CRE Sentiment Ticks Down

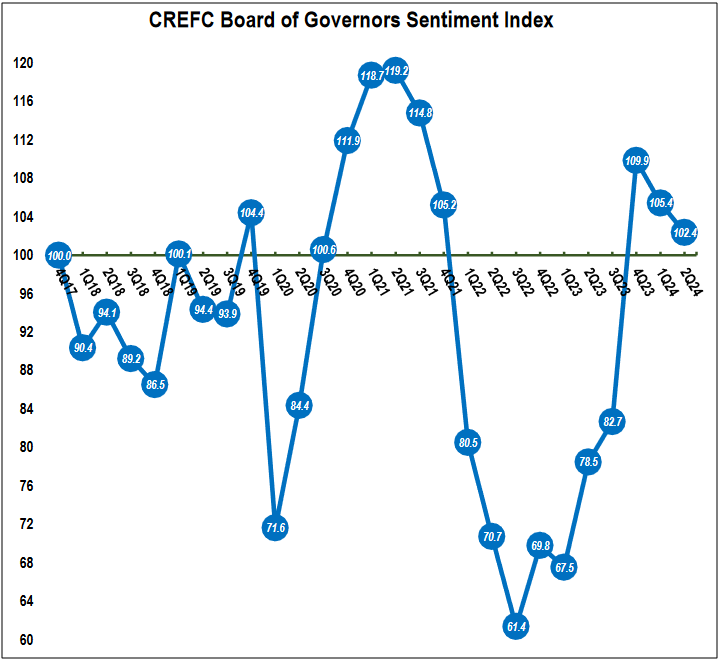

A key commercial real estate index ticked down 3 percent for the second quarter, reflecting growing caution in the economic outlook and the ongoing impacts of higher interest rates.

The broad-based Board of Governors Sentiment Index survey fell to 102.4 from the previous quarter’s 105.4.

Confidence in the U.S. economy has waned, according to the survey between June 26 and July 11 of more than 50 senior executives in the commercial real estate finance markets from every sector of real estate lending and mortgage-related debt investing markets.

Only 11 percent of respondents are expecting better performance over the next 12 months, down from 24 percent in the previous quarter.

Robert Martinek, director at EisnerAmper, told Commercial Property Executive, “The economy has continued to chug along even as interest rates have remained stubbornly high. Inflation has moderated and the stock market has hit an all-time high.”

Eric Brody, managing partner, ANAX Real Estate Partners, told CPE he is cautiously optimistic for the second half of 2024.

“Based on the capital markets space, we believe that economic conditions will stabilize,” Brody said.

“This stabilization is likely to be driven by steady job growth and potentially lower interest rates, creating a more favorable environment. As these factors typically lead to higher consumer confidence and increased demand, we expect to see an overall improvement in economic stability by the end of the year,” he continued.

“Additionally, the uncertainty is creating opportunity as borrowers are now realizing that economic conditions are not rapidly changing, and they must react by dealing with assets. We are seeing a plethora of opportunities in the NPL (non-performing loans), distress and short-term debt markets,” Brody added.

READ ALSO: Holistic Thinking for a Tough Finance Climate

Victor Gutierrez, vice president of Platform Operations at Ten-X, told CPE he is confident in the U.S. economy for the remainder of the year.

“Right now, we’re seeing high employment, strong consumer spending and healthy stock market performance,” Gutierrez said. “All point to strong performance going forward.”

Pierre Debbas, Esq., Romer Debbas, told CPE that an election year is always one that creates trepidation in the market and this year is certainly no exception.

“While certain parts of the economy such as unemployment and wages remain strong, inflation and the current interest rate level have created a negative outlook on the economy for anyone in the real estate industry. This sentiment will not change until rates start to significantly decline.”

John Blackmon, founder & manager of NV Capital Corp., told CPE he has confidence in the U.S. economy.

“We have the greatest economy in the world, and there is still a tremendous amount of cash in the system,” he said. “And, based on recent polls, it looks like Republicans may come back in power in the White House, which is usually good for business.”

Markets need a ‘150-basis-point’ decline in rates

There’s an optimistic shift in mortgage and cap rates with 41 percent of respondents viewing the impact of rates positively, compared to 31 percent in the prior quarter, according to the Index.

Debbas told CPE that a reduction in rates would certainly be positive for real estate.

“Commercial and residential transaction volume are at historic lows and the biggest reason for this is rates,” Debbas said. “25-basis-point declines will only show a light at the end of the tunnel, but the market will need to see a decline of 150+ basis points to get back to healthy transaction volume and development.”

Brody told CPE the impact of rates for the remainder of the year is more positive.

“This optimism is grounded in the anticipation that interest rates may stabilize or even decline, which would lead to lower borrowing costs,” Brody said. “Such conditions are expected to spur increased investment volumes and transactional activities, especially as there is a significant amount of unallocated capital ready to be deployed once there is more economic clarity.”

Martinek told CPE that with slowing inflation, all indications are that we will begin to see rate cuts sooner rather than later. Any cut in rates will benefit commercial real estate.”

Gutierrez is expecting a positive impact for the remainder of 2024.

He told CPE the anticipated rate cuts in September and December will bring a positive shift.

“A decrease in rates will lower borrowing costs and increase property values, which in turn should help to drive more demand and ease some stress in the market,” Gutierrez said.

Blackmon told CPE the interest rates have not yet begun to have a significant impact on the economy with just some minor slowdown in new home purchases. He expects further lowering in 2025 to also help the economy to continue to expand.

Transaction activity expected to remain strong

Transaction activity demand is expected to remain strong, with 54 percent expecting increased investor demand, consistent with the prior quarter (55 percent), according to the Index.

“The minute rates decline substantially or show a trend that that is where they are going, you will see a huge rebound in the real estate market,” according to Debbas.

He told CPE there is an abundance of cash waiting on the sidelines and investors know that rates will inevitably come down and there is no sense of urgency in the market till that happens.

Brody told CPE that he expects demand to remain strong for the remainder of the year.

“The forecasted rent growth acceleration, alongside economic stabilization, supports this outlook,” he said. “As the market absorbs excess supply and new units are leased, landlords will gain more pricing power, further driving demand,” Brody continued.

“Additionally, the substantial volume of maturing loans will likely lead to increased transactional activities as property owners refinance or sell assets, contributing to a robust demand landscape.”

Martinek told CPE, “After a wait-and-see period, transaction volumes are beginning to increase. After a wide variance in buy/sell attitudes, participants are starting to meet in the middle. I expect transaction activity to continue to increase.”

The CRE Finance Council is an industry association representing the nearly $6 trillion commercial and multifamily real estate finance industry, spanning approximately 400 companies and 19,000 individuals.

The post CRE Sentiment Ticks Down appeared first on Commercial Property Executive.