Placer.ai Office Index—October 2024 Recap

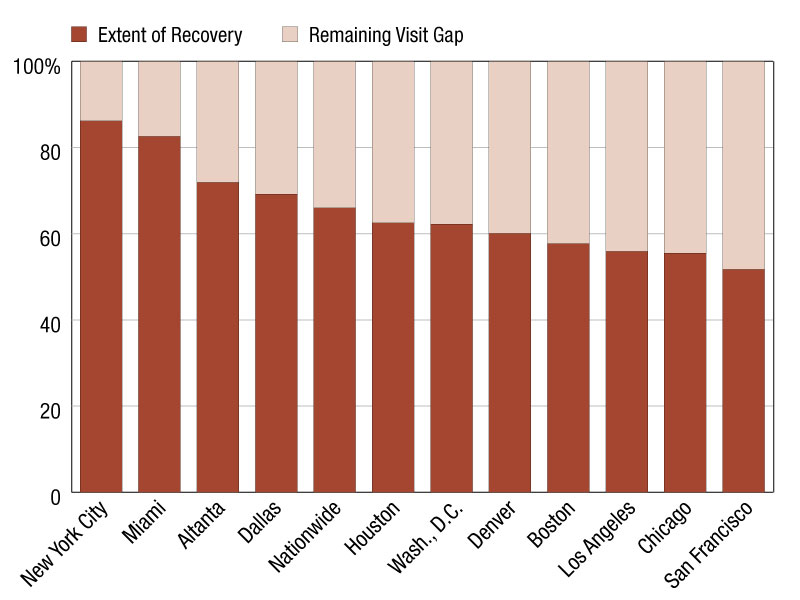

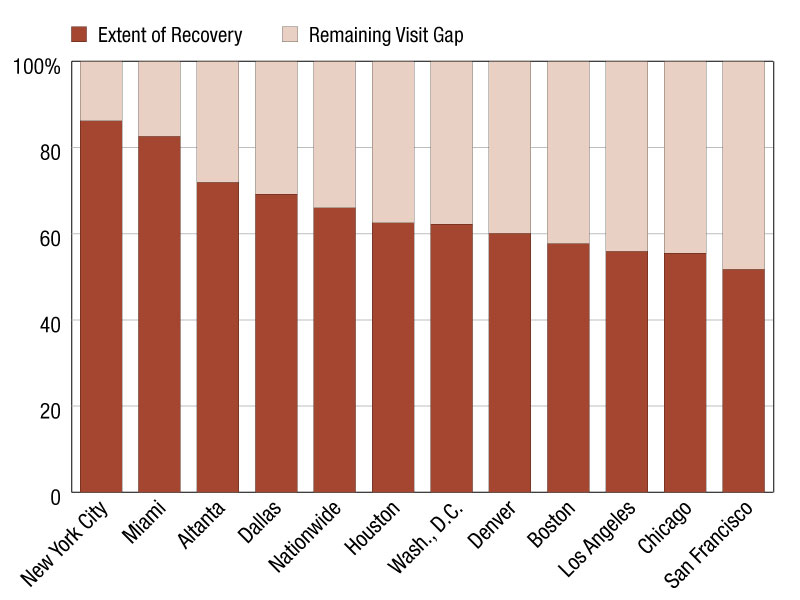

In October, visits to office buildings nationwide were 34.0 percent below October 2019 levels—and the highest they’ve been since February 2020. New York and Miami continued to lead the office recovery pack in October, with visits in the two cities back to 86.2 percent and 82.6 percent, respectively, of pre-pandemic levels. Washington, D.C., Boston, and Atlanta saw the biggest year-over-year office foot traffic increases last month.

Amazon, Dell, Goldman Sachs, Walmart and UPS are just a few of the major employers that have been cracking down on remote work in recent months, some requiring their teams to be on-site full time.

So with summer behind us, we dove into the data to assess the impact these accumulating RTO mandates are having on the ground. Are offices continuing to fill up, or has the office recovery run its course?

Growth leaders

In October 2024, office visits nationwide were 34.0 percent below October 2019 levels. And looking at monthly fluctuations in office foot traffic over the past five years shows that the RTO remains in full swing—with last month’s visits reaching the highest point seen since February 2020.

Digging down into regional data shows that in several major hubs—including Atlanta, Dallas, Houston, Denver, Washington, D.C., Chicago and San Francisco—October 2024 was the single busiest in-office month since COVID-19. In Boston, Los Angeles, Miami and New York, October was the second-busiest month, outpaced only by July.

READ ALSO: Manhattan Office Shows Strength in a Still Lackluster Market

Still, New York and Miami continued to lead the regional office recovery pack, with October 2024 visits in the two cities up to 86.2 percent and 82.6 percent, respectively, of 2019 levels. The two hubs, joined by Atlanta and Dallas, continued to outperform the nationwide average. And Houston, which lagged behind other major business hubs during the summer in the wake of major storms, reclaimed its position just under the nationwide baseline.

In October 2024, visits to office buildings in Washington D.C. increased by 16.4 percent year-over-year, likely boosted by a RTO push meant to increase meaningful in-person work in federal agencies—though many government employees continue to telework.

In Boston, where office building occupancy is outperforming national levels, visits saw a 15.6 percent year-over-year uptick. And Atlanta, where major employers from UPS to NCR Voyix are requiring workers to show up at the office five days a week, saw visits grow 13.8 percent year-over-year.

Nationwide, office foot traffic increased 10.1 percent year-over-year—showing that the return-to-office movement is still very much a work in progress.

This blog includes data from Placer.ai Data Version 2.1, which introduces a new dynamic model that stabilizes daily fluctuations in the panel, improving accuracy and alignment with external ground truth sources.

—Posted on November 25, 2024

The post Placer.ai Office Index—October 2024 Recap appeared first on Commercial Property Executive.