Construction Cost Increases Hit 3-Year Low

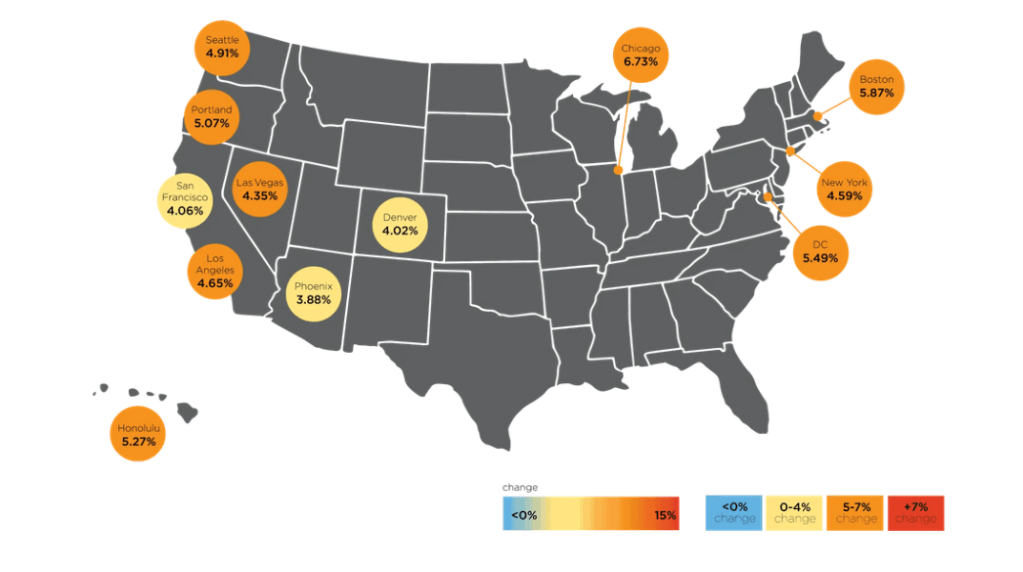

The national average increase in construction costs was 1.07 percent in the third quarter, the lowest in the past three years, according to Rider Levett Bucknall’s crane index and quarterly cost report, which studies 14 key markets.

Boston, Denver, Honolulu, New York City, Seattle and Washington, D.C., all saw gains exceeding the national average this quarter. Chicago, Las Vegas, Los Angeles, Phoenix, Portland and San Francisco recorded gains that were below the national rate.

The construction costs index increased 4.91 percent year-over-year, and the construction unemployment rate slipped slightly to 3.2 percent, down 0.7 percent from the same period last year.

Comparative map of the annual percentage change in construction costs between July 2023 to July 2024. Image courtesy of Rider Levett Bucknall

The national average increase in construction costs in the second quarter was 1.12 percent over the previous quarter. The U.S. national average increase in construction costs was approximately 5.41 percent, compared to 5.85 percent year-over-year in the first quarter.

Cushman Wakefield’s Research Manager Sandy Romero said this aligns with the U.S. August Producer Price Index’s year-over-year increase of 1.2 percent for nonresidential structures.

“With lower inflation rates, prices should continue normalizing, barring any major supply chain disruptions,” Romero told Commercial Property Executive.

Andrew Volz, research manager, project and development services for JLL, said that in JLL’s recent 2024 midyear construction update and reforecast, his firm predicted a modest 1 percent to 2 percent total cost growth for 2024.

“We remain optimistic about this tempered growth,” Volz said. “Looking ahead, we expect strong demand for construction as the industry continues addressing changing use patterns in the built environment, particularly around sustainability and technology integration.”

READ ALSO: CRE Sentiment Index at All-Time High

According to Volz, sustained construction activity from public and private sources will keep costs increasing, especially within emerging hotspots.

“Although the recent moderation in cost growth is welcome news for the industry, owners and developers should remain prepared and strategically plan for both near-term fluctuations and long-term trends shaping the construction landscape,” Volz added.

Aaron Faulk, construction national practice leader for Moss Adams accounting/consulting, told CPE that slowing construction cost increases and interest rate declines provide optimism for increased private sector construction activity.

“While certainly good news, we don’t expect significant new projects or activity in the private sector until mid-2025 at the earliest,” he said.

Hiring trends match RLB data

Lisa Flicker, senior managing partner & head of real estate at Jackson Lucas, said that while rising construction costs have slowed their upward trajectory, the Crane Index reveals a dynamic and evolving development landscape across North America that aligns with the hiring trends she is seeing.

“I was not surprised to see (the 1.07 percent national average) increase in construction costs,” Flicker said. “We have seen a significant increase in hiring for senior-level construction leaders,” she added.

According to Flicker, the cooling of the construction cost inflation is driving developers to think about construction again in a meaningful way. “This could open the door for developers to capitalize on more stable pricing, allowing for better financial planning and potential project acceleration in 2025. While overall construction activity remains robust, regional variations are notable,” Flicker observed.

Rider Levett Bucknall’s crane index map for the third quarter of 2024. Image courtesy of Rider Levett Bucknall

Construction costs stabilizing

Brian Gallagher, vice president of corporate development at Graycor, said that the decrease in the rate of escalation for construction costs—the lowest in the past three years—signals a possible stabilization in the market.

“This moderation in cost escalation may ease pressure on developers, allowing for more predictable budgeting and planning,” Gallagher said. “Combined with improving labor availability and lower interest rates, the more favorable cost environment could revive previously delayed or scaled-back projects, making them financially viable again.”

“Overall, this trend could spur investment growth across sectors, particularly in commercial developments, while providing relief amid broader economic uncertainty. Ultimately, developers will seek a balance between opportunity and risk, carefully considering construction costs, economic trends, and future market conditions.”

David Curry, real estate partner at Farrell Fritz in New York City, told CPE that since the pandemic began, real estate development has been hampered by a lethal combination of exponential increases in the cost of materials and high interest rates resulting from an alarming rise in inflation.

“High land prices create an additional roadblock depending on the area in which a project is planned. These factors have led to the stoppage and cancellation of many meaningful projects,” Curry said.

“We are finally seeing a leveling of prices of materials in construction from their unsustainable pandemic surges, including steel and concrete, as well as a decrease in the price of some raw materials, such as lumber. This is a meaningful start to the recovery needed to jumpstart projects sidelined by unsustainable price increases and interest rates. Continuing these price trends and reductions in interest rates will be key to boosting the economy and getting the cranes back in the air.”

Cost of steel down, while concrete’s is up

Mark Augustyn, co-founder & COO of Principle Construction Corp. said that he’s seen a reduction in the annual increase in construction costs.

“Interestingly, the cost of some commodities has decreased while that of others has continued their climb,” he said. “For example, the actual cost of steel has seen a price decline, roofing has stayed flat, and the cost of concrete continues to climb. Even with the price inflation at low rates, this generally isn’t a driver for new construction.”

According to Augustyn, reducing or at least consistent interest rates will drive new construction. Considering rates are stable or dropping and construction commodity price increases are very low, this would be a very advantageous time to invest in new construction.”

Frank He, managing director & head of construction, Parkview Financial, said that lower construction costs reduce project expenses and help make housing and infrastructure projects more accessible and feasible.

“Lower construction costs and the recent Fed rate cut should spur developers to take on more projects, leading to increased housing availability and potentially lower prices,” he said. “Further, the dual forces of lower construction costs and lower interest rates should lead to more development and improved living standards across the nation.”

According to Neil Axler, managing director at EisnerAmper, any construction cost trends that are increasing slower than the past three years are good for property values.

Axler said another benefit of the slowdown in construction cost trends is that it will help property owners resist insurance increases.

“We’re seeing many clients ordering insurance appraisals to negotiate lower insurance premiums, a trend that will help support those appraisals,” he said.

Some material prices still volatile

Skender Vice President Alex Panici said that he is still seeing volatility in steel and copper, which have been down 24 percent and up 17 percent, respectively, in the past year. Most prices are still significantly higher than four years ago.

Panici said steel, copper, plastic, gypsum and concrete have all risen by 35 percent to 60 percent since March 2020.

“Still, the recent improvement in stability coupled with downward-moving interest rates is giving developers greater clarity and optimism, which we expect will translate to more projects penciling out in 2025 and beyond,” he concluded.

The post Construction Cost Increases Hit 3-Year Low appeared first on Commercial Property Executive.