CRE Midyear Outlook: The Calm After the Storm

Commercial real estate development and investment is no stranger to cycles of recovery, expansion, supply booms and recessions. This round appears to have passed the recession and is slowly inching toward recovery, according to panelists at Commercial Property Executive’s Midyear Outlook 2024 webinar, moderated by Editorial Director Suzann Silverman.

While persistent challenges around interest rates, a lack of available debt, construction costs and geopolitical uncertainty remain, the panelists’ outlook remained positive, with most anticipating a recovery in 2025. Mark Rose, CEO of Avison Young, holds this view: “It doesn’t look like it’s going to get any worse, and we look like we’re positioned for a recovery,” he said.

For Rose, hampering recovery the most is both banks’ and smaller lenders’ near-complete exit from the market, as well as the muted investment volumes, which, amounting to $71 billion in the first quarter, have fallen by 19 percent year-over-year, according to CBRE. “Because of the lack of debt, we will have to push back some of the expectations for a bigger bounce back into the back half of 2025,” Rose noted.

READ ALSO: BOMA 2024 Conference Highlights

Adding fuel to this fire are the Fed’s potential decisions around interest rates, and Rose doesn’t see the needle move until after November’s elections. Before this happens, the uncertainty around investing, mostly in the short term, is likely to persist. “As much as we would like a decrease in September, we are likely to get some action after the election, but from there on out, things are falling into place where you have those incremental gains,” Rose predicted.

On the other hand, some see the Fed’s moves as being more symbolic in nature, given the inaccuracies the organization has related to when measuring inflation; often, part of the data can be a year old, leading Rose to believe that inflation is much lower than the Fed is letting on.

In turn, the Fed’s decisions may not be the be-all-end-all of the investment landscape. “The way the Fed measures inflation is catching up; it was wrong for the last year or so, and the real numbers are coming in,” weighed in Jeff DeBoer, founding president & CEO of The Real Estate Roundtable.

A positive attitude, despite the troughs

Despite near-term hurdles, the last thing that investors should feel is pessimistic, given strong fundamentals around retail space and industrial assets, as well as select elements of the office sector. “What people are getting emotional about are the facts, but this is part of a cyclical reality that has remained true for all of our lifetimes,” pointed out Stacie Trott, Co-Chair of Global Real Estate Practice & Co-Chair of New York Real Estate Practice at DLA Piper. “Depending on where you are, it’s an opportunity to buy,” Trott added.

Jeb Belford, managing director & chief investment officer at Clarion Partners, sees such negative views as creating a self-fulfilling prophecy. “If we remain in a continued uncertain period where they are not willing to commit capital, transactions remain slow and don’t move much to the positive, that will continue to wear on people. The more worn-out people get, the more (it hampers) on what you think would be a natural recovery,” Belford added.

Rose agreed, and pointed to the examples of grocery-anchored retail, outdoor storage and data centers as going from unknowns just a few years ago to some of the industry’s top investment performers for investors. “It was not in our vocabulary to talk about them,” Rose reflected. Real estate in general is not being overbuilt, but you do have to pay attention to what makes up this industry,’ Rose added.

Is the office sector really faring that badly?

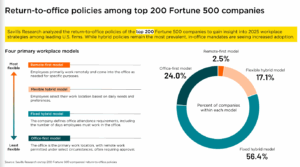

Even the office sector has its upsides, if one is realistic about its prospects. Belford, despite having a “bearish” view on the office market, pointed to the fact that much of the high vacancy rates are owed to both a lack of company expansions and smaller leases, as opposed to an aversion to working in-person. “What are the tenants really doing when they have to face the decision to renew or move is they are taking, on average, 20 percent less space than they had before, and that pattern has not yet changed,” Belford said.

When it comes to office leasing, Rose observed some of the decision-making as shifting from the CEO to the CFO, with office space and usage being seen as a potential cost-saver. Even tenants at the prestigious One Vanderbilt are undergoing the same shrinkage of space while paying triply the average rent, according to Rose. “Some of this is decision-making in this period of back-to-back black swans, but some of this should have happened a long time ago,” Rose opined.

Like retail before it, the office sector is in need of a revision of how people want to work. Given the fact that offices located in mixed-use business districts boast far stronger fundamentals than those downtown, investors and developers would do well to turn urban cores into experiences as opposed to commodities. Even in Washington, D.C., DeBoer’s base of operations, “every parking lot and restaurant is filled, and Biden has called people to come back to work.”

In Chicago, also seeing historically high office vacancy rates, “South Street is as dead as a doornail, but at one end, Google’s headquarters (at Fulton Market) is being built downtown,” according to Rose.

Will the election results change things?

A topic hovering over the entire discussion were the results of the upcoming presidential election. Even though there may be changes to tax code under a second Trump administration, most panelists see whoever occupies the White House as not meaningfully affecting the CRE investment and development.

No matter the results, DeBoer believes that CRE investors have a new opportunity to educate the public about the value of the industry, so that Washington no longer views it as what Rose refers to as “collateral damage.”

Pointing to his organization’s record, DeBoer reflected, “We have changed the narrative in the last 25 years away from rich people and have connected the dots in terms of what real estate brings in terms of local budgets for jobs, and helping people save for their retirements.”

“They don’t hate you, and we just have to have the facts and present them in a rational way that is long term,” DeBoer concluded.

The post CRE Midyear Outlook: The Calm After the Storm appeared first on Commercial Property Executive.