

Delinquency rates for commercial mortgages backed by office properties continued to increase during the third quarter but declined for loans backed by lodging, retail and industrial properties. The commercial mortgage market is large and diverse, covering a range of property types, sizes and ages, geographic markets and submarkets, borrower types, vintages and more. Each of those differences is affecting loan performance, some to the good and some to the bad.

The balance of commercial mortgages that are not current increased slightly in the third quarter of 2024.

- 96.8 percent of outstanding loan balances were current or less than 30 days late at the end of the quarter, down from 97.0 percent the previous quarter.

- 2.7 percent were 90+ days delinquent or in REO, up from 2.5 percent the previous quarter.

- 0.3 percent were 60-90 days delinquent, up from 0.2 percent the previous quarter.

- 0.3 percent were 30-60 days delinquent, down from 0.4 percent the previous quarter.

READ ALSO: Capital Ideas: What to Watch for in the Trump Presidency

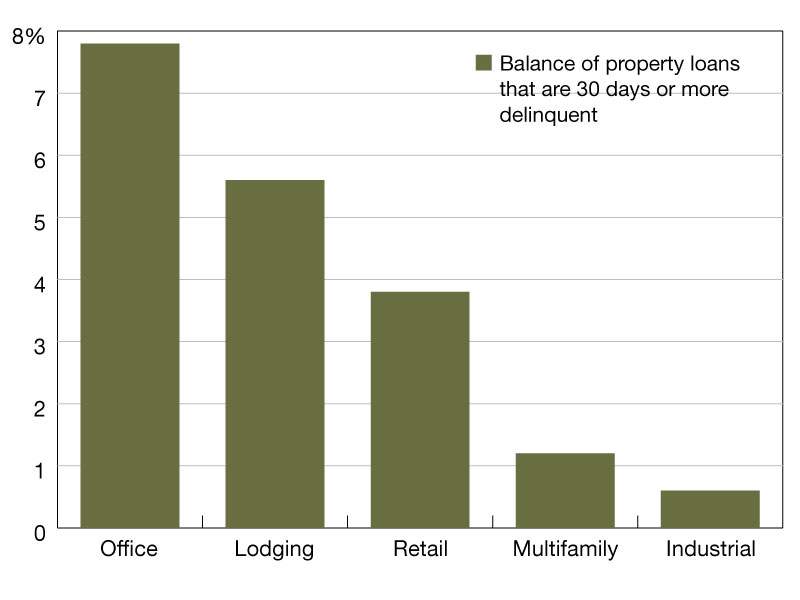

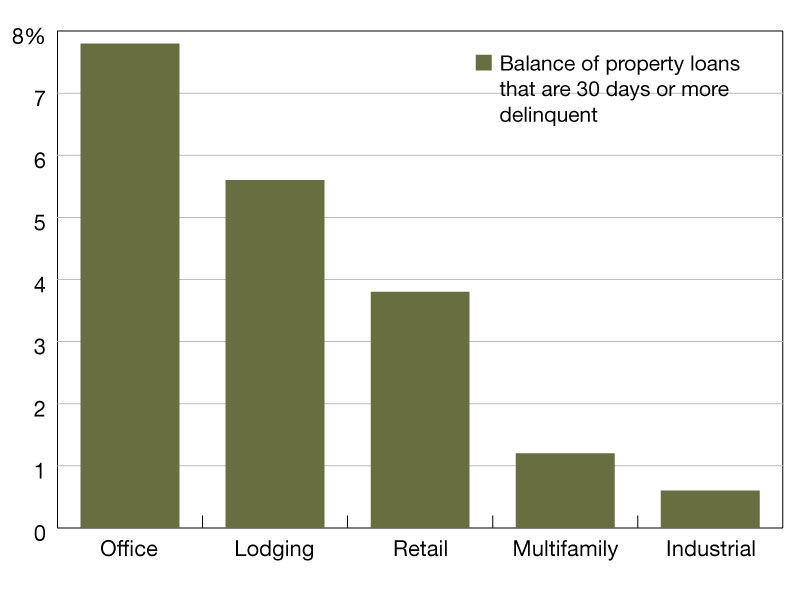

The share of loans that were delinquent increased for some property types, particularly office, and decreased for industrial, lodging and retail properties.

- 7.8 percent of the balance of office property loan balances were 30 days or more days delinquent, up from 7.1 percent at the end of last quarter.

- 5.6 percent of the balance of lodging loans were delinquent, down from 5.8 percent the previous quarter.

- 3.8 percent of retail balances were delinquent, down from 4.5 percent.

- 1.2 percent of multifamily balances were delinquent, up from 1.1 percent.

- 0.6 percent of the balance of industrial property loans were delinquent, down from 0.8 percent.

Among capital sources, CMBS loan delinquency rates saw the highest levels but were flat during the quarter.

- 4.8 percent of CMBS loan balances were 30 days or more delinquent, unchanged from the last quarter.

- Non-current rates for other capital sources remained more moderate.

- 0.9 percent of FHA multifamily and health care loan balances were 30 days or more delinquent, unchanged during the quarter.

- 0.9 percent of life company loan balances were delinquent, down from 1.0 percent.

- 0.5 percent of GSE loan balances were delinquent, up from 0.4 percent the previous quarter.

The post Commercial Mortgage Delinquency Rates Increased in Q3 appeared first on Commercial Property Executive.